by First Integrity Team Supreme Lending | Jan 31, 2025

Military veterans and active-duty service members have dedicated their lives to serving our country, and Supreme Lending couldn’t be more grateful for their service. When it comes to homeownership, there’s no one more deserving than those who risk their lives to protect our freedom and safety. Supreme Lending is proud to offer the VA loan program. Backed by the U.S. Department of Veterans Affairs (VA), VA loans are designed to give eligible borrowers valuable home financing benefits, including no down payment requirement.

In this article, we’ll explore VA loans, eligibility, and, more specifically, the VA loan funding fee and how it works.

What Is A VA Loan?

A VA loan is a mortgage backed by the U.S. Department of Veterans Affairs. VA financing helps miliary veterans, active-duty service members, and certain members of the National Guard and Reserves become homebuyers. These loans offer several advantages, such as:

- No Down Payment Requirement. One of the biggest benefits of VA loans is that they allow you to purchase a home without a down payment. This makes homeownership for eligible military families more accessible with less upfront costs.

- Competitive Rates. VA loans often come with lower rates compared to Conventional loans, which may save money in interest over the life of the loan.

- No Private Mortgage Insurance. Unlike many Conventional loans that require Private Mortgage Insurance (PMI) when you put less than 20% down, VA loans don’t require this added cost.

- Repeat Buyers. Another unique benefit of VA financing is that it is not only for first-time homebuyers. Repeat buyers are accepted and second homes may be eligible under certain circumstances.

- Low VA Loan Funding Fee. The one-time VA loan funding fee is greatly lower than the typical down payment requirements. Below, we will outline the various funding fee percentages depending on the situation.

- Exemptions for Eligible Borrowers Available. There is an option to be exempt from paying the funding fee for qualified borrowers. For example, veterans who receive compensation for a disability related to their miliary service or active-duty members who received the Purple Heart.

Who Is Eligible for a VA Loan?

To qualify for a VA loan, you must meet specific eligibility guidelines. Generally, you must be a veteran, active-duty service member, or a member of the National Guard or Reserves. When applying for a VA loan, you must have a valid Certificate of Eligibility (COE). This demonstrates your service record and entitlement to VA loan benefits. Some surviving spouses of veterans may also qualify under certain circumstances.

What Is a VA Loan Funding Fee?

While VA loans offer incredible benefits, there is an important cost borrowers need to keep in mind: the VA loan funding fee. The fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

Funding Fee Amounts

The amount of the funding fee varies based on the borrower, type of VA loan they’re getting, and how much down payment is being paid. First-time borrowers typically pay a lower funding fee compared to those who have previously used a VA loan

Click here for a breakdown of funding fees based on loan type.

Paying the Funding Fee

The VA funding fee is paid at closing. There are a few ways you may choose to pay the fee:

- Upfront Payment. Borrowers may pay the fee at closing, in full, which can be included as a closing cost.

- Finance Fee. Borrowers may also choose to roll the funding fee into their loan amount, allowing them to pay it over the life of the mortgage instead of upfront.

- Seller Concessions. In some cases, the seller may agree to cover the funding fee as part of the purchase agreement, providing additional assistance to the buyer.

Explore VA Loans from Supreme Lending

VA loans are a wonderful resource for military veterans and active-duty personnel looking to achieve homeownership. While there’s no down payment requirement, it’s essential to understand the VA loan funding fee. If you’re considering a VA loan or want to learn more about your home financing options, contact your local Supreme Lending branch today!

Related Articles:

by First Integrity Team Supreme Lending | Sep 30, 2024

Buying a home is a major milestone, and while most prospective buyers are focused on saving for the down payment, there are additional homebuying costs to consider. From closing costs to ongoing home maintenance expenses, it’s important to understand the costs beyond the down payment. Let’s dive into those homebuying costs so you can be well prepared.

Down Payment: The First Major Cost

The down payment is often the largest upfront cost when buying a home. The down payment requirements depend on the type of loan to determine what you may qualify for.

- Conventional loans typically require at least 5% for eligible borrowers. For first-time homebuyers, the minimum requirement can be as low as 3%.

- FHA loans require as little as 3.5% down, making them a popular choice for borrowers looking for more flexible guidelines.

- VA and USDA loans offer no down payment requirement for eligible military veterans, active military, or buyers in defined rural areas.

