by First Integrity Team Supreme Lending | Jan 31, 2025

Military veterans and active-duty service members have dedicated their lives to serving our country, and Supreme Lending couldn’t be more grateful for their service. When it comes to homeownership, there’s no one more deserving than those who risk their lives to protect our freedom and safety. Supreme Lending is proud to offer the VA loan program. Backed by the U.S. Department of Veterans Affairs (VA), VA loans are designed to give eligible borrowers valuable home financing benefits, including no down payment requirement.

In this article, we’ll explore VA loans, eligibility, and, more specifically, the VA loan funding fee and how it works.

What Is A VA Loan?

A VA loan is a mortgage backed by the U.S. Department of Veterans Affairs. VA financing helps miliary veterans, active-duty service members, and certain members of the National Guard and Reserves become homebuyers. These loans offer several advantages, such as:

- No Down Payment Requirement. One of the biggest benefits of VA loans is that they allow you to purchase a home without a down payment. This makes homeownership for eligible military families more accessible with less upfront costs.

- Competitive Rates. VA loans often come with lower rates compared to Conventional loans, which may save money in interest over the life of the loan.

- No Private Mortgage Insurance. Unlike many Conventional loans that require Private Mortgage Insurance (PMI) when you put less than 20% down, VA loans don’t require this added cost.

- Repeat Buyers. Another unique benefit of VA financing is that it is not only for first-time homebuyers. Repeat buyers are accepted and second homes may be eligible under certain circumstances.

- Low VA Loan Funding Fee. The one-time VA loan funding fee is greatly lower than the typical down payment requirements. Below, we will outline the various funding fee percentages depending on the situation.

- Exemptions for Eligible Borrowers Available. There is an option to be exempt from paying the funding fee for qualified borrowers. For example, veterans who receive compensation for a disability related to their miliary service or active-duty members who received the Purple Heart.

Who Is Eligible for a VA Loan?

To qualify for a VA loan, you must meet specific eligibility guidelines. Generally, you must be a veteran, active-duty service member, or a member of the National Guard or Reserves. When applying for a VA loan, you must have a valid Certificate of Eligibility (COE). This demonstrates your service record and entitlement to VA loan benefits. Some surviving spouses of veterans may also qualify under certain circumstances.

What Is a VA Loan Funding Fee?

While VA loans offer incredible benefits, there is an important cost borrowers need to keep in mind: the VA loan funding fee. The fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

Funding Fee Amounts

The amount of the funding fee varies based on the borrower, type of VA loan they’re getting, and how much down payment is being paid. First-time borrowers typically pay a lower funding fee compared to those who have previously used a VA loan

Click here for a breakdown of funding fees based on loan type.

Paying the Funding Fee

The VA funding fee is paid at closing. There are a few ways you may choose to pay the fee:

- Upfront Payment. Borrowers may pay the fee at closing, in full, which can be included as a closing cost.

- Finance Fee. Borrowers may also choose to roll the funding fee into their loan amount, allowing them to pay it over the life of the mortgage instead of upfront.

- Seller Concessions. In some cases, the seller may agree to cover the funding fee as part of the purchase agreement, providing additional assistance to the buyer.

Explore VA Loans from Supreme Lending

VA loans are a wonderful resource for military veterans and active-duty personnel looking to achieve homeownership. While there’s no down payment requirement, it’s essential to understand the VA loan funding fee. If you’re considering a VA loan or want to learn more about your home financing options, contact your local Supreme Lending branch today!

Related Articles:

by First Integrity Team Supreme Lending | Aug 30, 2024

An Overview of Supreme Lending Credit Score Requirements

When you’re preparing to buy a home, understanding the mortgage credit score requirements is essential. Your credit plays a significant role in determining your eligibility for various loan programs, as well as interest rates you may qualify for. Our goal at Supreme Lending is to provide the smoothest mortgage experience possible, that includes guiding you with transparent information to help you to make an informed, confident decision. Here’s an overview of Supreme Lending’s credit score requirements for common loan programs and frequently asked questions.

Conventional Loans

Conventional loans are popular among homebuyers due to their flexibility and competitive interest rates. As a general rule of thumb, Supreme Lending requires a minimum credit score of 620 for Conventional loans. However, a higher score typically results in securing more favorable rates and terms.

FHA Loans

Insured by the Federal Housing Administration, FHA loans are another common mortgage option –especially for first-time homebuyers or borrowers with lower credit. These loans have more lenient credit score requirements, accepting as low as 580.

VA Loans

For eligible military Veterans and active-duty personnel, VA loans offer affordable options as they don’t require a down payment or mortgage insurance premiums. Like FHA loans, Supreme Lending’s credit score requirement for VA loans is a minimum of 580.

