Everything You Need to Know About Jumbo Loans

House hunters who are interested in larger or more expensive homes that could exceed certain conforming loan thresholds may need to consider a Jumbo loan program. If you’re dreaming big in your homebuying journey, discover what exactly a Jumbo loan is, qualification requirements, and helpful considerations when looking into a Jumbo loan option.

What Is a Jumbo Loan?

To understand conforming loans, you first need to understand conforming loans, which have maximum loan amounts set by the Federal Housing Finance Agency (FHFA). The 2024 conforming loan limit in most of the country is $766,550, though this may vary depending on the county in which you’re looking to purchase a property. If a loan amount is larger than this, then it’s considered a Jumbo loan.

The FHFA establishes conforming loan limits to regulate the maximum size of loans that government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac can purchase or guarantee. These limits are put in place to ensure stability and liquidity in the mortgage market and to promote affordable homeownership. Because of this, Jumbo loans present a higher risk to lenders and often have different requirements than conforming loans.

For example, down payment requirements for Jumbo loans are typically higher, around 20% or more of the loan amount. They may also require private mortgage insurance (PMI) or carry higher interest rates than conforming loans.

Differences Between Jumbo Loans and Conforming Loans

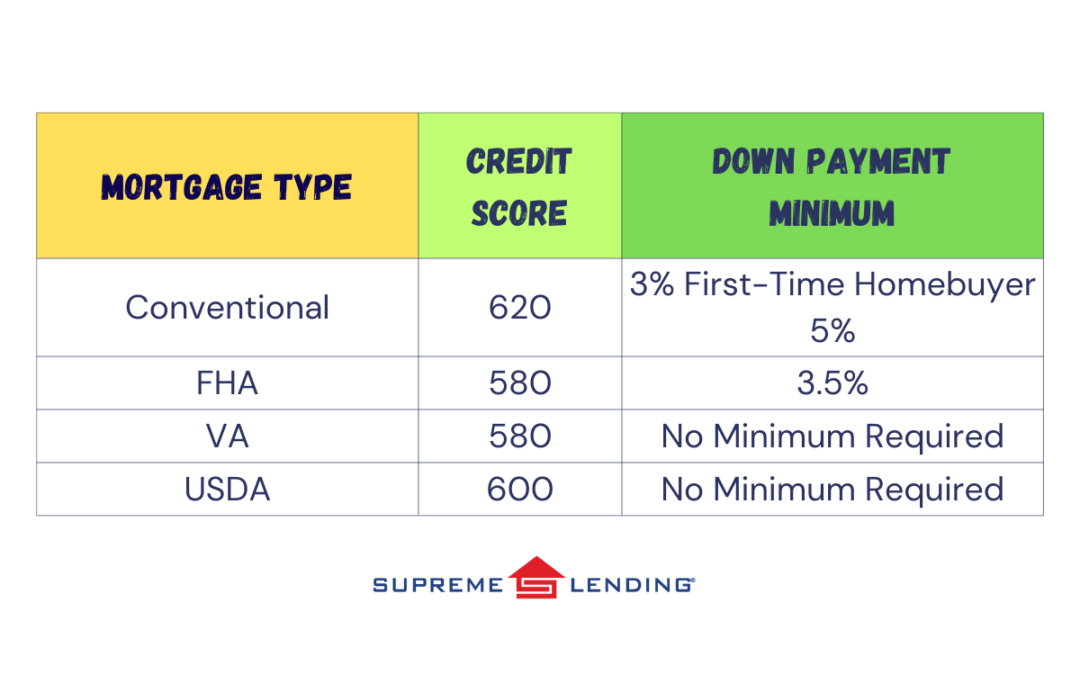

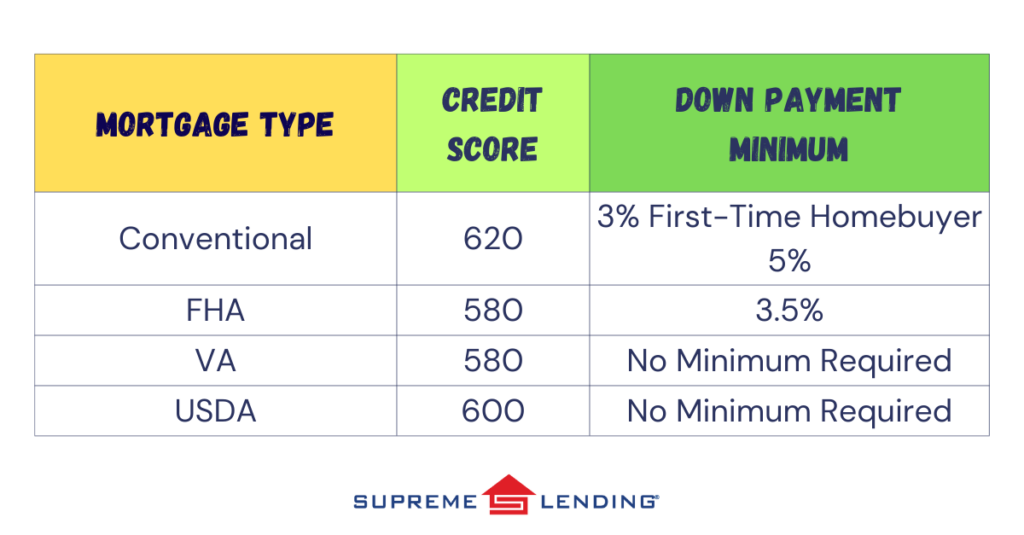

Let’s go over the direct differences in qualifications and other areas between Jumbo loans and conforming loans:

- Down payment requirements. Jumbo loans tend to have stricter minimum down payment guidelines, often 20% or more of the loan amount. Conforming loans may be as low as 3% for first-time homebuyers.

