by SupremeLending | Jun 7, 2024

Your Guide to Prepare Your Home for Hurricane Season and Severe Weather

Homeownership is a considerable, rewarding experience, offering a place of comfort and security. However, natural disasters are inevitable, so it’s important to keep your home safe and protected in the event of severe weather. HousingWire reported that nearly more than 32.7 million residential properties from Texas to Maine may be at risk of moderate or severe damage this year. To keep your home and family safe, here are seven homeownership tips to prepare your home for hurricane season.

1. Review and Update Your Insurance Policies.

Regularly assess your homeowners and flood insurance policies to ensure you’re adequately covered for potential damage. Make any necessary updates to safeguard your home, especially during hurricane season.

2. Assess the Vulnerability of Your Home.

As you prepare your home for hurricane season, evaluate the current condition of your property. Carefully examine windows, exterior doors, the roof, and nearby trees. This will help you prioritize your preparation efforts and focus on reinforcing any vulnerable areas on your property.

3. Have an Emergency Plan.

Create an emergency plan for your household, including your pets. This should include evacuation routes, shelter sites, an emergency kit of essential food and supplies, and a list of important contacts. Ensure all family members are familiar with the plan.

4. Protect Windows and Doors.

Homeowners in hurricane or tornado-prone areas can install storm shutters or impact resistant glass to help prevent breakage. Plywood can be a temporary solution if these are not available. Another important step to prepare your home for hurricane season is to check for and seal any gaps or cracks around windows and doors. This can help minimize damage from wind-driven rain.

5. Keep Trees Trimmed.

Preparing your home for hurricane season also includes yard maintenance. Dead or overgrown tree limbs are more at risk of breaking and falling. Undergo regular tree service by trimming and removing any hazardous limbs, especially if they’re over the roof of your home. This simple preventive measure could save you from potentially costly repairs, ensure the safety of your property, and support your landscaping.

6. Secure Outdoor Elements.

In the event of possible high winds, make sure any outdoor furniture and grills are secured. Keep umbrellas closed and fold up chairs. You can use furniture and grill covers to protect them from excess rainwater. Bring in more sensitive items such as potted plants, hammocks, and other items that could be displaced in high winds.

7. Reinforce the Roof.

This may be one of the most important steps to prepare your home for hurricane season and may even enhance your home’s value. Be sure to carefully inspect your roof for any loose or damaged shingles, leaks, cracks, rust, or decay. Promptly repair any roof damage to protect the home’s structural integrity. It’s crucial to address any minor roof issues so they don’t escalate into major problems down the road. If a large roof restoration is needed, you may consider a home renovation loan to help fund the project.

BONUS. Plan Backup Power Sources.

If your property is in an area known for frequent storms and power outages, consider adding a generator or heavy-duty battery in the event the power goes out. Have portable phone chargers and power banks readily available. Additionally, keep matches and candles on hand to provide extra lighting if needed.

As you prepare your home for hurricane season, remember that your home is a sanctuary – a place where memories are made and cherished. By taking these proactive steps, you not only protect your investment but also ensure your property is safe. Homeownership is a rewarding experience, and with the right preparation, you can face any storm with confidence and peace of mind.

by SupremeLending | May 31, 2024

The Ultimate Mortgage DTI Handbook

When it comes to securing a mortgage, understanding your finances has never been more important. One of the most important metrics lenders use when evaluating a borrower’s eligibility for a mortgage is Debt-to-Income ratio, commonly known as DTI. Let’s dive into what exactly mortgage DTI is, how it’s used, what sources of debt and income are considered, and what establishes a fair or good DTI. Plus, we’ll offer some helpful tips for potential homebuyers on understanding their DTI.

What Is Debt-to-Income (DTI) Ratio?

DTI is a financing metric that compares an individual’s monthly debt payments to their gross monthly income. Essentially, it measures the percentage of your income that goes toward paying off debts. Lenders use DTI to assess a borrower’s ability to make monthly payments to repay the loan. DTI is calculated by dividing your total monthly debt payments by your gross monthly income and multiplying the result by 100 to get the ratio percentage.