Plus, there are several down payment assistance programs available to help more people achieve their dream of homeownership. While the down payment is a key part of purchasing a home, it’s not the only cost to keep in mind.

Closing Costs: Hidden Homebuying Fees

Beyond the down payment, closing costs are another significant upfront expense buyers must account for. These are fees and expenses necessary to finalize your home purchase and close the loan. Closing costs typically range from 2% to 6% of the home’s purchase price. Here’s a breakdown of common closing costs:

- Loan origination fee is charged by your lender for processing your mortgage.

- Appraisal fee covers the cost of having your home professionally appraised to determine its market value.

- Home inspection fee is paid to inspect the home for any necessary repairs or safety hazards.

- Title insurance and search fees ensure the property’s title is clear of any disputes or liens.

- Escrow fee is charged by the third party handling the closing process.

- Property taxes and homeowners insurance are typically prepaid for a portion of the costs at closing so they’re included in your mortgage escrow account.

Ongoing Costs of Homeownership

After closing on your mortgage, owning a home comes with ongoing expenses that many new buyers often overlook. These homebuying costs are essential to consider when planning for the long-term.

- Utilities include monthly bills such as electricity, gas, water, and internet. These are widely dependent on the size and location of your home.

- Landscaping and yard maintenance, whether you hire a service or handle it by yourself, keeping up with lawn care, tree trimming, and other outdoor maintenance can add up.

- Homeowners Association (HOA) fees are required when your property is in a community with an HOA. These fees may be monthly or annual and cover community maintenance and amenities.

- Property taxes are ongoing local government taxes based on the assessed value of your home. Property taxes may increase over time, so review your tax bills carefully.

- Homeowners and mortgage insurance are often required. Homeowners insurance helps protect the home in the event of potential damages, while mortgage insurance protects the lender in the event of a loan default.

- Ongoing maintenance and repairs will occur over time, from replacing appliances to fixing the roof or plumbing. It’s smart to set aside funds for common home upkeep expenses to avoid hidden costs surprising you.

What’s Next?

We hope these additional homebuying costs are not so hidden anymore! The journey to homeownership comes with several financial considerations beyond the down payment. By understanding these homebuying costs, you can be prepared to buy with confidence.

If you’re ready to explore your mortgage options, contact Supreme Lending today. We’re here to help guide you through the loan process and beyond.

by First Integrity Team Supreme Lending | Aug 12, 2024

Unlocking Homeownership With Mortgage Gift Funds

When it comes to purchasing a home, the down payment is often a big hurdle for borrowers, especially first-time homebuyers. However, there may be an opportunity to help make homeownership a reality through mortgage gift funds. If you’re offered gift funds to use toward a home’s down payment or closing costs, it’s important to understand how the process works and what is needed. At Supreme Lending, we’re committed to guiding you through the mortgage process to achieve your dream of owning a home—that includes navigating gift funds.

What Are Mortgage Gift Funds?

Gift funds are sums of money given by family members, friends, or other eligible benefactors that can be used for the down payment or closing costs on a home purchase. These funds are a generous way for loved ones to help you invest in your homeownership journey without any expectation of repayment.

How Do Gift Funds Work?

Using gift funds for a mortgage is straightforward but requires adherence to certain rules to ensure they’re accepted by lenders. Here’s what you need to know:

- Documentation. The donor must provide a gift letter stating the amount of the gift, the relationship to the recipient, and that no repayment of the money is expected or required.

- Source Verification. Lenders will require proof of the donor’s ability to give the gift, often in the form of bank statements.

- Transfer Trail. It’s also crucial to provide documents verifying the transfer of funds from the donor to the borrower to satisfy lender requirements.

Lenders require these factors as confirmation that the gift isn’t in fact a loan, which would impact the borrower’s Loan-to-Value (LTV).

Guidelines for Loan Types

Depending on the type of loan you’re considering, there are specific guidelines to follow when using gift funds. These specify who may be eligible to provide the money and how much.

Conventional Loans

For conventional loans, gift funds may be used for some or all the down payment, closing costs, and financial reserves—as long as it’s from an acceptable source. The gift can be provided by a defined family member, including relatives by blood, marriage, adoption, legal guardianship, or domestic partner. The donor may not be or have an affiliation with the real estate agent, builder, developer, or any other interested party to the transaction.

Gift funds can be used for a primary residence and second home. Investment properties are not eligible. Minimum borrower contributions may apply depending on the down payment amount.