USDA Loans

Guaranteed by the U.S. Department of Agriculture, USDA loans provide affordable financing designed for homebuyers in designated rural areas with no down payment required. In general, Supreme Lending’s credit score requirement for this program is 600.

Jumbo Loans

Jumbo loans are used to purchase high-value properties with a loan amount greater than conforming loan limits, which is $766,550 for one-unit homes in 2024. Due to potential higher lending risk, Jumbo loans typically have stricter qualifications. Supreme Lending has jumbo programs with a minimum credit score of 680, but depending on the loan guidelines, some may require at least a 720 credit score or higher.

Frequently Asked Questions

Now that you have a snapshot of common credit score requirements at Supreme Lending, here’s some more insight on how your credit can impact your mortgage.

How is a credit score determined?

A credit score, often represented by a FICO® score, is a numerical assessment of a borrower’s financial health. It is calculated based on several key factors:

- Payment History: Your record of on-time payments versus late or missed payments.

- Credit Utilization: The amount of credit you’re using compared to your total credit limits.

- Length of Credit History: The duration of time you’ve had credit accounts open.

- Types of Credit in Use. The variety of credit accounts you have, such as credit cards, mortgages, and car loans.

- Recent Credit Behavior. This includes how many new credit accounts you’ve opened recently and credit inquiries.

Combining these factors provides a numerical score to help reflect your creditworthiness.

What qualifies as a generally “good” credit score?

In general, a credit score of 670 to 739 is considered good according to FICO® standards. Scores in this range suggest that you are a responsible borrower with a solid history of managing credit well. 740 or higher is considered very good or exceptional. Remember, a higher the credit score usually results in more favorable mortgage rates and terms.

Additionally, a credit score between 580 and 669 is considered fair. This range aligns with many of the credit score requirements outlined above depending on the loan type. So don’t fall victim to the common mortgage myth that you need perfect credit to qualify for a home loan.

What’s the difference between a soft credit pull and hard credit pull?

When applying for a mortgage, lenders need to pull your credit report. There are two ways to do this:

- A soft credit pull is a credit check that doesn’t affect your credit score. It’s typically used for pre-qualifications or when you check your own credit. Supreme Lending has this option when you get pre-qualified for a mortgage.

- A hard credit pull, on the other hand, occurs when a lender reviews your credit score as a formal credit application during the loan approval process. Hard pulls can temporarily lower your credit score by just a few points. However, there’s no significant impact, which is another mortgage myth to debunk.

Here to Help

Don’t navigate the mortgage process alone! Our experienced and knowledgeable team at Supreme Lending is here to help you understand all aspects of your homebuying journey. From understanding credit score requirements and determining which loan program may work for you to our seamless underwriting process, we help you close your loan with confidence.

Contact us today to get started!

Related articles:

Common Credit Score and Down Payment Requirements by Mortgage Type

FHA Loans vs. Conventional Mortgage: Which One Is Right for You?

by First Integrity Team Supreme Lending | Aug 12, 2024

Unlocking Homeownership With Mortgage Gift Funds

When it comes to purchasing a home, the down payment is often a big hurdle for borrowers, especially first-time homebuyers. However, there may be an opportunity to help make homeownership a reality through mortgage gift funds. If you’re offered gift funds to use toward a home’s down payment or closing costs, it’s important to understand how the process works and what is needed. At Supreme Lending, we’re committed to guiding you through the mortgage process to achieve your dream of owning a home—that includes navigating gift funds.

What Are Mortgage Gift Funds?

Gift funds are sums of money given by family members, friends, or other eligible benefactors that can be used for the down payment or closing costs on a home purchase. These funds are a generous way for loved ones to help you invest in your homeownership journey without any expectation of repayment.

How Do Gift Funds Work?

Using gift funds for a mortgage is straightforward but requires adherence to certain rules to ensure they’re accepted by lenders. Here’s what you need to know:

- Documentation. The donor must provide a gift letter stating the amount of the gift, the relationship to the recipient, and that no repayment of the money is expected or required.

- Source Verification. Lenders will require proof of the donor’s ability to give the gift, often in the form of bank statements.

- Transfer Trail. It’s also crucial to provide documents verifying the transfer of funds from the donor to the borrower to satisfy lender requirements.

Lenders require these factors as confirmation that the gift isn’t in fact a loan, which would impact the borrower’s Loan-to-Value (LTV).

Guidelines for Loan Types

Depending on the type of loan you’re considering, there are specific guidelines to follow when using gift funds. These specify who may be eligible to provide the money and how much.