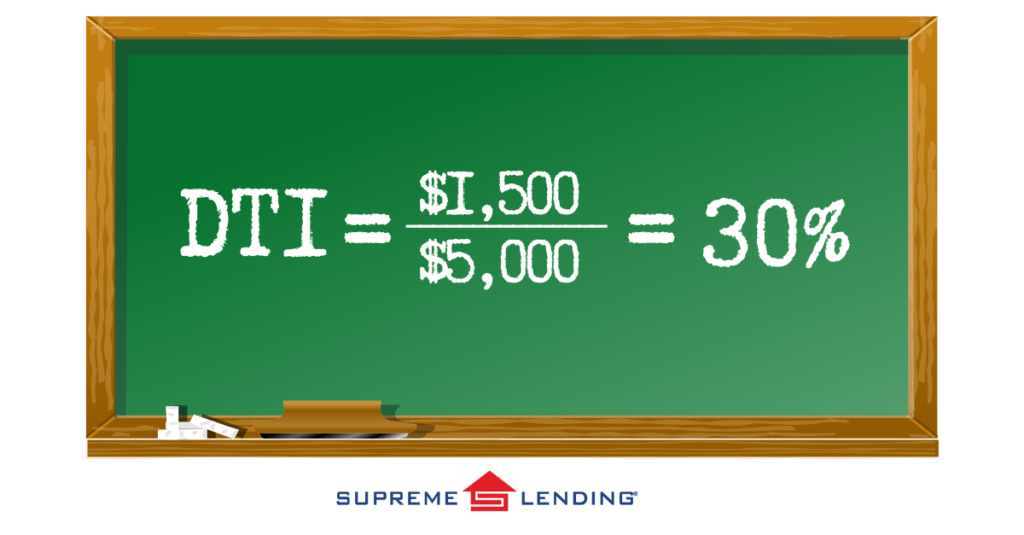

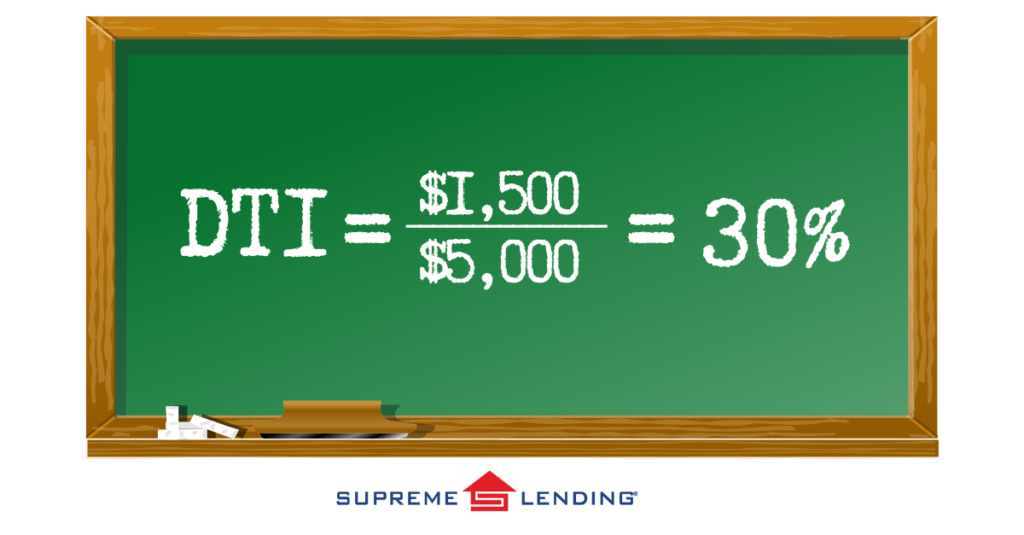

For example, if you have $1,500 in monthly debt payments and a gross monthly income of $5,000, your DTI would be 30%, as calculated below:

How DTI Is Used to Determine Mortgage Eligibility

Lenders look at your DTI to evaluate your ability to take on additional debt in the form of a mortgage. A lower DTI indicates that you have a good balance between debt and income, resulting in a more attractive and capable buyer. There are DTI thresholds that borrowers will need to meet, which can vary by lender or specified by the loan program guidelines.