FHA Loans

Insured by the Federal Housing Administration, FHA loans offer a little more flexibility when it comes to mortgage gift funds. Donors can be family and other eligible givers such as a close friend, an employer or labor union, and charitable organization. A governmental agency or public entity that provides down payment assistance programs may also be eligible. However, cousins, nieces, and nephews are not qualified to provide gift funds for FHA.

VA and USDA Loans

While these government-insured loan options do not have down payment requirements, gift funds can still be used to cover closing costs. The gift can be provided by anyone that does not have an affiliation with the transaction. However, gift funds cannot be used to meet reserve requirements for VA and USDA loans.

Advantages of Mortgage Gift Funds

Ultimately, gift funds can help open doors to homeownership if you may not have qualified without the funds for a down payment or closing costs. Potential benefits of receiving gift funds include:

- Lower the financial burden of a down payment

- Improve your Loan-to-Value ratio

- May help you qualify for a more favorable mortgage

- Allow you to maintain savings for other expenses or emergency funds

Down Payment Assistance Alternatives

If you don’t have the option to receive gift funds, there may be other options to consider buying a home with less upfront costs. For example, FHA loans require a lower 3.5% down while VA and USDA loans offer no down payment requirement. For Conventional loans, eligible first-time homebuyers may put down just 3%.

There are also several down payment assistance programs designed to help more people achieve homeownership. Supreme Lending offers the Supreme Dream Down Payment Assistance that offers a fully forgivable second loan to cover the down payment and closing costs. There are also several local, regional, or state-specific programs available to provide aid. Eligibility typically depends on factors such as income, credit score, and location.

Our team at Supreme Lending believes that informed homebuyers make empowered homeowners. Understanding gift funds and alternatives for down payment assistance can help open doors to homeownership that might otherwise seem closed.

Ready to take the next step to buying a home? We’re here to guide you every step of the way. Contact your local branch to get started.

by SupremeLending | Jul 29, 2024

If you’re thinking of buying a home, you may want to consider the possibility of seller concessions to help reduce upfront loan expenses. Imagine having a portion of your mortgage closing costs covered or even getting some essential home repairs taken care of without having to dig into your savings. That’s where seller concessions come in, also known as seller assistance. It can be a significant benefit for both buyers and sellers. In this guide, we’ll explore what seller concessions are, seller assist limits, and frequently asked questions.

What Are Seller Concessions?

Seller concessions are contributions paid by the seller that go toward the homebuyer’s closing costs. These can include closing fees, prepaid expenses, or even home repairs or improvements. These concessions can help lower the amount of money a buyer needs to bring to the closing table, making the home purchase more affordable.

The concession amount can be expressed as a percentage of the home’s purchase price or fixed dollar amount.

Examples of What Seller Concessions Can Cover

Seller concessions can be used for a variety of mortgage and homebuying costs including:

- Loan Origination Fees. Fees charged by the lender for processing the loan application.

- Appraisal Fees. This is the cost of having a home appraised.

- Home Inspection Fees. This is the cost of having a home inspected before closing.

- Property Taxes. Prepaid property taxes may be included in closing.

- Title Insurance. This insurance protects the buyer and lender from potential disputes over ownership.

- Discount Points. Also known as mortgage points, these help pay down the interest rate using upfront costs.

- Home Repairs or Improvements. Costs for necessary repairs identified during the home inspection or agreed-upon improvements before the sale.

How Do They Work?

- Negotiation. Seller concessions are typically negotiated as part of the buyer’s and seller’s purchase agreement. This request can be made with help from a real estate agent.

- Agreement. If the seller agrees to concessions, the specific details are outlined in the contract and must not exceed a specified limit depending on the loan type.

- Appraisal. The agreed-upon concessions cannot inflate the property’s value. Lenders require an appraisal to ensure the property’s market value supports the loan amount, including the concessions.

- Loan Approval. The lender will review the agreement and appraisal. This will ensure that the concessions align with the mortgage program’s guidelines.

- Closing. When the loan is ready to close, the costs are applied to the buyer’s closing costs or other agreed-upon expenses.

Who Benefits from Seller Concessions?

Both the buyers and sellers can benefit!

- Buyers. Concessions can lower the upfront costs needed to buy the home, making it easier to afford the property.

- Sellers. Offering concessions can also make the home more attractive for potential buyers, helping sell the home quicker.

