by First Integrity Team Supreme Lending | Apr 1, 2025

You’ve submitted your initial mortgage application, completed the necessary paperwork, and even had your home appraised. Now, you find yourself at the crucial stage of the loan process – underwriting. This is where the underwriter, acting as a gatekeeper for the lender, meticulously assesses your financial details to determine the risk of financing your home. In this article, we will explore the mortgage underwriting process, its significance, and what borrowers can expect during this critical phase.

Who Are Underwriters and What Do They Do?

Underwriters play a pivotal role in safeguarding the interests of the lender during the home loan process. Their primary responsibility is to assess your ability to repay the loan and evaluate the risk associated with lending money to you. They review various aspects of your financial profile, including your credit score, income, and the appraised value of the property. The goal is to ensure that borrowers are not taking on more mortgage responsibility than they may be able to handle.

Importance of Underwriting:

The housing crisis of 2008 highlighted the need for stricter underwriting guidelines. Loose regulations during that period allowed borrowers to access funds without adequate means to repay, resulting in widespread defaults. Today, underwriters adhere to stringent guidelines to help prevent the recurrence of such crises, protecting both borrowers and lenders alike.

What to Expect During the Underwriting Process:

Further Paperwork May Be Needed:

During the underwriting process, underwriters may request additional documentation to gain a comprehensive understanding of your financials. It’s crucial to provide any requested documents promptly to keep the mortgage process moving smoothly.

Turn-times Vary:

Depending on the loan type and market conditions, the underwriting process may take anywhere from 5 to 14 days. Understanding the potential timeline may help you manage expectations and plan accordingly.

Disclosure Mailings:

Borrowers may receive electronic or paper loan disclosures throughout the process. These disclosures are sent to ensure compliance with state and federal laws.

Loan Determinations:

After reviewing your application, the underwriter will issue one of three determinations:

Conditional Approval of Loan:

Your loan is cleared for funding, and your lender will discuss any remaining conditions specified by the underwriter. A closing date will be scheduled.

Suspension of Loan:

A suspension occurs when there are questions about a critical facet of your loan file. Your lender will work with you to identify and address any concerns, leading to a potential conditional approval.

Denial of Loan:

If your file indicates a high level of risk, the underwriter may deny the loan based on industry benchmarks, not personal intuition. For example, perhaps there was a significant drop in your credit score, indicating potential payment inconsistencies and a big risk for a lender.

What Happens If Your Loan Is Suspended or Denied?

Choosing the right lender is crucial, and at Supreme Lending, the relationship doesn’t end if your loan faces challenges. Supreme’s dedicated team may be able to help overcome underwriting objections, identify errors, and work with you to improve your application.

Understanding the mortgage underwriting process is vital for borrowers navigating the complex world of home loans. As you approach this final checkpoint, being prepared for potential requests for additional documents, varying turn times, and the possible outcomes of the underwriting review can help streamline the process. With Supreme Lending by your side, you can navigate the underwriting process with confidence and increase the chances of a successful loan closing.

Dos and Don’ts During the Mortgage Underwriting Process

The journey to homeownership involves various stages, and one of the most important steps is the mortgage underwriting process. This phase determines whether your loan will be approved or not. To ensure a smooth underwriting experience with Supreme Lending, it’s essential to follow a set of Do’s and Don’ts.

Do’s:

Maintain Consistent Debt Payments:

Make minimum monthly payments on your consumer debt until the loan closes. Any deviation from this may have adverse effects on your mortgage application.

Timely Mortgage Payments:

Ensure your mortgage payments are made on time and are no more than 15 days late. Any delay beyond this timeframe may pose risks to your loan approval.

Cooperate with the Title Company:

Respond to calls from the Title Company. Occasionally, there may be outdated or unreleased liens, which can complicate the ownership of your property. Addressing these issues promptly is vital for clearing your property’s title in preparation for closing.