Types of Mortgage DTI

- Front-end DTI: Also called a housing ratio or mortgage-to-income, this ratio only calculates housing-related expenses, such as the monthly mortgage payment, property taxes, homeowners’ insurance premiums, and homeowners association fees, if applicable, relative to your gross monthly income.

- Back-end DTI: This ratio includes all your monthly debt obligations, such as credit card payments, car loan payments, and student loan debt, in addition to the housing-related debt. Lenders typically focus more on back-end DTI when evaluating a buyer’s capability to repay a loan as it provides a clearer picture of their financial responsibilities.

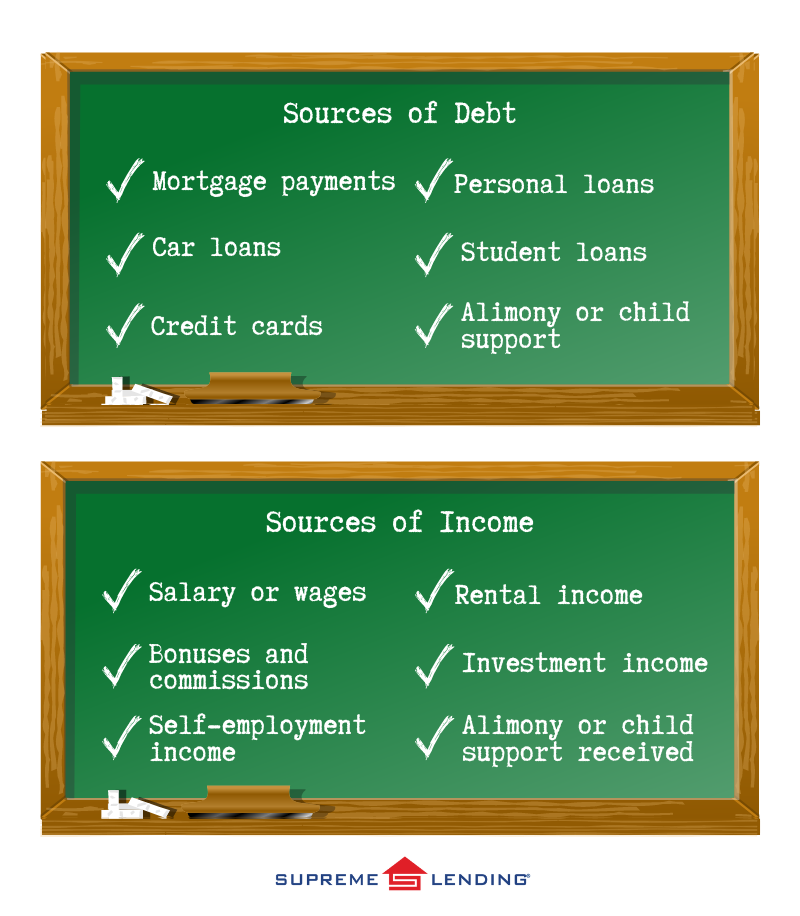

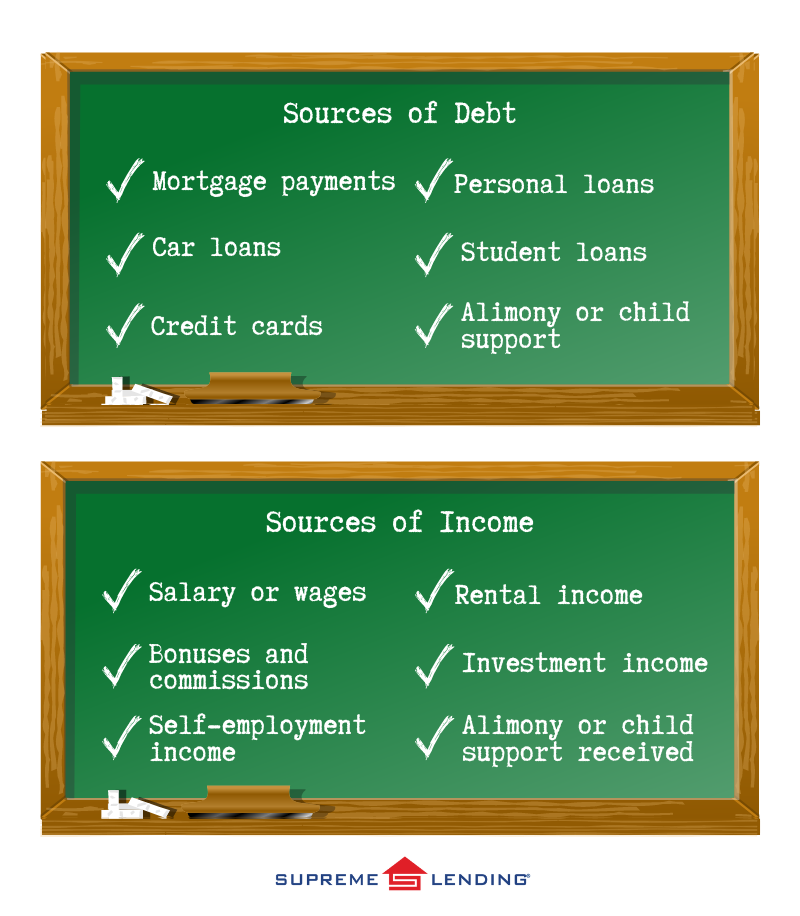

Sources of Debt and Income Considered

What Is Considered a Favorable DTI?

A good DTI ratio for a mortgage depends on the type of loan and the lender. Most lenders prefer a back-end DTI of around 36% or less, though some may accept higher ratios, especially for borrowers with strong credit scores or significant assets.

Helpful Mortgage DTI Tips for Potential Homebuyers

1. Avoid New Debt

Before applying for a mortgage, calculate your current DTI to give you a rough understanding of where you stand. This will help identify if you need to make any adjustments to potentially improve your DTI ratio before deciding to purchase a home.

2. Reduce Outstanding Debts

Paying down existing debts can significantly improve your DTI. Consider focusing on reducing or eliminating higher interest debts like credit card balances first.

3. Increase Your Income

Look for opportunities to boost your income. This could be through a salary increase, getting a higher-paying job, adding a part-time gig, or exploring other income sources.

4. Avoid New Debt

Refrain from taking on new debt before applying for a mortgage and during the loan approval process. New loans or credit lines may have an impact on your DTI and mortgage eligibility.

5. Seek Professional Advice