- Private mortgage insurance (PMI). Jumbo loans almost always require private mortgage insurance, whereas conforming loans typically only require it if the down payment is less than 20%.

- Interest rates. Jumbo loans often come with higher interest rates than conforming loans due to the potential of higher risk involved for lenders.

- Loan limits. The main difference between these two types of loans is the loan limit. If the amount you’re looking to borrow exceeds the FHFA’s limit for your county, it’s a Jumbo loan.

- Closing costs and fees. Finally, closing costs and fees tend to be higher for Jumbo loans than conforming loans because they’re generally more complex and involve more work for the lender.

Jumbo Loan Qualifications Overview

While these conditions can vary somewhat depending on your area and a few other factors, here are some general guidelines for homebuyers looking to qualify for a Jumbo loan:

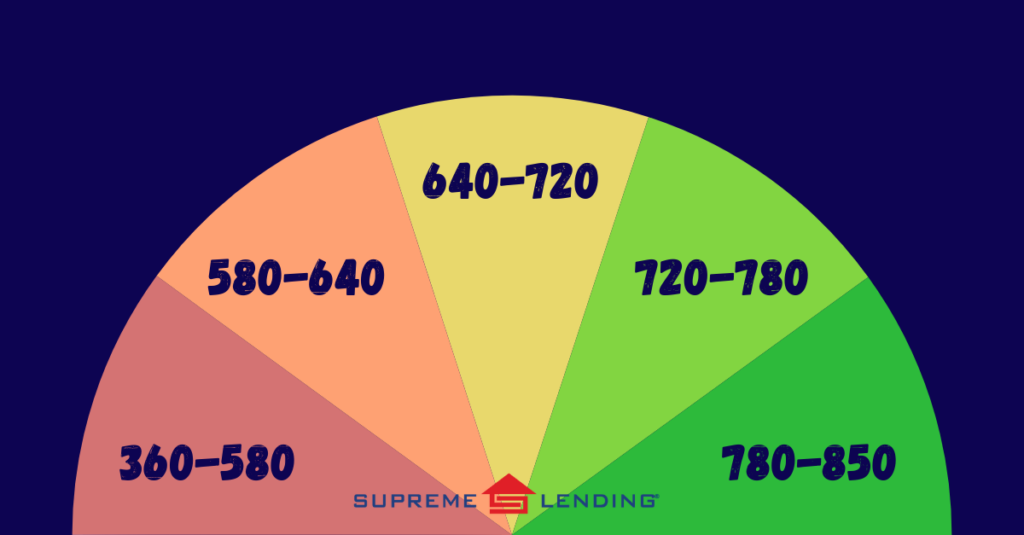

- Credit score. Credit and related requirements are typically higher for Jumbo loans than Conventional loans. In general, there tends to be a hard credit score minimum of 660, and many lenders may even require as high as 720 or 740.

- Debt-to-income (DTI) ratio. The maximum DTI for a Jumbo loan is typically around 43%, though this can vary depending on the specific lender. This means that no more than 43% of your income should be going towards debts each month.

- Documentation. Jumbo loans typically require extensive documentation, often including tax returns, bank statements, and asset verification. This is to ensure that you’re able to afford and repay the loan and aren’t taking on more debt than you can handle.

- Cash reserves. Another important factor that lenders will look at is your cash reserves. This is the amount of money you have left over after closing on a property that can be used to make mortgage payments if necessary. Lenders typically like to see at least six months’ worth of mortgage payments in cash reserves, though this can vary.

- Appraisals. In certain cases, not just one but two appraisals may be required for a Jumbo loan. This is to ensure that the property is worth at least as much as the loan amount and is yet another way for lenders to protect themselves from taking on too much risk.

As you can see, there’s a lot to think about if you’re looking to apply for a Jumbo mortgage. Make sure you understand all the requirements and are comfortable with any potential risks.

Considerations for Jumbo Loans

Jumbo loans may not be for everyone. There are a few potential reasons why someone may want to opt out of choosing a Jumbo loan and go with another option:

- You may not actually need a Jumbo loan. If you’re interested in a larger home but don’t need to borrow more than the conforming loan limit, it may not make sense to take out a Jumbo loan because you can end up paying more in interest and fees than necessary.

- You don’t qualify. As noted above, the lending criteria for Jumbo loans is typically stricter. If you don’t think you can meet them, it’s probably not worth your time to apply.

- The interest rates are high. Jumbo loan interest rates tend to be higher than conforming loan rates, so if you’re not comfortable with that you may want to look at other options.

Why Go Jumbo?

While there are important factors to consider, Jumbo loans can still be a great option for larger home purchases—especially in high-cost housing markets. Jumbo loans give qualified borrowers access to more expensive properties, including luxury estates, high-end condos, and prestigious neighborhoods. This expands the pool of available housing options, catering to diverse preferences and lifestyles. Additionally, Jumbo loans can often come with customizable terms and features tailored to the unique needs of high-net-worth individuals or savvy investors.

For more information on Jumbo loans, or to learn about any of our mortgage services, contact your local Supreme Lending team today.