Submit Requested Documents Promptly:

Provide any documents requested by Supreme Lending immediately. Timely submission is crucial, as documents can have expiration dates, and delays may affect your application.

Retain Financial Documents:

Hold onto electronic and paper copies of pay stubs, bank statements, and other financial documents until the loan closes. You may be required to provide them during the underwriting process.

Don’ts:

Avoid Job Changes or Retirement:

Refrain from resigning or retiring during the loan process without consulting your Supreme Lending mortgage expert. Changes in employment status may impact your loan approval.

No New Credit Accounts:

Do not open or apply for new credit accounts before your mortgage loan closes. New accounts or inquiries can be easily identified during underwriting and may jeopardize your application. Our experienced professionals understand that life happens, and should a need arise for situations such as applying for student loans or financing a child’s upcoming college tuition, we ask that you discuss your plans with a member of our team before you take action.

Avoid Balance Transfers:

Refrain from making balance transfers on existing credit card balances. Such actions may slow down the mortgage application process.

Don’t Pay Off Existing Credit Accounts in Full:

Avoid paying off existing consumer credit accounts (e.g. auto loans, credit cards, etc.) in full unless it aligns with the natural progression of making minimum monthly payments.

Successfully navigating the mortgage underwriting process requires careful attention to detail and adherence to specific guidelines. By following the Do’s and Don’ts outlined above, you may increase the likelihood of a smooth and successful loan approval. If you have any questions or concerns about your loan, don’t hesitate to reach out to the Supreme Lending team for assistance. Remember, open communication and timely action are key to a positive mortgage underwriting experience.

by First Integrity Team Supreme Lending | Jan 31, 2025

Military veterans and active-duty service members have dedicated their lives to serving our country, and Supreme Lending couldn’t be more grateful for their service. When it comes to homeownership, there’s no one more deserving than those who risk their lives to protect our freedom and safety. Supreme Lending is proud to offer the VA loan program. Backed by the U.S. Department of Veterans Affairs (VA), VA loans are designed to give eligible borrowers valuable home financing benefits, including no down payment requirement.

In this article, we’ll explore VA loans, eligibility, and, more specifically, the VA loan funding fee and how it works.

What Is A VA Loan?

A VA loan is a mortgage backed by the U.S. Department of Veterans Affairs. VA financing helps miliary veterans, active-duty service members, and certain members of the National Guard and Reserves become homebuyers. These loans offer several advantages, such as:

- No Down Payment Requirement. One of the biggest benefits of VA loans is that they allow you to purchase a home without a down payment. This makes homeownership for eligible military families more accessible with less upfront costs.

- Competitive Rates. VA loans often come with lower rates compared to Conventional loans, which may save money in interest over the life of the loan.

- No Private Mortgage Insurance. Unlike many Conventional loans that require Private Mortgage Insurance (PMI) when you put less than 20% down, VA loans don’t require this added cost.

- Repeat Buyers. Another unique benefit of VA financing is that it is not only for first-time homebuyers. Repeat buyers are accepted and second homes may be eligible under certain circumstances.

- Low VA Loan Funding Fee. The one-time VA loan funding fee is greatly lower than the typical down payment requirements. Below, we will outline the various funding fee percentages depending on the situation.

- Exemptions for Eligible Borrowers Available. There is an option to be exempt from paying the funding fee for qualified borrowers. For example, veterans who receive compensation for a disability related to their miliary service or active-duty members who received the Purple Heart.

Who Is Eligible for a VA Loan?

To qualify for a VA loan, you must meet specific eligibility guidelines. Generally, you must be a veteran, active-duty service member, or a member of the National Guard or Reserves. When applying for a VA loan, you must have a valid Certificate of Eligibility (COE). This demonstrates your service record and entitlement to VA loan benefits. Some surviving spouses of veterans may also qualify under certain circumstances.

What Is a VA Loan Funding Fee?

