by First Integrity Team Supreme Lending | Jan 9, 2025

All You Need to Know About the FHA 203(h) Disaster Relief Loan Program

When natural disaster strikes, the devastation it leaves behind can be overwhelming, especially if your home is damaged or destroyed. At Supreme Lending, we know how difficult it can be to rebuild after such destruction. That’s where the FHA 203(h) Disaster Relief Loan may be able to help as an affordable option for those in eligible areas.

If you’ve been affected by disaster and are looking to rebuild or purchase a new home for a fresh start, Supreme Lending is here to help you navigate the challenging time with care and expertise. This guide will walk you through the FHA 203(h) loan, how it works, benefits, and why it may be a valuable program for helping disaster victims get back on their feet.

What Is the FHA 203(h) Disaster Relief Loan?

The FHA 203(h) is a government-insured mortgage program that provides financial assistance to individuals whose homes have been damaged or destroyed in federally declared disaster areas. This is designed to help homeowners and renters alike rebuild or purchase new homes in the wake of devastating events like hurricanes, floods, tornadoes, and wildfires.

What makes the FHA 203(h) Disaster Relief Loan unique is the ability to help make homeownership more attainable after such tragedy by offering flexible guidelines and 100% financing.

How Does FHA 203(h) Work?

The FHA 203(h) Disaster Relief Loan works similarly to other FHA programs but comes with added benefits and provisions specifically for disaster victims. Here’s a breakdown of how it works.

What Properties Are Eligible?

To qualify, your current home must be in a Presidentially Declared Major Disaster Area (PDMDA) and must have been damaged to the point where it is no longer livable. The loan must be secured within one year of the disaster declaration, offering you plenty of time to regroup and take the next step towards recovery.

Program Benefits

- No down payment required. One of the biggest benefits of this program is that there is no down payment requirement for eligible borrowers. This makes it easier to secure financing without the burden of saving for large upfront costs, especially after facing potential hardships caused by a disaster.

- Minimum credit score of 580. While there are still credit parameters in place, the FHA 203(h) offers more lenient requirements than other financing options. This may help borrowers whose credit was negatively impacted due to the natural disaster.

- Available for single-family or FHA-approved condos. The home must be a primary residence – either a single-family home or approved condominium project. This program is not designed for second homes or investment properties but is focused on truly helping homeowners get back on their feet.

- Purchase location flexibility. Through this program, it allows you to purchase a new home anywhere in the United States. The replacement home doesn’t have to be in a designated disaster area.

Combining FHA 203(h) with 203(k) Renovation

The FHA 203(h) program also offers the option to combine with an FHA 203(k) Standard or Limited Renovation loan. This involves adding renovation costs into a single mortgage to cover repairs and remodel projects ranging from minor updates to structural if approved. Plus, the damaged property is eligible regardless of the age of the home. It only needs to have been a habitable residence prior to the disaster.

Ready to Relocate or Rebuild?

Supreme Lending is here to help you move forward and rebuild when disaster strikes. To learn more about the FHA 203(h) Disaster Relief Loan or to go over other mortgage options, contact your local Supreme Lending branch today!

More Resources from the U.S. Department of Housing and Urban Development:

Related Articles:

by First Integrity Team Supreme Lending | Oct 17, 2024

Discover the Program Highlights of an FHA 203(k) Renovation Loan

Are you ready to turn a fixer-upper into your dream home? Whether it’s a home you’ve just bought or already own, renovation loans like the FHA 203(k) program may help you finance both the purchase and necessary repairs or updates all in one mortgage. Plus, the U.S. Department of Housing and Urban Development (HUD) announced that it is increasing the loan amount for Limited FHA 203(k) loans to $75,000 on all FHA case numbers effective November 4, 2024—that’s up from $35,000 which is huge news!

Here’s an in-depth look at how the FHA 203(k) renovation loan works, the differences between the Limited and Standard options, and what types of renovations may be covered.

What Is an FHA 203(k) Loan?

Insured by the Federal Housing Administration, the FHA 203(k) renovation loan allows homeowners to finance the cost of both the property and its renovations in a single loan. Whether you’re purchasing a home that needs updates or making repairs to your current home, this loan program may help make those dreams a reality. It offers the similar benefits of FHA loans for first-time buyers and repeat buyers alike. To qualify, eligible borrowers only need 3.5% down payment and there’s more lenient credit score requirements than other renovation loans.