Consult with a financial professional for personalized guidance or a loan officer to get a better understanding of your DTI and loan program requirements. There may be other mortgage options better suited for you depending on your goals, such as Debt Service Coverage Ratio (DSCR) loans for investment properties that don’t use DTI.

6. Consider a Co-Signer

If your DTI is in the higher range, you may benefit from having a co-signer who has a higher income or less debt to contribute.

7. Understand Loan Programs

Guidelines and criteria to qualify for a mortgage vary depending on the program and lender. For example, FHA loans typically have more lenient DTI requirements than Conventional loans. Work with our team at Supreme Lending to explore a variety of different mortgage options and find the one best fit for you.

Managing Your Debt-to-Income Ratio

Understanding mortgage DTI and your Debt-to-Income ratio is essential for navigating the loan process. By managing your DTI and making informed decisions, you may potentially improve your mortgage eligibility and chances of securing your dream home.

Contact Supreme Lending to learn more about how we can help you achieve your homeownership goals with confidence.

Related articles:

by SupremeLending | May 21, 2024

Undergoing home renovation projects can not only enhance your living space but, if done right, may increase the value of your home. Whether you’re looking to attract buyers before selling your home or want to modernize your space, here are eight popular home renovation projects to consider that may add value and pay off in the long-term. Plus, with renovation loans or refinancing,* funding these projects may be easier than you think.

1. Upgrade the Front Door

The front door of your home is the first thing people see, and first impressions matter. Replacing an old, worn-out door with a new, sleek one can instantly boost your home’s curb appeal. Opt for a steel or fiberglass door for durability. For a lower budget option, a fresh coat of paint and new hardware can also do wonders.