Conventional Loans

For conventional loans, gift funds may be used for some or all the down payment, closing costs, and financial reserves—as long as it’s from an acceptable source. The gift can be provided by a defined family member, including relatives by blood, marriage, adoption, legal guardianship, or domestic partner. The donor may not be or have an affiliation with the real estate agent, builder, developer, or any other interested party to the transaction.

Gift funds can be used for a primary residence and second home. Investment properties are not eligible. Minimum borrower contributions may apply depending on the down payment amount.

FHA Loans

Insured by the Federal Housing Administration, FHA loans offer a little more flexibility when it comes to mortgage gift funds. Donors can be family and other eligible givers such as a close friend, an employer or labor union, and charitable organization. A governmental agency or public entity that provides down payment assistance programs may also be eligible. However, cousins, nieces, and nephews are not qualified to provide gift funds for FHA.

VA and USDA Loans

While these government-insured loan options do not have down payment requirements, gift funds can still be used to cover closing costs. The gift can be provided by anyone that does not have an affiliation with the transaction. However, gift funds cannot be used to meet reserve requirements for VA and USDA loans.

Advantages of Mortgage Gift Funds

Ultimately, gift funds can help open doors to homeownership if you may not have qualified without the funds for a down payment or closing costs. Potential benefits of receiving gift funds include:

- Lower the financial burden of a down payment

- Improve your Loan-to-Value ratio

- May help you qualify for a more favorable mortgage

- Allow you to maintain savings for other expenses or emergency funds

Down Payment Assistance Alternatives

If you don’t have the option to receive gift funds, there may be other options to consider buying a home with less upfront costs. For example, FHA loans require a lower 3.5% down while VA and USDA loans offer no down payment requirement. For Conventional loans, eligible first-time homebuyers may put down just 3%.

There are also several down payment assistance programs designed to help more people achieve homeownership. Supreme Lending offers the Supreme Dream Down Payment Assistance that offers a fully forgivable second loan to cover the down payment and closing costs. There are also several local, regional, or state-specific programs available to provide aid. Eligibility typically depends on factors such as income, credit score, and location.

Our team at Supreme Lending believes that informed homebuyers make empowered homeowners. Understanding gift funds and alternatives for down payment assistance can help open doors to homeownership that might otherwise seem closed.

Ready to take the next step to buying a home? We’re here to guide you every step of the way. Contact your local branch to get started.

by SupremeLending | Mar 21, 2024

Picture this – you currently own or want to buy a home with good bones, but it needs some TLC. The good news is that you don’t have to handle a home remodel alone. Renovation loans are a great option to help fund home improvements, repairs, and enhancements by rolling the renovation costs into a single mortgage payment. It’s important to understand how renovation or home improvement loans work, types of renovation loan options, and benefits.

What Is a Renovation Loan?

Renovation loans are designed to help borrowers finance home improvement projects that will increase the value of the home. Whether you’re planning a small home makeover or extensive rehab project, a renovation loan combines a traditional purchase or refinance mortgage with the cost of renovations—it is an all-in-one mortgage financing option that covers the upfront costs of large repairs and projects.

Taking on the remodel before moving in can enhance your living space and home functionalities without the pressure of taking out an additional loan or paying out of pocket for costly repairs in the future.

