by First Integrity Team Supreme Lending | Oct 17, 2024

Discover the Program Highlights of an FHA 203(k) Renovation Loan

Are you ready to turn a fixer-upper into your dream home? Whether it’s a home you’ve just bought or already own, renovation loans like the FHA 203(k) program may help you finance both the purchase and necessary repairs or updates all in one mortgage. Plus, the U.S. Department of Housing and Urban Development (HUD) announced that it is increasing the loan amount for Limited FHA 203(k) loans to $75,000 on all FHA case numbers effective November 4, 2024—that’s up from $35,000 which is huge news!

Here’s an in-depth look at how the FHA 203(k) renovation loan works, the differences between the Limited and Standard options, and what types of renovations may be covered.

What Is an FHA 203(k) Loan?

Insured by the Federal Housing Administration, the FHA 203(k) renovation loan allows homeowners to finance the cost of both the property and its renovations in a single loan. Whether you’re purchasing a home that needs updates or making repairs to your current home, this loan program may help make those dreams a reality. It offers the similar benefits of FHA loans for first-time buyers and repeat buyers alike. To qualify, eligible borrowers only need 3.5% down payment and there’s more lenient credit score requirements than other renovation loans.

Limited vs. Standard FHA 203(k) Renovation Loan

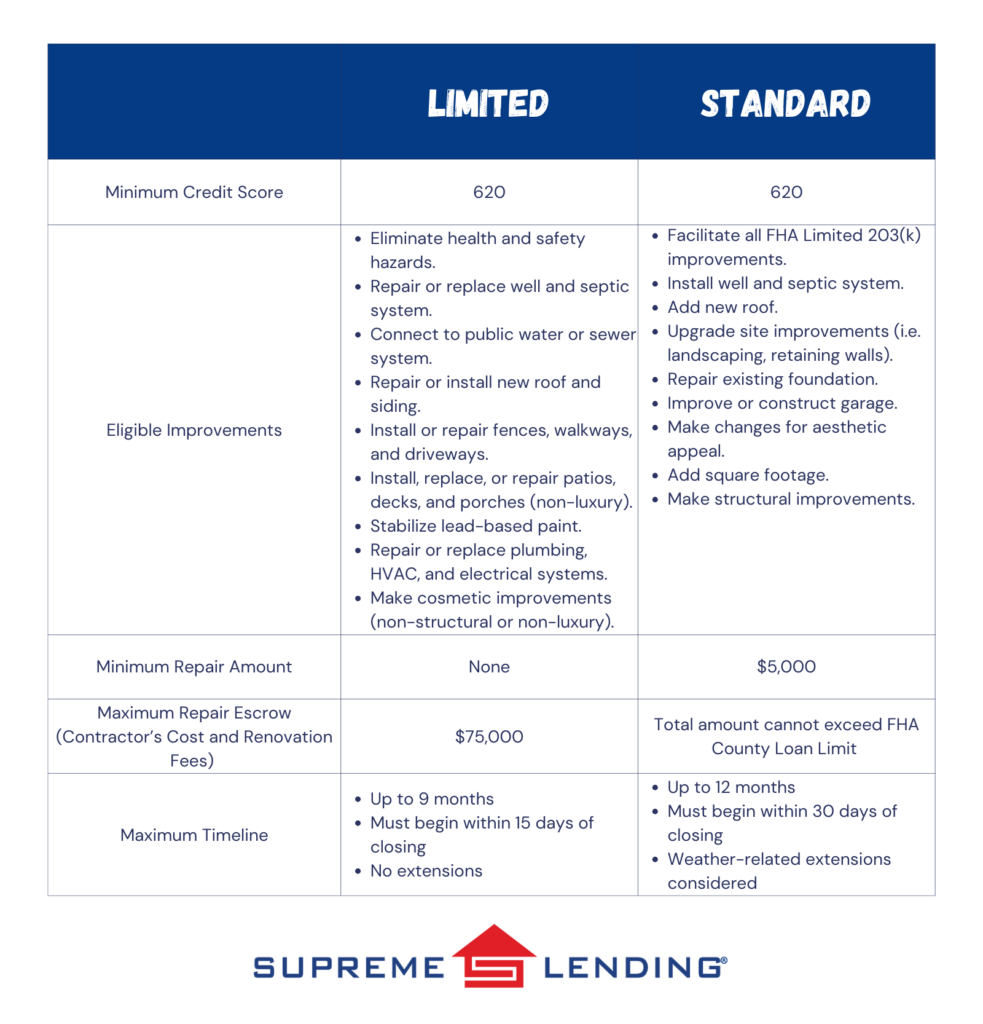

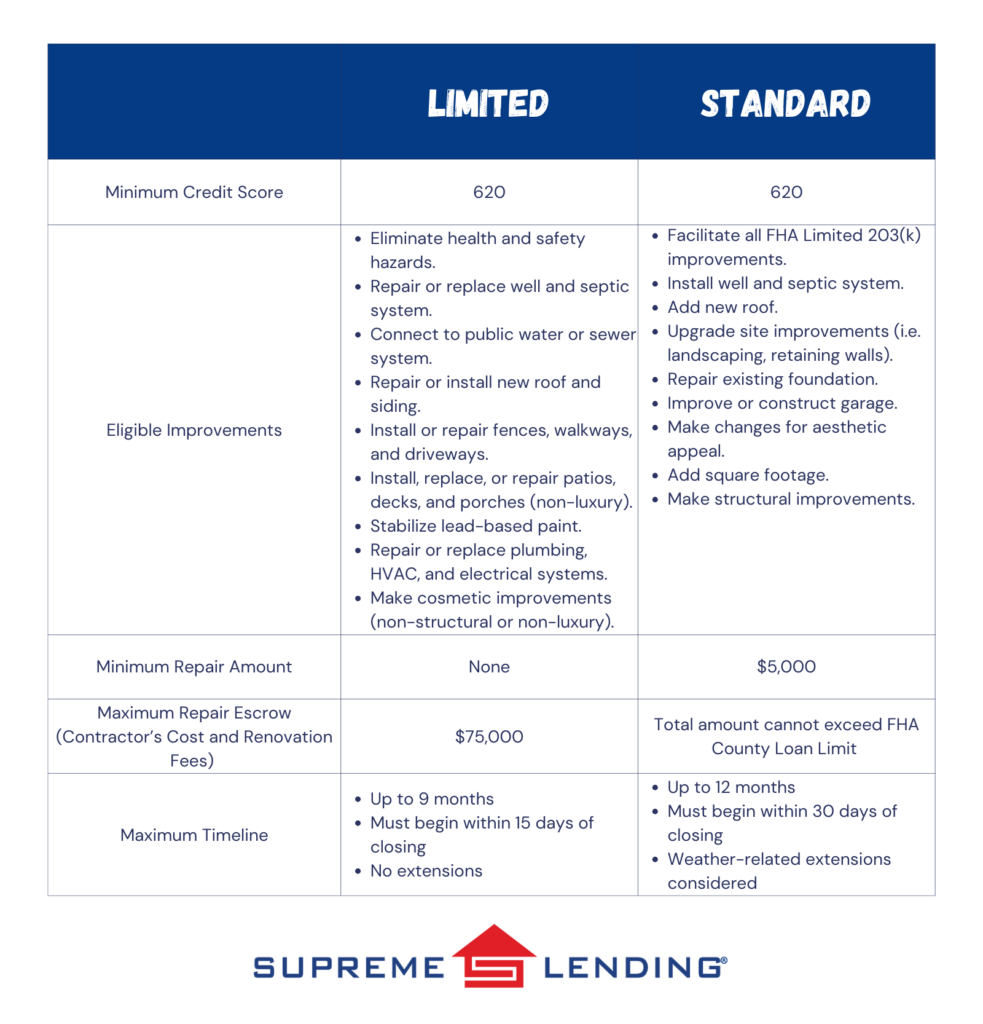

There are two types of FHA 203(k) loans—Standard and Limited. Each has specific uses and limits depending on the scope of renovations you can make.