Seller Assistance Limits

Limits on how much a seller can contribute vary depending on the loan type and down payment:

Conventional Loans

- Primary residence and second homes:

- 3% maximum with less than 10% down

- 6% maximum with 10-25% down

- 9% maximum with more than 25% down

- Investment properties:

- 2% maximum regardless of down payment

FHA/USDA Loans

- 6% maximum toward closing costs and prepaid items

VA Loans

- 4% maximum toward prepaid items

- No limit for closing costs or reasonable discount points

Frequently Asked Questions

Can the seller cover the entire down payment?

No. Seller concessions cannot be used for the full down payment. They are typically used for closing costs, prepaid expenses, and other associated fees, while meeting the loan guideline limits.

Does seller assistance affect the loan approval process?

Seller concessions themselves do not affect loan approval, but lenders can consider the impact on the Loan-to-Value (LTV) ratio and may require specific guidelines.

How does it impact the home appraisal?

The home’s appraisal must support the purchase price, including any seller contributions. If the appraised value is lower than the agreed-upon price, the lender may require adjustments.

Can a buyer negotiate for concessions?

Yes! Homebuyers can request this during negotiations. It’s essential to work with a knowledgeable real estate agent to help navigate the process.

How do seller concessions benefit first-time homebuyers?

First-time buyers often benefit from this as they may have limited funds for closing costs and other expenses. Seller assistance is another great way for more people to unlock the door to homeownership!

If you’re ready to start your homebuying journey, your local Supreme Lending team is ready to help! Contact us to learn about your mortgage options and get pre-qualified today.

by SupremeLending | Jul 26, 2024

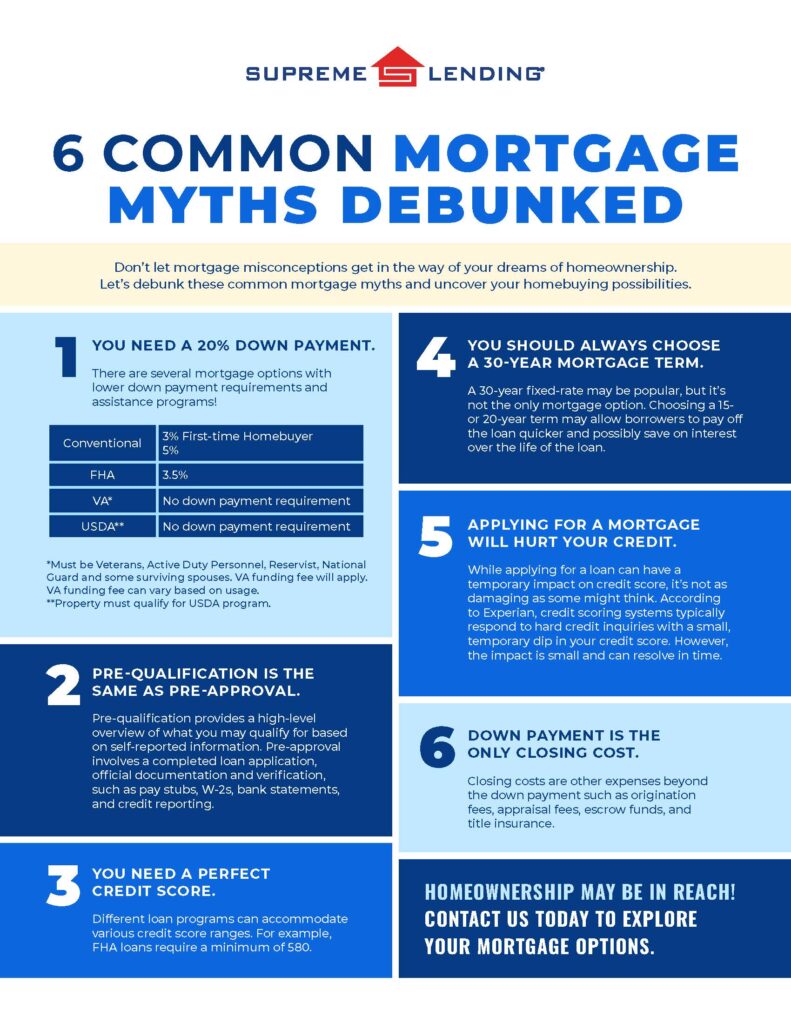

Don’t let mortgage myths get in the way of your dreams of homeownership. Unfortunately, there are several misconceptions about home financing that can make getting approved for a loan seem more difficult than it could be. Supreme Lending is here to set the record straight and help you navigate the steps of the mortgage process with the knowledge you need. Let’s debunk these six common mortgage myths and uncover your homebuying possibilities.

