by First Integrity Team Supreme Lending | Sep 20, 2024

Can repeat buyers qualify for FHA loans?

When you think of an FHA loan, it’s often associated with first-time homebuyers. After all, FHA loans are widely known for lower down payment and flexible credit requirements. But did you know that FHA loans are not just limited to first-time homebuyers? Insured by the Federal Housing Administration, FHA loans are available to anyone who meets the guidelines, including repeat buyers.

Whether you’re upgrading to a larger home, downsizing, or simply moving to a new area, FHA loans can still be a valuable mortgage option for eligible borrowers. However, there are some caveats. Let’s explore why repeat buyers may consider an FHA loan, how it works, and answer a few frequently asked questions.

FHA Loan Benefits for Repeat Buyers

Lower Down Payment

One of the key benefits of an FHA loan is the down payment requirement as low as 3.5% of the purchase price for qualified buyers. For repeat buyers who may have limited equity from a previous home sale or do not want to pay for a sizable down payment, this lower down payment may be appealing.

Flexible Credit Score

FHA are also known for their flexibility when it comes to a borrower’s credit score. While Conventional loans typically require a score of 620, the minimum for FHA loans is 580.

Competitive Rates

FHA loans often come with competitive interest rates, even for buyers who may not have top-tier credit. Locking in a lower rate may make a significant difference in the monthly mortgage payment and may result in potential savings over the life of the loan.

Assumable Loan

One of the most unique features of an FHA loan is that it’s assumable. This means that if you sell your home in the future, the buyer can essentially take over your FHA loan, including the rate, if they qualify. When you’re looking to sell the home, this could make the offer more attractive to potential buyers, especially if interest rates are higher than when you purchased the loan.

Gift Funds

FHA loans also allow mortgage gift funds to be used for 100% of the down payment or closing costs. In this case, family members or other eligible donors may give you the money to cover the upfront costs with no repayment obligation.

FHA Loans for Repeat Buyers: Frequently Asked Questions

Can non-first-time homebuyers use an FHA loan?

Yes, FHA loans are not reserved exclusively for first-time homebuyers. As long as the property is your primary residence and you meet the income, credit, and other qualifications, you may consider an FHA loan – regardless if it’s your first home or not.

Can FHA loans be used for second home or investment properties?

FHA loans are designed for primary residences only, which means you cannot use them to buy a second home or an investment property.

Can I have more than one FHA loan at a time?

In general, FHA only allows you to have one active FHA loan at one time. This is because the mortgage is designed for primary residences only. However, there may be exceptions such as relocating for work, a growing family, or having been a co-signer. Each situation is unique and requires proof to qualify for an exception. That’s why it’s important to work with a knowledgeable lender to go over your options.

Do FHA loans require mortgage insurance?

Yes, FHA loans require both an upfront mortgage insurance premium and ongoing monthly mortgage insurance payments. These payments help protect the lender in case of a default on the loan. Unlike private mortgage insurance for Conventional loans, FHA mortgage insurance premiums typically remain for the life of the loan unless you refinance into a non-FHA mortgage.

Ready to Take the Next Step?

The journey of homeownership doesn’t end after your first home purchase. Even if you’re not a first-time homebuyer, discover how FHA financing may still help open the door to your next home. Contact Supreme Lending today to get pre-qualified.

Related Articles:

by First Integrity Team Supreme Lending | Aug 30, 2024

An Overview of Supreme Lending Credit Score Requirements

When you’re preparing to buy a home, understanding the mortgage credit score requirements is essential. Your credit plays a significant role in determining your eligibility for various loan programs, as well as interest rates you may qualify for. Our goal at Supreme Lending is to provide the smoothest mortgage experience possible, that includes guiding you with transparent information to help you to make an informed, confident decision. Here’s an overview of Supreme Lending’s credit score requirements for common loan programs and frequently asked questions.