Limited FHA 203(k) Loan

The Limited 203(k) option is commonly used for smaller repairs and cosmetic upgrades. As mentioned, the loan amount will increase to $75,000 in November 2024, an exciting enhancement that will help open the door to renovations for more people. This loan covers non-structural projects such as remodeling kitchen fixtures, replacing flooring, painting, and minor landscaping. Unlike the Standard, the Limited program doesn’t require working with an HUD consultant or have a minimum loan amount.

Common Projects the Limited Covers

- Minor remodeling (i.e. updating kitchens or bathrooms)

- Replacing appliances or flooring

- Repainting or refinishing surfaces

- Energy-efficient improvements (i.e. installing new windows or insulation)

- Repairing roofs and gutters

Standard FHA 203(k) Loan

The Standard FHA 203(k) Renovation loan is more ideal for homes needing larger renovations and structural repairs. These may include adding rooms, replacing outdated plumbing or electrical systems, and fixing major structural issues. It has a minimum of $5,000 that must be used for renovations and the total loan amount must be within the FHA County Loan Limit. Because these projects are typically more complex, you’re required to work with an HUD-approved consultant.

Common Projects the Standard Covers

- Structural repairs or additions (i.e. adding on square footage or fixing foundation issues)

- Major systems replacements (i.e. plumbing, electrical, or HVAC systems)

- Roof repairs or replacements

- Modernization and improvements to the home’s function

- Accessibility improvements for people with disabilities

How Does the FHA 203(k) Renovation Loan Work?

The process for applying for an FHA 203(k) loan is similar to a regular FHA mortgage but comes with a few additional steps. Here’s an overview of how this loan program works.

- Find a property. Whether it’s a home you already own and want to refinance* or one you’re planning to purchase, identify a property that needs renovations.

- Get an appraisal. The home appraisal will assess both the home’s current market value as well as it’s “as-completed” value after the renovations are completed.

- Contractor and Estimates. Work with a licensed contractor to obtain the estimated costs for the repairs and improvements.

- Loan Application. You’ll apply for the loan based on the combined cost of the home and repairs.

- Renovation Timeline. Once the loan is approved, the renovation funds are placed into an escrow account and work begins. The renovation timeline can typically range from six months to one year.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

FHA 203(k) Combined with FHA 203(h) Disaster Relief Loan

Did you know that eligible borrowers affected by federally declared disaster areas may be able to combine the FHA 203(k) renovation loan with the FHA 203(h) disaster relief loan? This means adding the renovation costs into a new mortgage if your home was destroyed and deemed unlivable. Plus, the damaged property is eligible regardless of the age of the home. It only needs to have been a habitable residence prior to the disaster.

Ready to Rebuild?

At Supreme Lending, we understand how important it is to transform a home into one that truly meets your needs. Whether you’re fixing up a new property or renovating your current home, the FHA 203(k) renovation loan offers an excellent way to finance those improvements. We’re proud to offer both Standard and Limited options to fit the scope of your home projects.

Want to learn more about FHA 203(k) renovation loans or other mortgage options? Contact our team at Supreme Lending today and get pre-qualified!

Looking for other renovation loan options? Read more:

by First Integrity Team Supreme Lending | Aug 20, 2024

When homeowners think about tapping into the equity they’ve built in their property, a Home Equity Line of Credit, also known as a HELOC, may come to mind. This alterative transaction mortgage can be incredibly versatile and useful for eligible homeowners to access funds. However, it’s important to understand exactly what a HELOC is and how it works when deciding if it’s the right option for you. Let’s explore how you may benefit from using a Home Equity Line of Credit.

What Is a HELOC?