2. Enhance Landscaping

The exterior yard is crucial when it comes to selling a home, and well-maintained landscaping can make a big difference. Simple tasks such as trimming bushes, planting flowers, and adding fresh mulch can create an inviting environment. Consider adding attractive features such as a stone walkway, small fountain, or boxwood bushes.

3. Remodel the Kitchen

The kitchen is the heart of the home and is oftentimes a key deciding factor for people looking to buy a property. Even minor updates like replacing outdated appliances, installing new countertops, or refreshing cabinet hardware can make a big impact. If you have a larger budget, consider a complete kitchen overhaul including modern cabinetry, a marble island, or a luxurious backsplash.

4. Remake the Bathroom

Updating bathrooms can significantly boost your home’s value. Start with easy fixes like re-caulking the tub, replacing outdated fixtures, upgrading to a modern mirror, or adding a fresh coat of paint. Depending on the condition, it may be worth to completely renovate the bathroom by updating the shower or tub and retiling the space.

5. Add or Upgrade a Deck or Patio

Outdoor space has always been an appealing feature to homebuyers. Adding a deck or patio can extend the living space and create an enjoyable area for entertaining and relaxation. If you already have a deck, ensure it’s in good condition by making any repairs or replacements. You can even add unique features like an outdoor kitchen or elegant lighting.

6. Add Fresh Paint

A fresh coat of paint is a simple, cost-effective way to update your home. Choose neutral colors that would appeal to a wide range of buyers and make spaces feel larger and brighter. Painting can cover up any scuffs and marks, making your home look cleaner and well-maintained.

7. Improve Energy Efficiencies

Energy efficiency can be a top priority for many homebuyers. Simple upgrades like adding insulation or installing programable smart home technology can make your home more attractive. Larger investments, such as replacing old windows and converting to Energy Star-rated appliances, may also add significant value.

8. Increase Spare Footage

If you have the budget, increasing your home’s square footage may considerably raise its market value. Options include finishing a basement, converting an attic, or adding on an extension. The new space could be marketed as an extra bedroom, bathroom, or home office, making your home more appealing to a wider range of buyers.

Financing Home Renovation Projects

While remodeling a home may add significant value, it can also be costly. Fortunately, there are financing options available to help fund home renovation projects, such as a renovation loan, home equity loans, or cash-out refinancing.

Have any home renovation projects in mind? Contact us today to learn how we can help you finance the home of your dreams.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | May 17, 2024

If you’re a homeowner looking to gain access to the equity you’ve built in your home, you’ve most likely heard about cash-out refinancing,* also commonly known as cash-out refi loans. These offer a useful way to access cash by refinancing your current mortgage. But there’s more to the process than that! What exactly are cash-out refinance loans, and when do they make the most sense? Here’s an overview to gain a comprehensive understanding of cash-out refinancing, potential benefits, and different scenarios to consider.

How Cash-Out Refinancing Works

A cash-out refi loan is a refinancing option where you replace your existing mortgage with a new, larger loan than what you currently owe. The difference between the new loan amount and your existing mortgage balance is paid to you in cash. This allows you to tap into your home equity, which is the portion of your property’s value that you own outright.

Scenarios When Cash-Out Refinancing May Be Beneficial

1. Home Improvements

A popular reason homeowners opt for cash-out refi loans is to fund home renovation projects and upgrades. For example, if your home needs a new roof, a modernized kitchen, or an additional bathroom, using the equity in your home to finance these projects may be a smart move. Home improvements can not only enhance your living space but may increase your property’s value.

2. Pay Off High Interest Debt

Another practical use for a cash-out refinance is to pay off other high-interest debt, such as credit card balances or personal loans, potentially allowing you to roll it into a new mortgage with a lower rate.

3. Education Expenses

If you or a family member is planning to attend college, a cash-out refinance may help provide funds to cover tuition and other education-related expenses. This may offer a more affordable, manageable option compared to student loans, while helping build a brighter future.

4. Emergency Funds

Life is unpredictable, and having access to emergency savings can provide peace of mind. Cash-out refi loans could be used to create that financial safety net set aside for unforeseen expenses, such as medical bills or urgent vehicle or home repairs, offering a potential alternative to using high-interest personal loans or credit cards.