Types of Renovation Loans

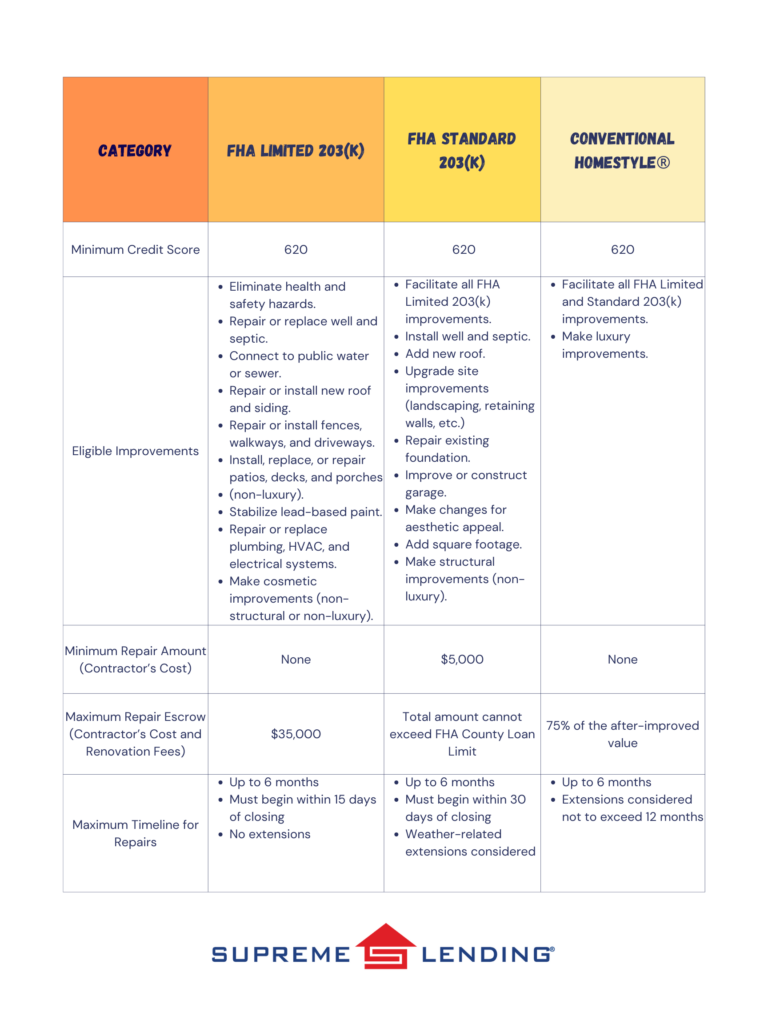

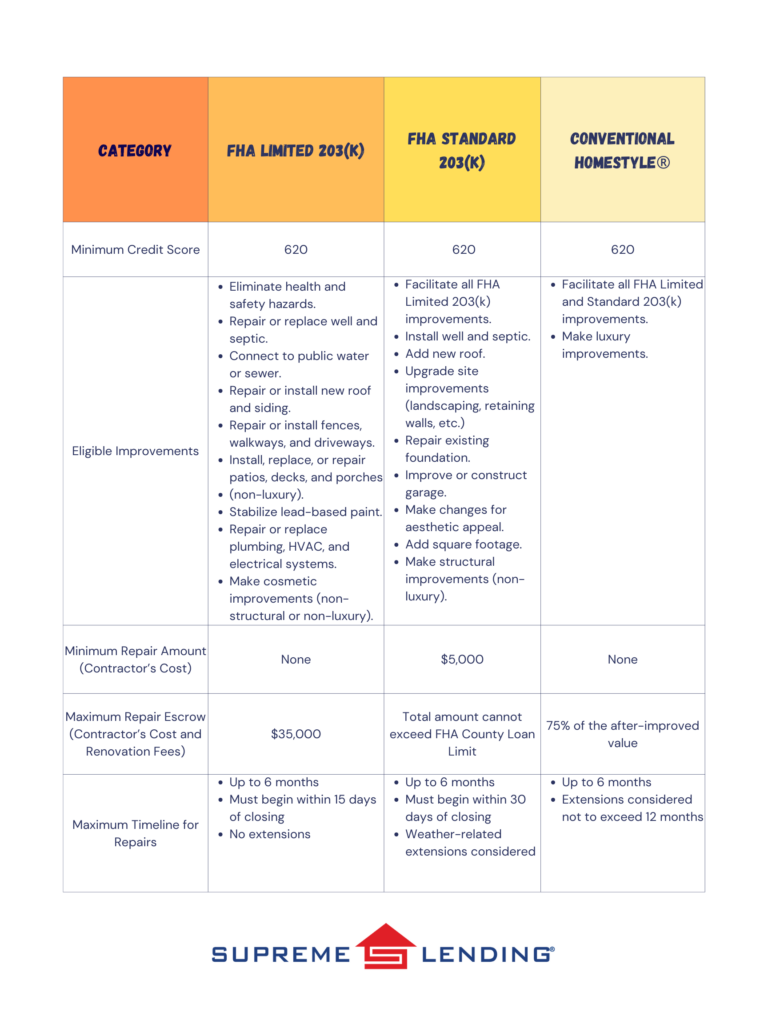

When it comes to renovation loans, there are a few options for prospective homebuyers and homeowners to consider based on eligibility, timing, and the scale of the home improvements needed.

FHA 203(k) Renovation

An FHA 203(k) loan, or an FHA rehab loan, is insured by the Federal Housing Administration and provides two options depending on the scope of the home improvement projects, including Limited 203(k) and Standard 203(k), offering different levels of renovation financing.

The minimum down payment for an FHA 203(k) loan is 3.5%. An FHA 203(k) loan covers common basic home improvements and repairs but excludes larger luxury projects and amenities. The Limited option has no minimum renovation amount and can cover up to $35,000 in renovation costs. The Standard has expanded eligible improvements including some structural upgrades and a minimum renovation cost of $5,000. Typically, all renovations must be completed within 6 months.