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against the equity in their home, essentially turning part of their home’s value into cash. Unlike a traditional home loan, a HELOC functions similar to a credit card. Homeowners can borrow, repay, and borrow again up to a maximum credit limit. A HELOC is meant to use toward large expenses such as home renovations, tuition, or paying down other debts with higher interest.

How Does a HELOC Work?

A HELOC has a designated draw period, which is the time during which you can borrow money. This period is typically the first 10 years of a 30-year term. During this time, you’re only required to make interest payments on the amount you borrowed, which is significantly less than other loan types. Although, you may be able to pay down your principal with no penalty, which can result in lowering your minimum monthly payment.

After the draw period ends, the repayment period begins. This is when you can no longer draw money out and need to start paying back both the principal and interest of the loan. This new minimum payment will ensure the balance is paid in full by the maturity date. Interest rates on HELOCs are variable, meaning they change over time due to market conditions and set margins. As a result, the monthly payments can fluctuate.

Who Might Consider a HELOC?

HELOCs are a flexible financing option that may be attractive for homeowners who need access to funds for various reasons, including:

- Home Improvements. If you’re planning to remodel your kitchen, add an extension, or make other home renovation projects, a HELOC could provide the necessary funds.

- Pay Off High-Interest Debt. HELOCs often have lower interest rates than credit cards or personal loans, which makes them a good option to pay off other debts.

- Education Expenses. If you or your children need assistance paying for tuition, a HELOC may provide a helpful solution.

- Unexpected Expenses. A HELOC can also serve as a financial safety net for unseen expenses, such as medical bills or emergency repairs.

Supreme Lending HELOC Options

Did you know that Supreme Lending offers different types of HELOC programs? In addition to a standard HELOC, there is also a program specifically designed for home renovations, which uses the home value after improvements. There is also an option to tap into a line of credit on current investment properties.

HELOC Pros and Cons

Pros:

- Flexibility. You can borrow as much or as little as you need up to your limit during the draw period.

- Interest-Only Payments. During the draw period, borrowers have the option to only pay interest, which results in lower monthly payments compared to traditional loans.

- Potentially Lower Rates. HELOCs typically have lower interest rates than credit cards and personal loans, offering affordability.

Cons:

- Variable Rates. HELOCs have variable interest rates, which means they can change. If rates increase, so will the monthly payments.

- Risk of Foreclosure. When using a HELOC, you’re using your home as collateral. Therefore, if you default on the payments, you could risk losing your home.

- Potentially Overspend. Easy access to credit and funds may lead to overspending, which could put the home at risk.

HELOC vs. Cash-Out Refinance: What Is the Difference?

A cash-out refinance* is another way to tap into your home’s equity, but it works differently from a line of credit. With cash-out refi loans, you replace your existing mortgage with a new one for more than you currently owe. In turn, you receive the difference in cash. Explore when you may want to choose a HELOC or a cash-out refinance.

Key Differences

- Loan Structure. A HELOC is a revolving line of credit, while a cash-out refinance is a one-time lump sum.

- Interest Rates. Refinancing can offer fixed interest rates to maintain predictable, stable monthly payments. Unlike a HELOC, which involves variable rates.

When to Choose One Over the Other?

- HELOC. You may consider a home equity line of credit if you have ongoing expenses or projects that don’t need all the funds at once. For example, home renovations, you can use the funds on an as-needed basis.

- Cash-Out Refinance. This is best if you prefer a fixed-rate and want a large sum of money upfront instead of opening a line a credit.

Frequently Asked Questions

How much can I borrow with a HELOC?

The amount you can borrow depends on your home’s value, the amount you owe on your current mortgage, your credit score, and the program’s guidelines. Typically, you can borrow up to 85% of your home’s equity if you qualify.

Are there fees associated with it?

Yes! Similar to closing costs with traditional mortgages, there may be fees for a HELOC such as an application fee, appraisal cost, and potential annual fees.

Can I pay off a HELOC early?

Yes, most HELOCs allow for early repayment with no penalty costs. Be sure to confirm the details with your loan officer.