Conventional Loans

Conventional loans are popular among homebuyers due to their flexibility and competitive interest rates. As a general rule of thumb, Supreme Lending requires a minimum credit score of 620 for Conventional loans. However, a higher score typically results in securing more favorable rates and terms.

FHA Loans

Insured by the Federal Housing Administration, FHA loans are another common mortgage option –especially for first-time homebuyers or borrowers with lower credit. These loans have more lenient credit score requirements, accepting as low as 580.

VA Loans

For eligible military Veterans and active-duty personnel, VA loans offer affordable options as they don’t require a down payment or mortgage insurance premiums. Like FHA loans, Supreme Lending’s credit score requirement for VA loans is a minimum of 580.

USDA Loans

Guaranteed by the U.S. Department of Agriculture, USDA loans provide affordable financing designed for homebuyers in designated rural areas with no down payment required. In general, Supreme Lending’s credit score requirement for this program is 600.

Jumbo Loans

Jumbo loans are used to purchase high-value properties with a loan amount greater than conforming loan limits, which is $766,550 for one-unit homes in 2024. Due to potential higher lending risk, Jumbo loans typically have stricter qualifications. Supreme Lending has jumbo programs with a minimum credit score of 680, but depending on the loan guidelines, some may require at least a 720 credit score or higher.

Frequently Asked Questions

Now that you have a snapshot of common credit score requirements at Supreme Lending, here’s some more insight on how your credit can impact your mortgage.

How is a credit score determined?

A credit score, often represented by a FICO® score, is a numerical assessment of a borrower’s financial health. It is calculated based on several key factors:

- Payment History: Your record of on-time payments versus late or missed payments.

- Credit Utilization: The amount of credit you’re using compared to your total credit limits.

- Length of Credit History: The duration of time you’ve had credit accounts open.

- Types of Credit in Use. The variety of credit accounts you have, such as credit cards, mortgages, and car loans.

- Recent Credit Behavior. This includes how many new credit accounts you’ve opened recently and credit inquiries.

Combining these factors provides a numerical score to help reflect your creditworthiness.

What qualifies as a generally “good” credit score?

In general, a credit score of 670 to 739 is considered good according to FICO® standards. Scores in this range suggest that you are a responsible borrower with a solid history of managing credit well. 740 or higher is considered very good or exceptional. Remember, a higher the credit score usually results in more favorable mortgage rates and terms.

Additionally, a credit score between 580 and 669 is considered fair. This range aligns with many of the credit score requirements outlined above depending on the loan type. So don’t fall victim to the common mortgage myth that you need perfect credit to qualify for a home loan.

What’s the difference between a soft credit pull and hard credit pull?

When applying for a mortgage, lenders need to pull your credit report. There are two ways to do this:

- A soft credit pull is a credit check that doesn’t affect your credit score. It’s typically used for pre-qualifications or when you check your own credit. Supreme Lending has this option when you get pre-qualified for a mortgage.

- A hard credit pull, on the other hand, occurs when a lender reviews your credit score as a formal credit application during the loan approval process. Hard pulls can temporarily lower your credit score by just a few points. However, there’s no significant impact, which is another mortgage myth to debunk.

Here to Help

Don’t navigate the mortgage process alone! Our experienced and knowledgeable team at Supreme Lending is here to help you understand all aspects of your homebuying journey. From understanding credit score requirements and determining which loan program may work for you to our seamless underwriting process, we help you close your loan with confidence.

Contact us today to get started!

Related articles:

Common Credit Score and Down Payment Requirements by Mortgage Type

FHA Loans vs. Conventional Mortgage: Which One Is Right for You?

by First Integrity Team Supreme Lending | Aug 20, 2024

When homeowners think about tapping into the equity they’ve built in their property, a Home Equity Line of Credit, also known as a HELOC, may come to mind. This alterative transaction mortgage can be incredibly versatile and useful for eligible homeowners to access funds. However, it’s important to understand exactly what a HELOC is and how it works when deciding if it’s the right option for you. Let’s explore how you may benefit from using a Home Equity Line of Credit.