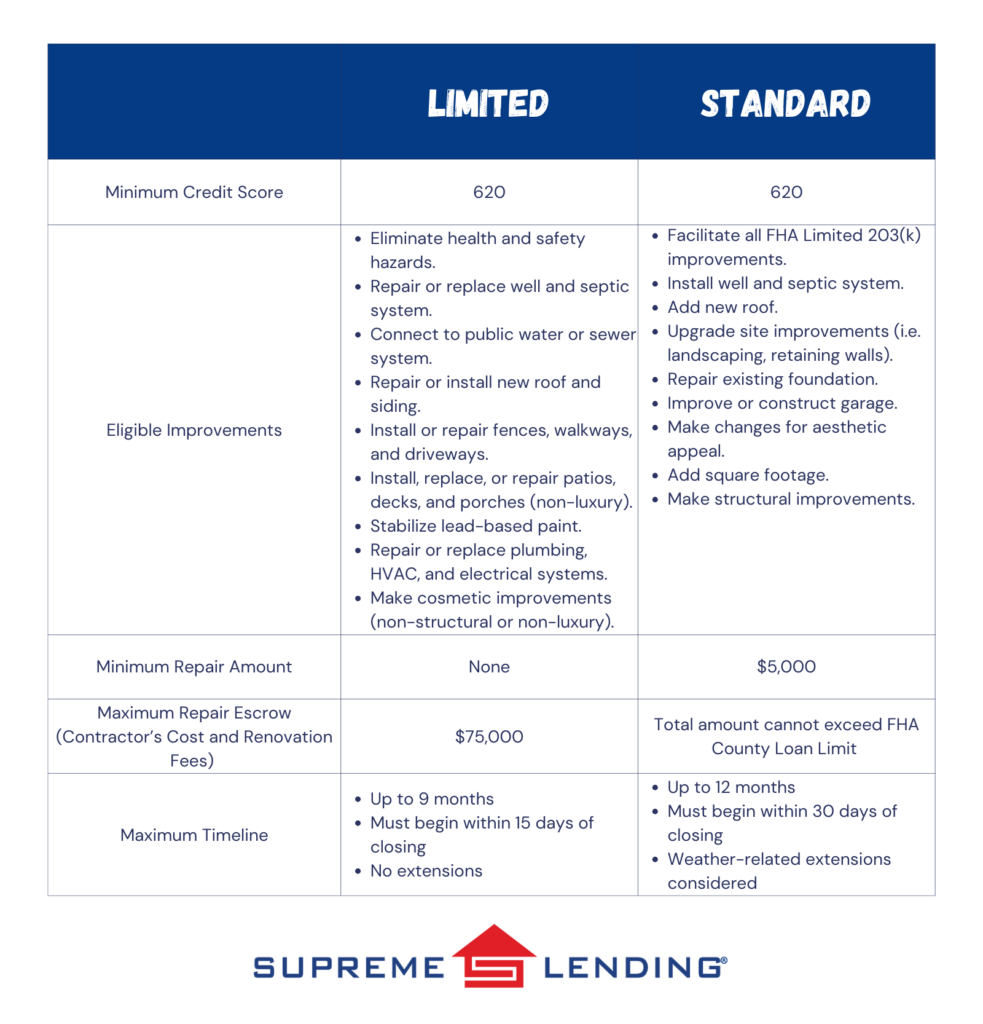

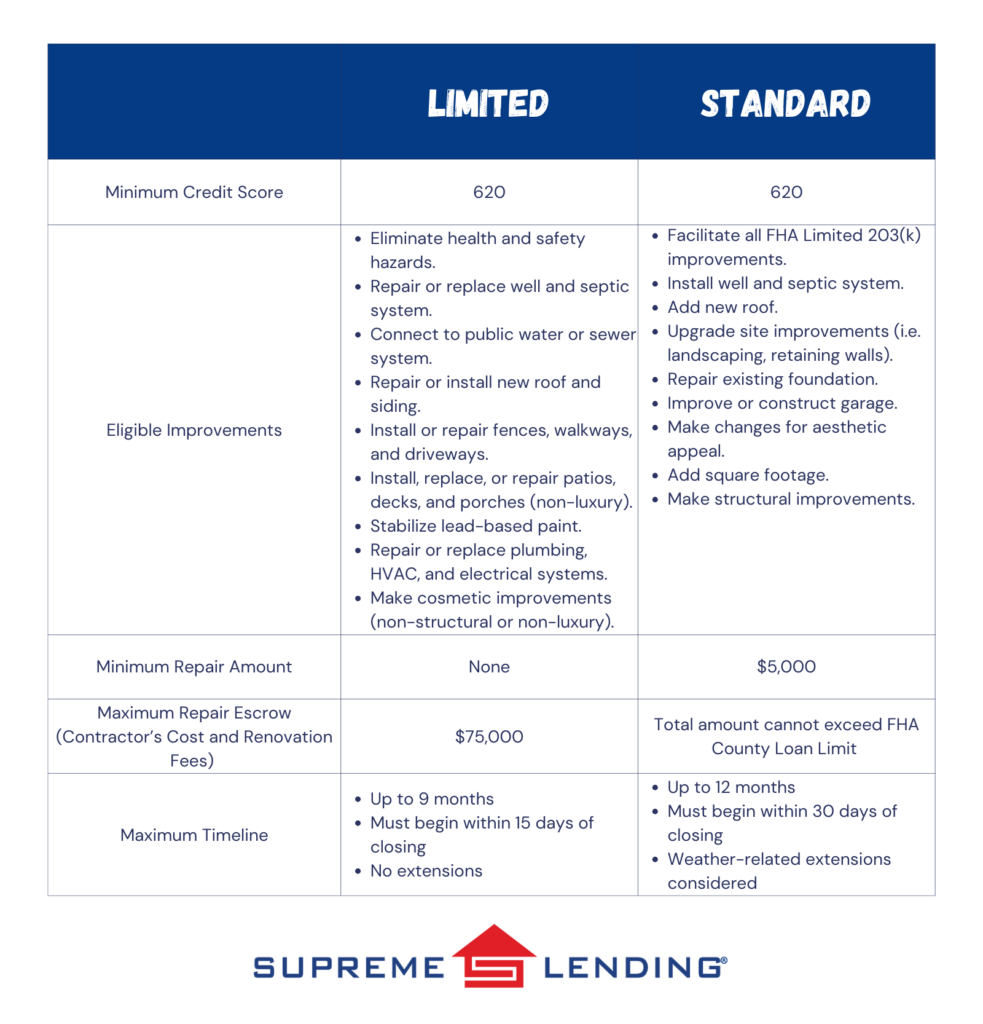

Limited vs. Standard FHA 203(k) Renovation Loan

There are two types of FHA 203(k) loans—Standard and Limited. Each has specific uses and limits depending on the scope of renovations you can make.

Limited FHA 203(k) Loan

The Limited 203(k) option is commonly used for smaller repairs and cosmetic upgrades. As mentioned, the loan amount will increase to $75,000 in November 2024, an exciting enhancement that will help open the door to renovations for more people. This loan covers non-structural projects such as remodeling kitchen fixtures, replacing flooring, painting, and minor landscaping. Unlike the Standard, the Limited program doesn’t require working with an HUD consultant or have a minimum loan amount.

Common Projects the Limited Covers

- Minor remodeling (i.e. updating kitchens or bathrooms)

- Replacing appliances or flooring

- Repainting or refinishing surfaces

- Energy-efficient improvements (i.e. installing new windows or insulation)

- Repairing roofs and gutters

Standard FHA 203(k) Loan

The Standard FHA 203(k) Renovation loan is more ideal for homes needing larger renovations and structural repairs. These may include adding rooms, replacing outdated plumbing or electrical systems, and fixing major structural issues. It has a minimum of $5,000 that must be used for renovations and the total loan amount must be within the FHA County Loan Limit. Because these projects are typically more complex, you’re required to work with an HUD-approved consultant.

Common Projects the Standard Covers

- Structural repairs or additions (i.e. adding on square footage or fixing foundation issues)

- Major systems replacements (i.e. plumbing, electrical, or HVAC systems)

- Roof repairs or replacements

- Modernization and improvements to the home’s function

- Accessibility improvements for people with disabilities

How Does the FHA 203(k) Renovation Loan Work?

The process for applying for an FHA 203(k) loan is similar to a regular FHA mortgage but comes with a few additional steps. Here’s an overview of how this loan program works.

- Find a property. Whether it’s a home you already own and want to refinance* or one you’re planning to purchase, identify a property that needs renovations.