When Cash-Out Refi Loans May Not Be Ideal

1. High Closing Costs

Doing a cash-out refinance comes with associated closing costs, which can typically range from 2% to 6% of the loan amount. If the closing costs outweigh the benefits of refinancing, it may not be the best option. It’s important to ensure that the cash-out amount or potential return on investment can justify the closing cost amount.

2. Increased Monthly Payments

Refinancing into a larger loan amount may increase your monthly mortgage payments, especially if you do not secure a lower interest rate. It’s important to know how your monthly payment may change and be prepared to handle any increases.

3. Extended Loan Term

In some cases, a cash-out refinance can extend your mortgage term,. This may offset the potential increase in your monthly payment. However, it also means you might be paying more interest over a longer period of time.

As there are several common reasons to refinance a mortgage, cash-out refi loans may be a strategic way to gain access to your home equity and fund several initiatives. It’s important to understand what all goes into the refinancing process, such as closing costs, potentially increased monthly payments, and extended loan terms.

Ready to explore if a cash-out refinance is right for you? Getting pre-qualified can provide an estimate on how much cash you can take out and a breakdown of your potential refinancing expenses to help you make an informed decision. Contact our expert team today to discuss your mortgage options.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | Apr 9, 2024

When considering buying a home and what your mortgage payment will look like, it’s important to be familiar with private mortgage insurance (PMI). All parties in the mortgage and homebuying process must be protected from certain risks, and this includes not only buyers and sellers, but also mortgage lenders. That’s where PMI comes in.

What exactly is private mortgage insurance, when is it required, what types are there, and when can it be removed? Here’s a breakdown of PMI and how it may impact your mortgage.

Private Mortgage Insurance Basics

PMI is an insurance that homebuyers are typically required to have when they pay less than 20 percent down payment for a home with a Conventional loan. The purpose of PMI is to protect the lender in case the borrower defaults on the loan and fails to make payments. This mitigates risk for the loan provider. If a property goes into foreclosure, PMI can reimburse the lender for a portion of their losses.

The cost for PMI is typically rolled into the monthly mortgage payment and funneled to the insurance provider—in the event the lender needs to make a claim.

It’s important to note that PMI is not homeowners insurance, which protects against things like fire damage or theft. PMI is required by lenders, and it only covers the lender in case of default. It’s not used to protect homebuyers’ interests. However, having PMI may allow borrowers to buy a home sooner than later, without having to save up for a larger down payment.

Types of PMI

While private mortgage insurance plans have the same goals, there are a few different ways to structure the PMI payments applied to a mortgage depending on specific circumstances or preferences. These options include:

- Buyer-Paid PMI: By far the most common type of PMI, buyer-paid private mortgage insurance involves the homebuyer or borrower paying a monthly insurance premium, which is added on to the monthly loan payment and paid to the insurance provider, though the charge can sometimes be rolled into the mortgage itself if applicable.

- Lender-Paid PMI: A much less common option is when the lender pays the monthly premiums, however as a result, the borrower would pay a higher interest rate to make up for the lender’s investment.

- Single-Premium PMI: This type of private mortgage insurance consists of the borrower paying for the full PMI policy upfront in a single lump sum, often at closing. Once this is paid, it eliminates monthly PMI payments.

- Split-Premium PMI: Borrowers may also have the option to combine the PMI payment options listed above by paying an upfront lump sum at closing that doesn’t cover the entire insurance policy, so a lower monthly premium is still required in addition to the mortgage payment.

Benefits of PMI

When lenders have the appropriate protections in place to provide loans, like requiring PMI in certain cases, they can offer mortgages to more families and individuals than if they were faced with taking on more risk.

Similar to how car insurance can protect both the owner of the car and the lender in case of an accident, private mortgage insurance is just another way to ensure that things go smoothly for all parties involved in a home loan. It gives more people the opportunity to buy homes with lower down payment options, while also making sure that lenders have protection against borrowers defaulting on their loans.

When PMI Is Required and How to Get Rid of It?

As noted above, the most common PMI requirement is when a homebuyer puts down less than 20 percent for a Conventional loan. However, this isn’t a set-in-stone rule. There can be loan programs with lower down payment requirements that may not require PMI. Always discuss with your loan officer to go over your qualified options.