What Is a HELOC?

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against the equity in their home, essentially turning part of their home’s value into cash. Unlike a traditional home loan, a HELOC functions similar to a credit card. Homeowners can borrow, repay, and borrow again up to a maximum credit limit. A HELOC is meant to use toward large expenses such as home renovations, tuition, or paying down other debts with higher interest.

How Does a HELOC Work?

A HELOC has a designated draw period, which is the time during which you can borrow money. This period is typically the first 10 years of a 30-year term. During this time, you’re only required to make interest payments on the amount you borrowed, which is significantly less than other loan types. Although, you may be able to pay down your principal with no penalty, which can result in lowering your minimum monthly payment.

After the draw period ends, the repayment period begins. This is when you can no longer draw money out and need to start paying back both the principal and interest of the loan. This new minimum payment will ensure the balance is paid in full by the maturity date. Interest rates on HELOCs are variable, meaning they change over time due to market conditions and set margins. As a result, the monthly payments can fluctuate.

Who Might Consider a HELOC?

HELOCs are a flexible financing option that may be attractive for homeowners who need access to funds for various reasons, including:

- Home Improvements. If you’re planning to remodel your kitchen, add an extension, or make other home renovation projects, a HELOC could provide the necessary funds.

- Pay Off High-Interest Debt. HELOCs often have lower interest rates than credit cards or personal loans, which makes them a good option to pay off other debts.

- Education Expenses. If you or your children need assistance paying for tuition, a HELOC may provide a helpful solution.

- Unexpected Expenses. A HELOC can also serve as a financial safety net for unseen expenses, such as medical bills or emergency repairs.

Supreme Lending HELOC Options

Did you know that Supreme Lending offers different types of HELOC programs? In addition to a standard HELOC, there is also a program specifically designed for home renovations, which uses the home value after improvements. There is also an option to tap into a line of credit on current investment properties.

HELOC Pros and Cons

Pros:

- Flexibility. You can borrow as much or as little as you need up to your limit during the draw period.

- Interest-Only Payments. During the draw period, borrowers have the option to only pay interest, which results in lower monthly payments compared to traditional loans.

- Potentially Lower Rates. HELOCs typically have lower interest rates than credit cards and personal loans, offering affordability.

Cons:

- Variable Rates. HELOCs have variable interest rates, which means they can change. If rates increase, so will the monthly payments.

- Risk of Foreclosure. When using a HELOC, you’re using your home as collateral. Therefore, if you default on the payments, you could risk losing your home.

- Potentially Overspend. Easy access to credit and funds may lead to overspending, which could put the home at risk.

HELOC vs. Cash-Out Refinance: What Is the Difference?

A cash-out refinance* is another way to tap into your home’s equity, but it works differently from a line of credit. With cash-out refi loans, you replace your existing mortgage with a new one for more than you currently owe. In turn, you receive the difference in cash. Explore when you may want to choose a HELOC or a cash-out refinance.

Key Differences

- Loan Structure. A HELOC is a revolving line of credit, while a cash-out refinance is a one-time lump sum.

- Interest Rates. Refinancing can offer fixed interest rates to maintain predictable, stable monthly payments. Unlike a HELOC, which involves variable rates.

When to Choose One Over the Other?

- HELOC. You may consider a home equity line of credit if you have ongoing expenses or projects that don’t need all the funds at once. For example, home renovations, you can use the funds on an as-needed basis.

- Cash-Out Refinance. This is best if you prefer a fixed-rate and want a large sum of money upfront instead of opening a line a credit.

Frequently Asked Questions

How much can I borrow with a HELOC?

The amount you can borrow depends on your home’s value, the amount you owe on your current mortgage, your credit score, and the program’s guidelines. Typically, you can borrow up to 85% of your home’s equity if you qualify.