While VA loans offer incredible benefits, there is an important cost borrowers need to keep in mind: the VA loan funding fee. The fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

Funding Fee Amounts

The amount of the funding fee varies based on the borrower, type of VA loan they’re getting, and how much down payment is being paid. First-time borrowers typically pay a lower funding fee compared to those who have previously used a VA loan

Click here for a breakdown of funding fees based on loan type.

Paying the Funding Fee

The VA funding fee is paid at closing. There are a few ways you may choose to pay the fee:

- Upfront Payment. Borrowers may pay the fee at closing, in full, which can be included as a closing cost.

- Finance Fee. Borrowers may also choose to roll the funding fee into their loan amount, allowing them to pay it over the life of the mortgage instead of upfront.

- Seller Concessions. In some cases, the seller may agree to cover the funding fee as part of the purchase agreement, providing additional assistance to the buyer.

Explore VA Loans from Supreme Lending

VA loans are a wonderful resource for military veterans and active-duty personnel looking to achieve homeownership. While there’s no down payment requirement, it’s essential to understand the VA loan funding fee. If you’re considering a VA loan or want to learn more about your home financing options, contact your local Supreme Lending branch today!

Related Articles:

by SupremeLending | Mar 1, 2024

The men and women who have served in America’s Armed Forces have sacrificed so much to protect our freedom and communities, including time away from their families. There’s no profession more deserving of having a home to call their own. Supreme Lending is honored to provide opportunities to help Veterans and active military personnel achieve their dreams of homeownership through affordable mortgage options, including VA loans that can offer 100% financing. Let’s dive into the benefits and eligibility of VA loan programs.

Guaranteed by the U.S. Department of Veterans Affairs, VA loans are designed to help those who have served in the military and their eligible surviving spouses obtain homeownership with more flexible and favorable terms.

VA Loan Benefits

Two of the biggest benefits of VA loans are the no down payment or mortgage insurance premium requirements—making homeownership more accessible for those who may not qualify for a traditional loan. Other unique VA loan benefits and features include:

- Lower origination fees, appraisal fees, and closing costs.

- Purchase and refinance for primary homes.

- No prepayment penalties.

- Fixed- and adjustable-rate loan options available.

- Variety of eligible property types (single-family, townhomes, VA-approved condos, etc.).

- Available for qualified first-time and repeat homebuyers.

- 580 minimum credit score; 620 minimum credit score for loan amounts more than $ 766,550.

- At least 41% Debt-to-Income (DTI) ratio.

- VA non-allowable fees can be paid by seller, up to 4% of the loan amount.

- Two year waiting period after foreclosure or bankruptcy after discharged.

- Some states may offer additional options for extra affordability.

VA Loan Eligibility

A requirement of VA loans is that the homeowner lives in the home as their primary residence. A valid Certificate of Eligibility (COE) must be presented at the time of application, which includes military eligibility such as length of service or service commitment, duty status, and character of service.

VA Funding Fee

While there is no down payment requirement, VA loans do require a one-time funding fee to cover administrative or processing costs. The fee is 2.15% for first-time use of the program with zero down payment, still much lower than a traditional down payment! Additionally, the funding fee decreases to 1.5% with 5% or more down payment and to 1.25% with more than 10% down payment.

VA Loan Refinancing

Veterans Affairs also offers options for refinancing. A VA streamline refinance, also known as an Interest Rate Reduction Refinance Loan (IRRRL), could be a great option for military homeowners looking to potentially reduce their interest rate and monthly payments of a current VA loan. A VA cash-out refinance allows borrowers to leverage the equity they’ve built in their home and could help homeowners fund renovations or other large expenses.

For more information on VA loans and other mortgage options, reach out to your local Supreme Lending Loan Officer or contact us today.

by SupremeLending | Feb 20, 2024

When it comes to buying a home, which could be one of the biggest investments you make, it’s important to understand your financing options. While a Conventional loan is more traditional, FHA loans have seen a rise in popularity due to more flexible guidelines. Let’s dive into a few of the FHA loan benefits and features for homebuyers to consider when choosing a mortgage.