Additionally, in most cases, PMI can be removed at some point during the life of the loan. Generally, once the borrower reaches 22 percent equity built in the home through things like paying down the mortgage or appreciation of the home’s value, PMI can be removed. This is done by request so if you think you may have reached this point, it’s important to contact your lender and ask about removal of the insurance. In other situations, PMI may automatically be removed once the homeowner reaches a certain agreed upon equity threshold.

For more on private mortgage insurance or to learn about other home loan programs, contact the team at Supreme Lending today.

by SupremeLending | Mar 21, 2024

Picture this – you currently own or want to buy a home with good bones, but it needs some TLC. The good news is that you don’t have to handle a home remodel alone. Renovation loans are a great option to help fund home improvements, repairs, and enhancements by rolling the renovation costs into a single mortgage payment. It’s important to understand how renovation or home improvement loans work, types of renovation loan options, and benefits.

What Is a Renovation Loan?

Renovation loans are designed to help borrowers finance home improvement projects that will increase the value of the home. Whether you’re planning a small home makeover or extensive rehab project, a renovation loan combines a traditional purchase or refinance mortgage with the cost of renovations—it is an all-in-one mortgage financing option that covers the upfront costs of large repairs and projects.

Taking on the remodel before moving in can enhance your living space and home functionalities without the pressure of taking out an additional loan or paying out of pocket for costly repairs in the future.

Types of Renovation Loans

When it comes to renovation loans, there are a few options for prospective homebuyers and homeowners to consider based on eligibility, timing, and the scale of the home improvements needed.