How does a HELOC affect my credit score?

A HELOC can impact your credit score depending on how you manage the credit line. Timely payments may boost your score, while missed payments can harm it.

Is it tax deductible?

Interest on HELOC loans may be tax deductible. Please consult with your tax professional for more details.

What happens if I sell my home?

If you have a HELOC and then sell your home, you’ll need to pay it off in full. You could use the proceeds of the sale toward the HELOC.

Ready to Unlock Your Home Equity Line of Credit?

A HELOC may be a strategic financial tool for homeowners needing to access funds. Whether you’re paying for home renovation projects, education, or other significant expenses, a line of credit offers flexibility when you need it. However, it’s crucial to weigh the pros and cons, understand potential risks, and compare your options.

Want to learn more about HELOCs or other mortgage services? Contact your local Supreme Lending branch. We’re ready to help!

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | May 21, 2024

Undergoing home renovation projects can not only enhance your living space but, if done right, may increase the value of your home. Whether you’re looking to attract buyers before selling your home or want to modernize your space, here are eight popular home renovation projects to consider that may add value and pay off in the long-term. Plus, with renovation loans or refinancing,* funding these projects may be easier than you think.

1. Upgrade the Front Door

The front door of your home is the first thing people see, and first impressions matter. Replacing an old, worn-out door with a new, sleek one can instantly boost your home’s curb appeal. Opt for a steel or fiberglass door for durability. For a lower budget option, a fresh coat of paint and new hardware can also do wonders.

2. Enhance Landscaping

The exterior yard is crucial when it comes to selling a home, and well-maintained landscaping can make a big difference. Simple tasks such as trimming bushes, planting flowers, and adding fresh mulch can create an inviting environment. Consider adding attractive features such as a stone walkway, small fountain, or boxwood bushes.

3. Remodel the Kitchen

The kitchen is the heart of the home and is oftentimes a key deciding factor for people looking to buy a property. Even minor updates like replacing outdated appliances, installing new countertops, or refreshing cabinet hardware can make a big impact. If you have a larger budget, consider a complete kitchen overhaul including modern cabinetry, a marble island, or a luxurious backsplash.

4. Remake the Bathroom

Updating bathrooms can significantly boost your home’s value. Start with easy fixes like re-caulking the tub, replacing outdated fixtures, upgrading to a modern mirror, or adding a fresh coat of paint. Depending on the condition, it may be worth to completely renovate the bathroom by updating the shower or tub and retiling the space.

5. Add or Upgrade a Deck or Patio

Outdoor space has always been an appealing feature to homebuyers. Adding a deck or patio can extend the living space and create an enjoyable area for entertaining and relaxation. If you already have a deck, ensure it’s in good condition by making any repairs or replacements. You can even add unique features like an outdoor kitchen or elegant lighting.

6. Add Fresh Paint

A fresh coat of paint is a simple, cost-effective way to update your home. Choose neutral colors that would appeal to a wide range of buyers and make spaces feel larger and brighter. Painting can cover up any scuffs and marks, making your home look cleaner and well-maintained.

7. Improve Energy Efficiencies

Energy efficiency can be a top priority for many homebuyers. Simple upgrades like adding insulation or installing programable smart home technology can make your home more attractive. Larger investments, such as replacing old windows and converting to Energy Star-rated appliances, may also add significant value.

8. Increase Spare Footage

If you have the budget, increasing your home’s square footage may considerably raise its market value. Options include finishing a basement, converting an attic, or adding on an extension. The new space could be marketed as an extra bedroom, bathroom, or home office, making your home more appealing to a wider range of buyers.

Financing Home Renovation Projects

While remodeling a home may add significant value, it can also be costly. Fortunately, there are financing options available to help fund home renovation projects, such as a renovation loan, home equity loans, or cash-out refinancing.

Have any home renovation projects in mind? Contact us today to learn how we can help you finance the home of your dreams.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.