Are there fees associated with it?

Yes! Similar to closing costs with traditional mortgages, there may be fees for a HELOC such as an application fee, appraisal cost, and potential annual fees.

Can I pay off a HELOC early?

Yes, most HELOCs allow for early repayment with no penalty costs. Be sure to confirm the details with your loan officer.

How does a HELOC affect my credit score?

A HELOC can impact your credit score depending on how you manage the credit line. Timely payments may boost your score, while missed payments can harm it.

Is it tax deductible?

Interest on HELOC loans may be tax deductible. Please consult with your tax professional for more details.

What happens if I sell my home?

If you have a HELOC and then sell your home, you’ll need to pay it off in full. You could use the proceeds of the sale toward the HELOC.

Ready to Unlock Your Home Equity Line of Credit?

A HELOC may be a strategic financial tool for homeowners needing to access funds. Whether you’re paying for home renovation projects, education, or other significant expenses, a line of credit offers flexibility when you need it. However, it’s crucial to weigh the pros and cons, understand potential risks, and compare your options.

Want to learn more about HELOCs or other mortgage services? Contact your local Supreme Lending branch. We’re ready to help!

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by First Integrity Team Supreme Lending | Aug 14, 2024

There are several things to consider when deciding to refinance* your mortgage. It’s essential that you’re well-informed and ready to make an educated home financing decision to reach your goals. Once you’ve established how soon you can refinance, here are seven other important considerations.

1. Home Equity: The Foundation of Refinancing

One of the first things to evaluate when deciding to refinance your mortgage is how much equity you have built in your home. Equity is the portion of the property that you truly “own”—the value of your home minus your mortgage debt. Typically, lenders require that you have at least 20% equity in your home to qualify for a refinance. If you haven’t built up sufficient equity, you may not be eligible or you may receive less favorable terms. Your home equity is especially important when considering cash-out refi loans.

2. Credit Score: Your Financial Passport

Your credit score is crucial when it comes to your mortgage and loan program requirements. Your credit reflects your financial history. It also helps lenders determine a borrower’s potential risk. A higher credit score may help you unlock a more favorable mortgage. Before applying for a refinance loan, understand where you stand with your credit. Also, ensure that you’re up to date on making other debt payments.

3. Debt-to-Income (DTI) Ratio: Balancing Your Financial Obligations

Lenders will also review your Debt-to-Income (DTI), which is the ratio percentage of your monthly income that goes toward paying debts. A lower DTI ratio can demonstrate to lenders that you’re capable of managing your current debts and have the ability to repay your mortgage. Generally, a DTI of 43% or less is preferred but some loan programs and lenders can be more flexible and accept higher ratios.

4. Closing Costs: The Price of Change

Refinancing isn’t free. Don’t forget about the closing costs and associated fees that come when you refinance your mortgage. These can include application fees, originating fees, appraisals, and more. These expenses can add up to anywhere from 2% to 6% of the loan amount. It’s vital to review these costs to determine if refinancing makes sense for you. A breakdown of refinance closing fees will be included in your mortgage closing disclosure.

5. Break-Even Point: Calculating the Payoff

Understanding your break-even point is essential when you refinance your mortgage. This is the point at which your possible savings from a new loan exceed the costs of refinancing. To calculate this, divide the total cost of refinancing by the potential monthly savings from the new monthly mortgage payment. The result is the number of months it may take to recoup the costs. If you plan to stay in your home past the break-even point, refinancing may be very beneficial.

6. Interest Rates: When Is the Right Time?

Interest rates are also a driving factor when deciding to refinance your mortgage. A general rule of thumb is that refinancing is worth considering if you can reduce your interest rate by at least 0.5% or more. However, every borrower’s situation is different, so it’s important to analyze how a new rate will impact your unique financial picture and monthly mortgage payments. There are other reasons to refinance beyond the interest rate.