- Get an appraisal. The home appraisal will assess both the home’s current market value as well as it’s “as-completed” value after the renovations are completed.

- Contractor and Estimates. Work with a licensed contractor to obtain the estimated costs for the repairs and improvements.

- Loan Application. You’ll apply for the loan based on the combined cost of the home and repairs.

- Renovation Timeline. Once the loan is approved, the renovation funds are placed into an escrow account and work begins. The renovation timeline can typically range from six months to one year.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

FHA 203(k) Combined with FHA 203(h) Disaster Relief Loan

Did you know that eligible borrowers affected by federally declared disaster areas may be able to combine the FHA 203(k) renovation loan with the FHA 203(h) disaster relief loan? This means adding the renovation costs into a new mortgage if your home was destroyed and deemed unlivable. Plus, the damaged property is eligible regardless of the age of the home. It only needs to have been a habitable residence prior to the disaster.

Ready to Rebuild?

At Supreme Lending, we understand how important it is to transform a home into one that truly meets your needs. Whether you’re fixing up a new property or renovating your current home, the FHA 203(k) renovation loan offers an excellent way to finance those improvements. We’re proud to offer both Standard and Limited options to fit the scope of your home projects.

Want to learn more about FHA 203(k) renovation loans or other mortgage options? Contact our team at Supreme Lending today and get pre-qualified!

Looking for other renovation loan options? Read more:

by First Integrity Team Supreme Lending | Sep 20, 2024

Can repeat buyers qualify for FHA loans?

When you think of an FHA loan, it’s often associated with first-time homebuyers. After all, FHA loans are widely known for lower down payment and flexible credit requirements. But did you know that FHA loans are not just limited to first-time homebuyers? Insured by the Federal Housing Administration, FHA loans are available to anyone who meets the guidelines, including repeat buyers.

Whether you’re upgrading to a larger home, downsizing, or simply moving to a new area, FHA loans can still be a valuable mortgage option for eligible borrowers. However, there are some caveats. Let’s explore why repeat buyers may consider an FHA loan, how it works, and answer a few frequently asked questions.

FHA Loan Benefits for Repeat Buyers

Lower Down Payment

One of the key benefits of an FHA loan is the down payment requirement as low as 3.5% of the purchase price for qualified buyers. For repeat buyers who may have limited equity from a previous home sale or do not want to pay for a sizable down payment, this lower down payment may be appealing.

Flexible Credit Score

FHA are also known for their flexibility when it comes to a borrower’s credit score. While Conventional loans typically require a score of 620, the minimum for FHA loans is 580.

Competitive Rates

FHA loans often come with competitive interest rates, even for buyers who may not have top-tier credit. Locking in a lower rate may make a significant difference in the monthly mortgage payment and may result in potential savings over the life of the loan.

Assumable Loan

One of the most unique features of an FHA loan is that it’s assumable. This means that if you sell your home in the future, the buyer can essentially take over your FHA loan, including the rate, if they qualify. When you’re looking to sell the home, this could make the offer more attractive to potential buyers, especially if interest rates are higher than when you purchased the loan.

Gift Funds

FHA loans also allow mortgage gift funds to be used for 100% of the down payment or closing costs. In this case, family members or other eligible donors may give you the money to cover the upfront costs with no repayment obligation.

FHA Loans for Repeat Buyers: Frequently Asked Questions

Can non-first-time homebuyers use an FHA loan?

Yes, FHA loans are not reserved exclusively for first-time homebuyers. As long as the property is your primary residence and you meet the income, credit, and other qualifications, you may consider an FHA loan – regardless if it’s your first home or not.

Can FHA loans be used for second home or investment properties?

FHA loans are designed for primary residences only, which means you cannot use them to buy a second home or an investment property.

Can I have more than one FHA loan at a time?

In general, FHA only allows you to have one active FHA loan at one time. This is because the mortgage is designed for primary residences only. However, there may be exceptions such as relocating for work, a growing family, or having been a co-signer. Each situation is unique and requires proof to qualify for an exception. That’s why it’s important to work with a knowledgeable lender to go over your options.

Do FHA loans require mortgage insurance?

Yes, FHA loans require both an upfront mortgage insurance premium and ongoing monthly mortgage insurance payments. These payments help protect the lender in case of a default on the loan. Unlike private mortgage insurance for Conventional loans, FHA mortgage insurance premiums typically remain for the life of the loan unless you refinance into a non-FHA mortgage.