What is an FHA loan?

The Federal Housing Administration (FHA) knows the tremendous value homeownership can bring to people’s lives and communities, which is why it was founded in 1934 to boost home sales and the economy. The government organization offers special mortgage insurance to lenders as an option to help more people who may not qualify for a Conventional or other type of home loan, qualify through an FHA loan.

When applying for a home loan, an FHA loan may be a practical option, especially if you:

- Are a first-time homebuyer.

- Have a lower credit score.

- Want a lower down payment.

- Are refinancing a high-cost mortgage.

FHA loan benefits and features include:

- Low down payment requirements with a minimum of 3.5%. Mortgage insurance is required.

- Credit scores as low as 580 may be accepted.

- Gift funds can be used for 100% of the down payment or closing costs.

- Fixed-rate and adjustable-rate mortgage options are available.

- Flexible qualification guidelines.

Now you might be asking, what properties are eligible for FHA loans? In addition to single family homes, FHA loans could also finance other qualified properties, such as 2- to 4-unit complexes and condos. Properties with an FHA loan will require an FHA appraisal to ensure the living space is safe and meets proper standards.

FHA loans could be a great option as a steppingstone into homeownership. Could these FHA loan benefits match your mortgage needs?

If you’re ready to see if an FHA loan or other home loan program is right for you, Supreme Lending is ready to help. Contact us to get started today!