7. Private Mortgage Insurance: Can You Remove It?

If you put less than 20% down payment on your initial mortgage, you’re typically required to pay for private mortgage insurance (PMI). This protects lenders in case of a default on the loan. It’s an additional cost to your monthly payments. However, if you have more than 20% equity built in your home, refinancing may help remove the cost of PMI and reduce your payments.

At Supreme Lending, we understand that deciding to refinance your mortgage is a significant step, and you deserve significant service. By carefully weighing these seven considerations, you’ll be in a strong position to make a decision that aligns with your desired outcomes. When you’re ready to discuss your mortgage and refinancing options, our team is here to guide you every step of the way.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | Jul 26, 2024

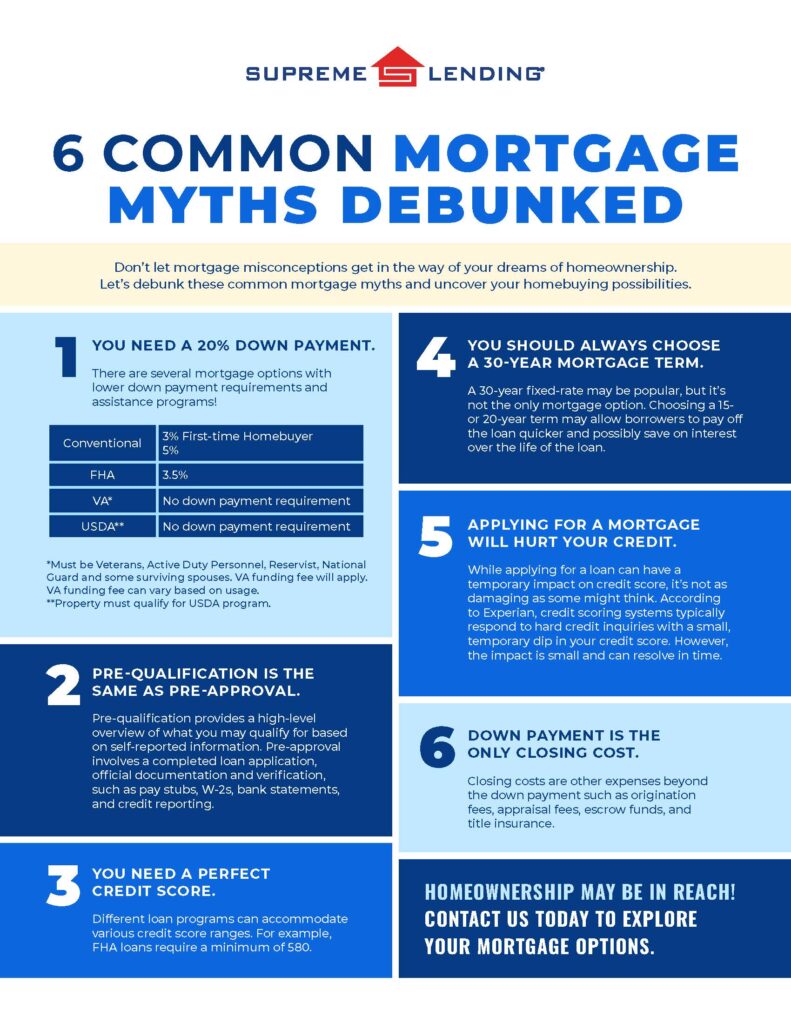

Don’t let mortgage myths get in the way of your dreams of homeownership. Unfortunately, there are several misconceptions about home financing that can make getting approved for a loan seem more difficult than it could be. Supreme Lending is here to set the record straight and help you navigate the steps of the mortgage process with the knowledge you need. Let’s debunk these six common mortgage myths and uncover your homebuying possibilities.

#1 Myth: You Need a 20% Down Payment.