VA Renovation

The Department of Veterans Affairs (VA) also has a Renovation loan option. A VA Renovation loan offers 100% financing for eligible U.S. Veterans or military personnel to cover a mortgage combined with planned renovation costs into a single loan. Eligible home improvements are similar to FHA 203(k) to cover common upgrades that will make the property safer, healthier, or more functional, excluding luxury projects. VA Renovation loans can finance up to $50,000 in home repair costs.

Conventional Renovation

A Conventional Renovation loan, such as Fannie Mae’s HomeStyle® program, is another financing option that rolls the costs of home renovation projects into a single mortgage and offers more flexibility than a government loan. Conventional Renovation mortgages can cover larger, luxury upgrades, such as creating a high-end bathroom or kitchen with decorative tilework or adding a sparkling backyard pool. The maximum home repair amount is 75% of the home’s post-construction appraised value.

More Benefits of Renovation Loans and Remodeling

- Expand Your Home Search. Prospective homebuyers may have a broader range of properties to choose from, including fixer-uppers, knowing that they could finance custom home upgrades or needed repairs with a Renovation loan.

- Save on Upfront Costs. Home renovation projects can be costly. Funding home remodeling projects with your mortgage could help keep you from tapping into your personal savings and avoid hefty upfront repair costs.

- Grow Your Home Value. Renovation loans are intended to increase the value of your home, which may result in a smart, long-term investment and the potential to build more equity.

- Personalize Your Dream Home. Renovation loans offer an affordable option to help make your design visions come to life and beautify your home to fit your character.

- Enhance Comfort and Livability. Whether it’s expanding a kitchen, adding a bathroom, or creating a home office space, upgrading your home can add modern conveniences and improve your overall well-being.

If you’re looking to enhance your living spaces and potentially increase your property value, a Renovation loan could be the answer to creating the home of your dreams. To learn more about renovation financing or other mortgages, contact your local Supreme Lending branch today.

Related Articles:

by SupremeLending | Mar 1, 2024

The men and women who have served in America’s Armed Forces have sacrificed so much to protect our freedom and communities, including time away from their families. There’s no profession more deserving of having a home to call their own. Supreme Lending is honored to provide opportunities to help Veterans and active military personnel achieve their dreams of homeownership through affordable mortgage options, including VA loans that can offer 100% financing. Let’s dive into the benefits and eligibility of VA loan programs.

Guaranteed by the U.S. Department of Veterans Affairs, VA loans are designed to help those who have served in the military and their eligible surviving spouses obtain homeownership with more flexible and favorable terms.

VA Loan Benefits

Two of the biggest benefits of VA loans are the no down payment or mortgage insurance premium requirements—making homeownership more accessible for those who may not qualify for a traditional loan. Other unique VA loan benefits and features include:

- Lower origination fees, appraisal fees, and closing costs.

- Purchase and refinance for primary homes.

- No prepayment penalties.

- Fixed- and adjustable-rate loan options available.

- Variety of eligible property types (single-family, townhomes, VA-approved condos, etc.).

- Available for qualified first-time and repeat homebuyers.

- 580 minimum credit score; 620 minimum credit score for loan amounts more than $ 766,550.

- At least 41% Debt-to-Income (DTI) ratio.

- VA non-allowable fees can be paid by seller, up to 4% of the loan amount.

- Two year waiting period after foreclosure or bankruptcy after discharged.

- Some states may offer additional options for extra affordability.

VA Loan Eligibility

A requirement of VA loans is that the homeowner lives in the home as their primary residence. A valid Certificate of Eligibility (COE) must be presented at the time of application, which includes military eligibility such as length of service or service commitment, duty status, and character of service.

VA Funding Fee

While there is no down payment requirement, VA loans do require a one-time funding fee to cover administrative or processing costs. The fee is 2.15% for first-time use of the program with zero down payment, still much lower than a traditional down payment! Additionally, the funding fee decreases to 1.5% with 5% or more down payment and to 1.25% with more than 10% down payment.

VA Loan Refinancing

Veterans Affairs also offers options for refinancing. A VA streamline refinance, also known as an Interest Rate Reduction Refinance Loan (IRRRL), could be a great option for military homeowners looking to potentially reduce their interest rate and monthly payments of a current VA loan. A VA cash-out refinance allows borrowers to leverage the equity they’ve built in their home and could help homeowners fund renovations or other large expenses.

For more information on VA loans and other mortgage options, reach out to your local Supreme Lending Loan Officer or contact us today.