#1 Myth: You Need a 20% Down Payment.

Believing that you must have at least a 20% down payment saved up for a home may be one of the most common mortgage myths of all. When in fact, there are several loan options with lower down payment requirements.

For example, Conventional loans can require as low as 3% down for first-time homebuyers and 5% for repeat buyers. FHA loans require 3.5% down, serving as another affordable option. VA* and USDA** loans are unique in that they require zero down payment. There are also several down payment assistance programs for eligible homebuyers depending on various factors such as income or geographic location.

Why 20% Down?

The 20% myth may be misunderstood because of private mortgage insurance (PMI). If you don’t put down 20% for a Conventional loan, lenders will typically require you to have PMI, which is an added cost to your monthly mortgage payment. It’s important to note that if a borrower reaches a specified equity threshold in their home, mortgage insurance may be removed.

#2 Myth: Pre-Qualification Is the Same as Pre-Approval.

Nope. These terms are often used interchangeably but they are not the same when it comes to where you are in the loan process. Both provide an estimate of how much you may be able to afford for your monthly mortgage payments. However, the key difference between a mortgage pre-qualification and pre-approval is how lenders verify your information.

Pre-qualification is a high-level mortgage estimate based on self-reported information, such as income, debts, and assets. Plus, it’s oftentimes quicker to obtain.

On the other hand, a pre-approval takes a more detailed approach. This involves a completed loan application. Homebuyers must provide thorough documentation of financial history such as pay stubs, W-2s, and bank statements for verification. To get pre-approved, lenders will also verify your credit and employment.

#3 Myth: You Need a Perfect Credit Score.

A recent study found that people either don’t know or significantly overestimate the minimum credit score required for a typical mortgage, reported by Mortgage Professional America. While a higher credit score may help you secure more favorable mortgage rates or qualify for a higher loan amount, you don’t need to have flawless credit.

Different loan programs can accommodate various credit score ranges. For example, FHA loans are designed to make homeownership more accessible by accepting lower credit scores, a minimum requirement of 580.

#4 Myth: You Should Always Choose a 30-Year Mortgage Term.

A 30-year fixed-rate may be one of the most popular mortgages, but it’s not the only one to choose from. Depending on your situation or long-term goals, other mortgage terms may be a better fit. Whether it’s a 15-year term to pay the loan off quicker, or a 20-year term, Supreme Lending offers a wide range of options that can be tailored to match your needs.

#5 Myth: Applying for a Mortgage Will Hurt Your Credit.

While applying for a loan can have a temporary impact on your credit score, it’s not as damaging as some might think. When you apply for a new loan, lenders will pull your credit. This is also known has a hard inquiry for your credit report. According to Experian, credit scoring systems typically respond to hard credit inquiries with a slight, temporary dip in your credit score by a few points. However, the impact is small and can resolve in time.

Additionally, once approved for a mortgage, making on-time monthly payments may strengthen your credit in the long run.

#6 Myth: Down Payment Is the Only Closing Cost.

The down payment is a key part of closing a loan but isn’t the only cash you need to finalize your mortgage. Closing costs are other expenses beyond the down payment such as origination fees, appraisal fees, escrow funds, and title insurance. These costs will be outlined in the closing disclosure.

In addition, some lender programs allow borrowers to buy discount points to reduce their interest rate. This is essentially buying down the rate to save in interest over time. One discount point would equal 1% of the loan amount and would be included as a closing cost.

Understanding the Mortgage Process

Buying a home is one of the most significant purchases you can make. It’s crucial you’re properly informed about the loan process. By debunking these common mortgage myths, we hope to empower you with the knowledge needed to make informed decisions.

At Supreme Lending, we’re dedicated to providing personalized service and expert guidance throughout your homebuying journey. If you have any questions or want to explore your mortgage options, contact us today!

*Must be eligible Veterans, Active Duty Personnel, Reservist, National Guard, or qualifying surviving spouses. VA funding fee will apply. VA funding fee can vary based on usage.

**Property must qualify for USDA program.