Believing that you must have at least a 20% down payment saved up for a home may be one of the most common mortgage myths of all. When in fact, there are several loan options with lower down payment requirements.

For example, Conventional loans can require as low as 3% down for first-time homebuyers and 5% for repeat buyers. FHA loans require 3.5% down, serving as another affordable option. VA* and USDA** loans are unique in that they require zero down payment. There are also several down payment assistance programs for eligible homebuyers depending on various factors such as income or geographic location.

Why 20% Down?

The 20% myth may be misunderstood because of private mortgage insurance (PMI). If you don’t put down 20% for a Conventional loan, lenders will typically require you to have PMI, which is an added cost to your monthly mortgage payment. It’s important to note that if a borrower reaches a specified equity threshold in their home, mortgage insurance may be removed.

#2 Myth: Pre-Qualification Is the Same as Pre-Approval.

Nope. These terms are often used interchangeably but they are not the same when it comes to where you are in the loan process. Both provide an estimate of how much you may be able to afford for your monthly mortgage payments. However, the key difference between a mortgage pre-qualification and pre-approval is how lenders verify your information.

Pre-qualification is a high-level mortgage estimate based on self-reported information, such as income, debts, and assets. Plus, it’s oftentimes quicker to obtain.

On the other hand, a pre-approval takes a more detailed approach. This involves a completed loan application. Homebuyers must provide thorough documentation of financial history such as pay stubs, W-2s, and bank statements for verification. To get pre-approved, lenders will also verify your credit and employment.

#3 Myth: You Need a Perfect Credit Score.

A recent study found that people either don’t know or significantly overestimate the minimum credit score required for a typical mortgage, reported by Mortgage Professional America. While a higher credit score may help you secure more favorable mortgage rates or qualify for a higher loan amount, you don’t need to have flawless credit.

Different loan programs can accommodate various credit score ranges. For example, FHA loans are designed to make homeownership more accessible by accepting lower credit scores, a minimum requirement of 580.

#4 Myth: You Should Always Choose a 30-Year Mortgage Term.

A 30-year fixed-rate may be one of the most popular mortgages, but it’s not the only one to choose from. Depending on your situation or long-term goals, other mortgage terms may be a better fit. Whether it’s a 15-year term to pay the loan off quicker, or a 20-year term, Supreme Lending offers a wide range of options that can be tailored to match your needs.

#5 Myth: Applying for a Mortgage Will Hurt Your Credit.

While applying for a loan can have a temporary impact on your credit score, it’s not as damaging as some might think. When you apply for a new loan, lenders will pull your credit. This is also known has a hard inquiry for your credit report. According to Experian, credit scoring systems typically respond to hard credit inquiries with a slight, temporary dip in your credit score by a few points. However, the impact is small and can resolve in time.

Additionally, once approved for a mortgage, making on-time monthly payments may strengthen your credit in the long run.

#6 Myth: Down Payment Is the Only Closing Cost.

The down payment is a key part of closing a loan but isn’t the only cash you need to finalize your mortgage. Closing costs are other expenses beyond the down payment such as origination fees, appraisal fees, escrow funds, and title insurance. These costs will be outlined in the closing disclosure.

In addition, some lender programs allow borrowers to buy discount points to reduce their interest rate. This is essentially buying down the rate to save in interest over time. One discount point would equal 1% of the loan amount and would be included as a closing cost.

Understanding the Mortgage Process

Buying a home is one of the most significant purchases you can make. It’s crucial you’re properly informed about the loan process. By debunking these common mortgage myths, we hope to empower you with the knowledge needed to make informed decisions.

At Supreme Lending, we’re dedicated to providing personalized service and expert guidance throughout your homebuying journey. If you have any questions or want to explore your mortgage options, contact us today!

*Must be eligible Veterans, Active Duty Personnel, Reservist, National Guard, or qualifying surviving spouses. VA funding fee will apply. VA funding fee can vary based on usage.

**Property must qualify for USDA program.