by SupremeLending | Feb 12, 2024

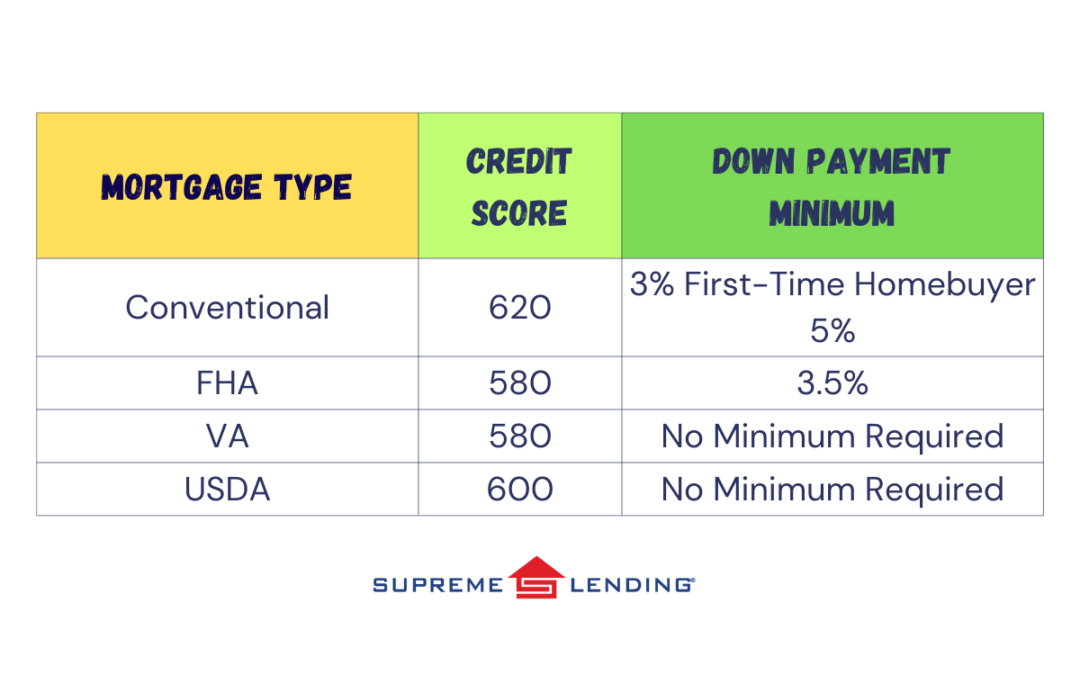

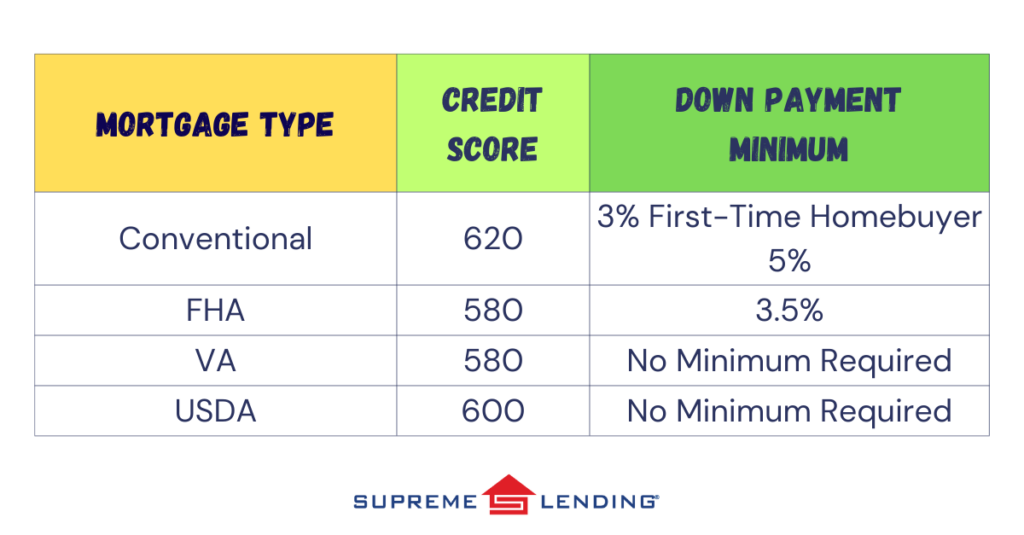

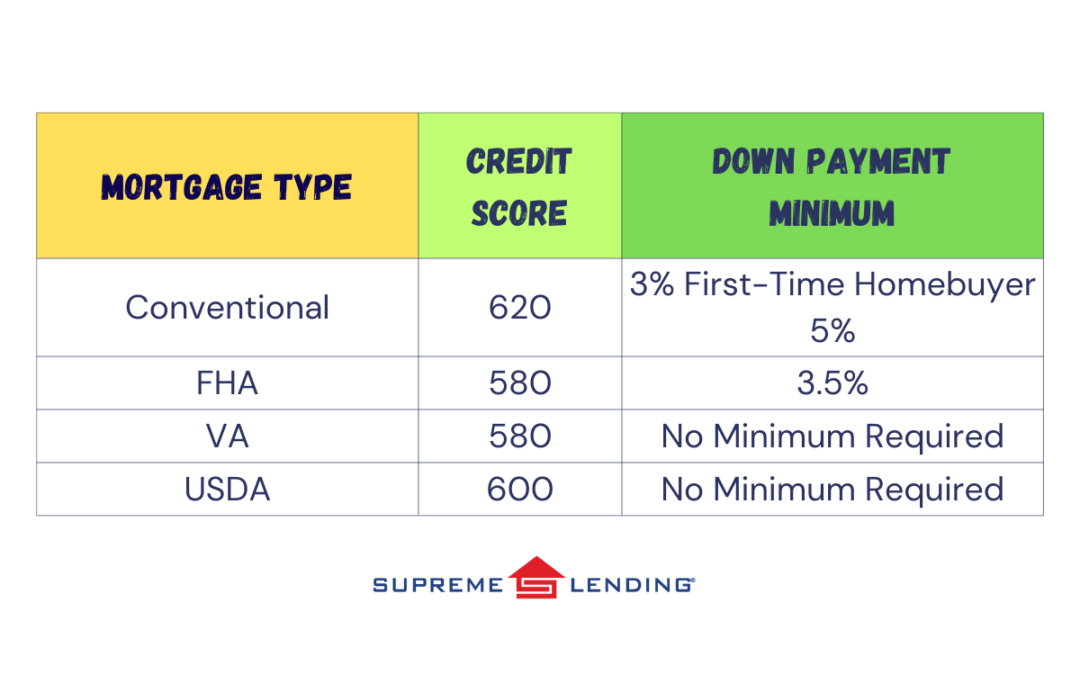

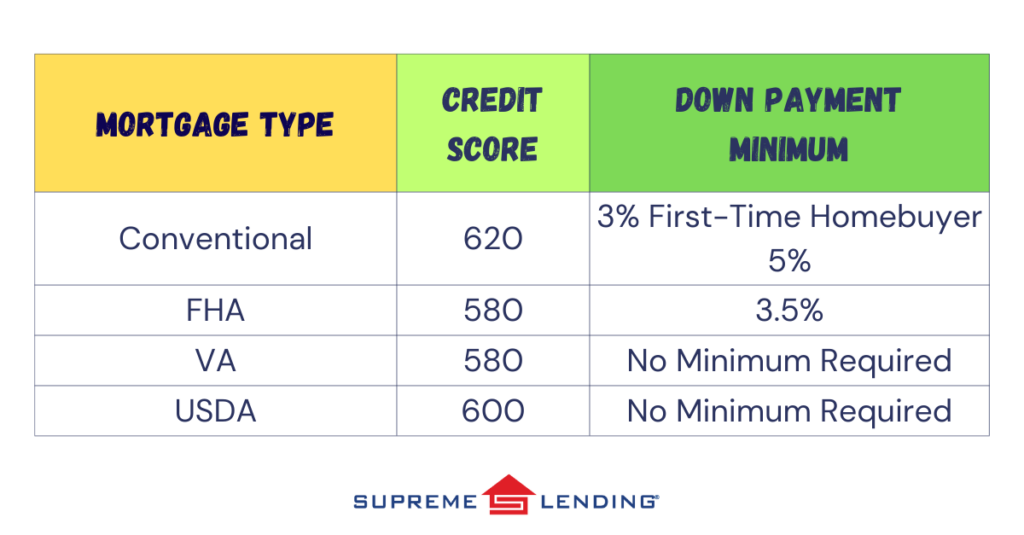

For aspiring homeowners and first-time buyers, many questions can arise about the mortgage process. What credit score do you need to qualify? How much down payment is required? Answers are based on several factors including the property, purchase price, and, most importantly, the mortgage type.

Here’s a breakdown to simplify the numbers and help you understand what you need to open the door to your dream home depending on common mortgage types:

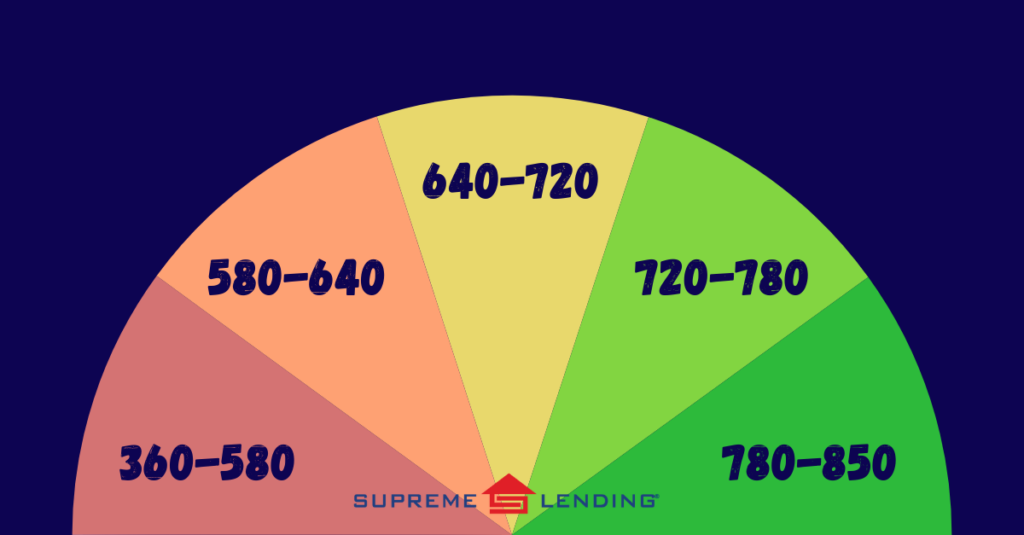

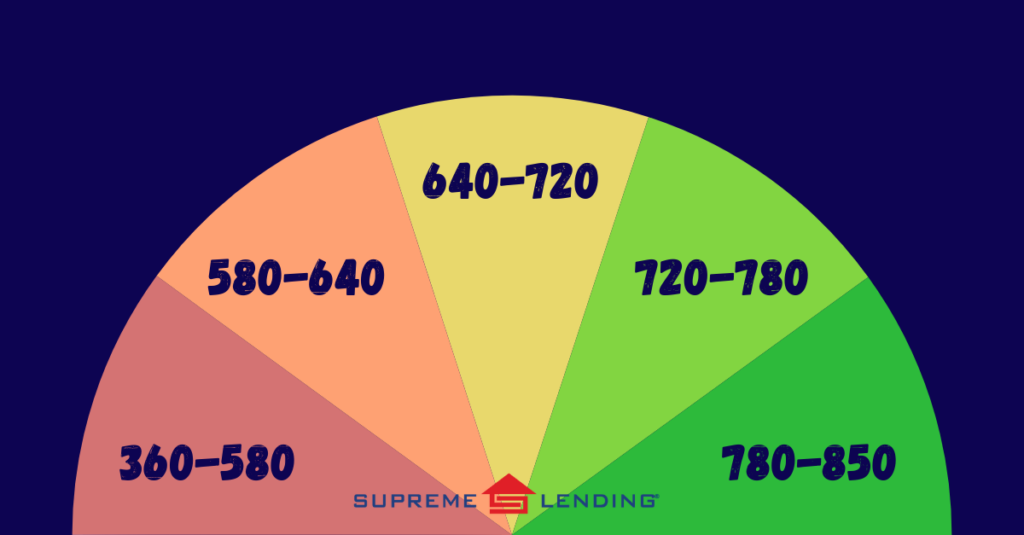

What Is a Credit Score?

Commonly determined by FICO® score, credit scores are calculated using the borrower’s financial background information such as payment history, credit utilization, length of credit history, types of credit in use, and recent credit behavior. The average credit score in the United States in 2023 was 715, according to Experian data.

Down Payment Assistance Options

If a homebuyer doesn’t have the required minimum down payment or would like to access more financing, Supreme Lending offers several down payment assistance options for qualified buyers. This can also help first-time buyers open the door to homeownership. Guidelines and eligibility vary depending on the program. For example, the Supreme Dream program offers down payment assistance in the form of a fully forgivable second loan and requires a minimum credit score of 620. Ask your Supreme Lending Loan Officer about qualified assistance programs.

Understanding credit score and down payment requirements for different types of mortgages is crucial for prospective homebuyers. While each loan type has its own guidelines, maintaining a good credit score and having sufficient funds for upfront costs at closing remains a common denominator for securing favorable terms and interest rates. By proactively managing your credit and staying informed about your options, you can navigate the mortgage process with confidence on your journey to homeownership.

Contact your local Supreme Lending branch to get pre-qualified and learn about your home financing options.