Ready to Take the Next Step?

The journey of homeownership doesn’t end after your first home purchase. Even if you’re not a first-time homebuyer, discover how FHA financing may still help open the door to your next home. Contact Supreme Lending today to get pre-qualified.

Related Articles:

by SupremeLending | May 9, 2024

Learn why FHA loans may be a perfect option for first-time buyers.

While first-time buyers are hunting for their perfect home, they’ll also need to be on the hunt for the perfect mortgage—which may seem more overwhelming and not as enjoyable as touring properties. There are several financing options to choose from and programs available. It’s all about finding the one that fits best. At Supreme Lending, our goal is to provide the guidance you need to make informed decisions and be confident with your loan choice.

In this article, we’re highlighting a mortgage option that is designed specifically to help first-time buyers, FHA loans. Discover the many FHA loan benefits and why this option may be right for you.

Understanding FHA Loans: A Brief Overview

First, what exactly is an FHA loan? The Federal Housing Administration (FHA), a branch of the U.S. Department of Housing and Urban Development (HUD), insures FHA loans, which are issued by approved lenders. This insurance protects lenders against losses if a borrower defaults on their loan, making FHA loans less risky for lenders and consequently more accessible to first-time buyers.

FHA Loan Benefits

1. Low Down Payments.

To help overcome one of the biggest barriers for first-time homebuyers, FHA loans typically require a lower down payment compared to Conventional loans. This makes homeownership more accessible to people who may not have substantial savings or want to pay less upfront costs.

2. Flexible Credit Requirements.

FHA loans are more lenient when it comes to credit, allowing borrowers with lower credit scores to qualify for financing, which is beneficial for those who are still establishing their credit history. See common credit score and down payment requirements here.

3. Assumable Loans.

What does this mean? FHA loans are assumable, which means that if you sell your home, the buyer can take over your FHA loan, potentially offering them a competitive advantage in a rising interest rate environment. Restrictions on assumability may apply.

4. Lenient Debt-to-Income (DTI) Ratios.

DTI compares a borrower’s debt to their monthly income to measure’s their ability to manage monthly mortgage payments. FHA loans often allow for higher debt-to-income ratios compared to Conventional loans.

5. Lower Mortgage Insurance Premiums.

While FHA loans require mortgage insurance premiums (MIP), the premiums are often lower than those of Conventional loans, especially for borrowers with lower credit scores or smaller down payments. In fact, the FHA annual mortgage insurance premium was lowered from 0.85% to 055% in 2023 for most borrowers.

6. Seller Closing Cost Assistance.

Another benefit buyers could take advantage of is negotiating seller concessions to help cover upfront costs. FHA loans can allow sellers to contribute up to 6% toward the buyer’s down payment, appraisal fees, or other associated closing costs.

7. Gift Funds.

Gift funds are given to someone with no expectation of repayment, for example parents gifting their newlywed children money for a down payment. FHA loans allow borrowers to use gift funds from family members or other eligible sources to cover their down payment and closing costs. Note: A gift letter is required to confirm the gift funds.

8. Renovation Loans.

The FHA 203(k) Renovation loan is a home rehabilitation financing option, which allow borrowers to finance both the purchase price of the home and the cost of eligible renovations or repairs into a single loan. This helps buyers afford any necessary improvements and can open their home search to consider fixer-uppers.

9. Streamline Refinancing.

FHA loans offer a streamlined refinancing option, known as the FHA Streamline Refinance. This allows borrowers to refinance their current FHA loan with minimal paperwork and documentation, saving time and money.

10. No Prepayment Penalties.

FHA loans do not have prepayment penalties unlike some traditional mortgages. This allows borrowers to pay off their mortgage early without facing additional fees or charges, which can save money on interest over time.

11. 100% FHA Financing Available.

Did you know Supreme Lending offers two competitive FHA 100% financing options? Through the Chenoa Fund or the Supreme Dream program, these include a 30-year fixed-rate FHA loan paired with a second forgivable loan to be used toward down payment, closing costs, and prepaids.

These benefits make FHA loans an attractive option for first-time homebuyers, offering accessibility, flexibility, and affordability to achieve homeownership.

Ready to get started? Contact Supreme Lending today to learn more about FHA loans or other mortgage services we offer.