FHA 203(k) Renovation

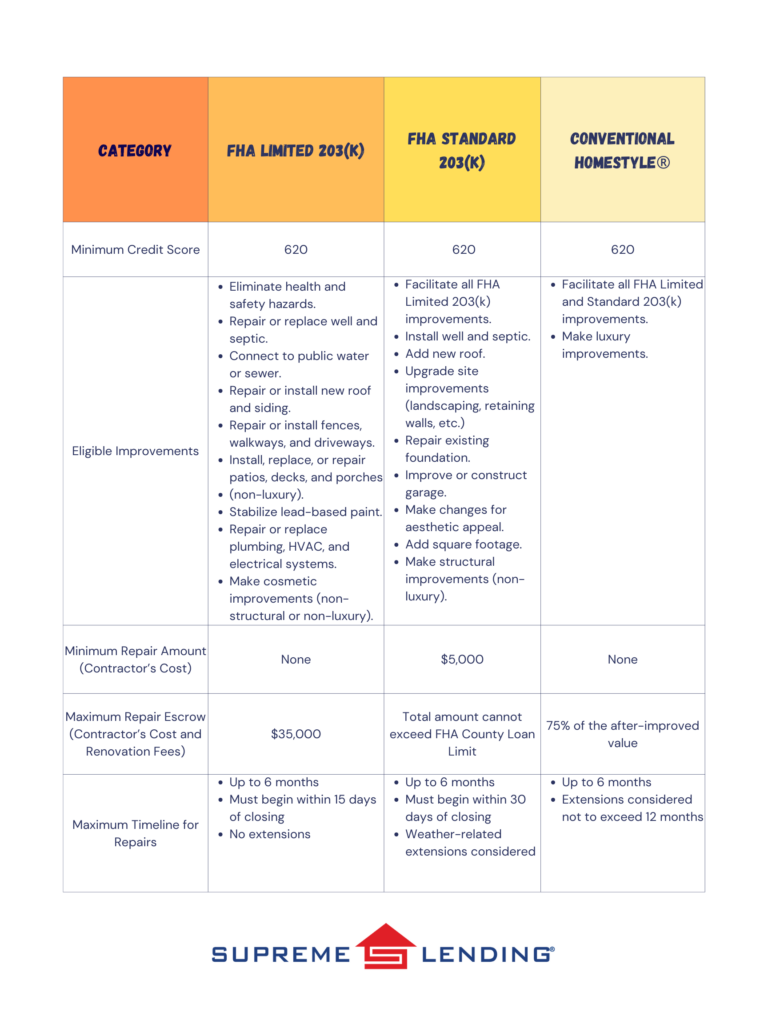

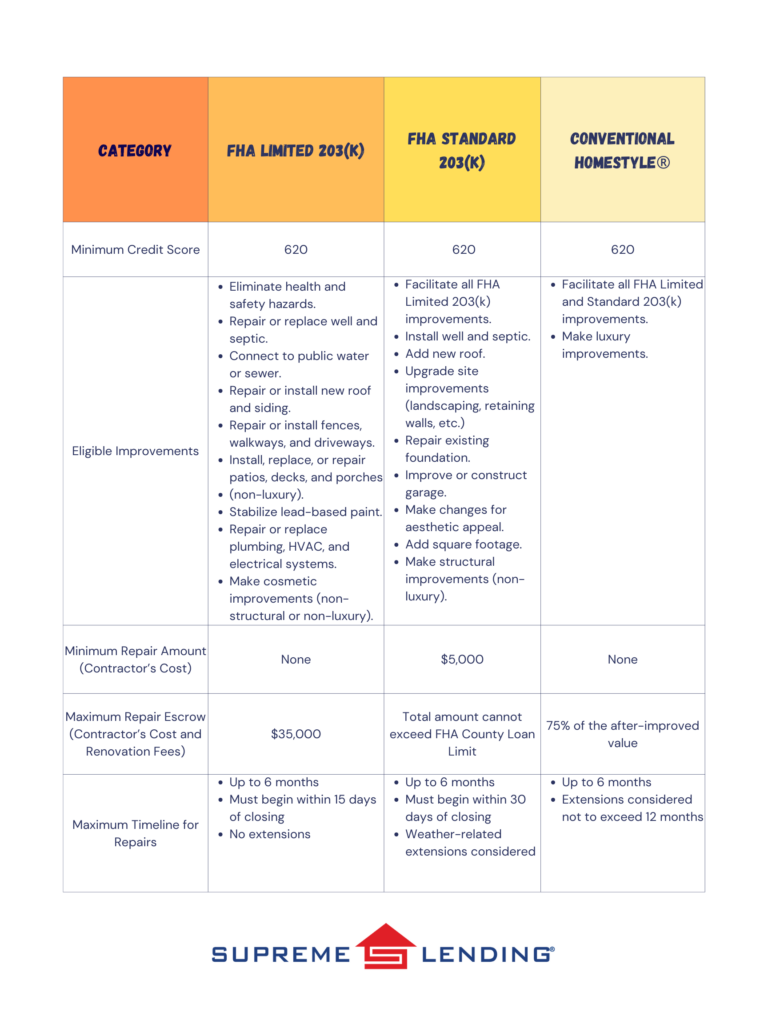

An FHA 203(k) loan, or an FHA rehab loan, is insured by the Federal Housing Administration and provides two options depending on the scope of the home improvement projects, including Limited 203(k) and Standard 203(k), offering different levels of renovation financing.

The minimum down payment for an FHA 203(k) loan is 3.5%. An FHA 203(k) loan covers common basic home improvements and repairs but excludes larger luxury projects and amenities. The Limited option has no minimum renovation amount and can cover up to $35,000 in renovation costs. The Standard has expanded eligible improvements including some structural upgrades and a minimum renovation cost of $5,000. Typically, all renovations must be completed within 6 months.

VA Renovation

The Department of Veterans Affairs (VA) also has a Renovation loan option. A VA Renovation loan offers 100% financing for eligible U.S. Veterans or military personnel to cover a mortgage combined with planned renovation costs into a single loan. Eligible home improvements are similar to FHA 203(k) to cover common upgrades that will make the property safer, healthier, or more functional, excluding luxury projects. VA Renovation loans can finance up to $50,000 in home repair costs.

Conventional Renovation

A Conventional Renovation loan, such as Fannie Mae’s HomeStyle® program, is another financing option that rolls the costs of home renovation projects into a single mortgage and offers more flexibility than a government loan. Conventional Renovation mortgages can cover larger, luxury upgrades, such as creating a high-end bathroom or kitchen with decorative tilework or adding a sparkling backyard pool. The maximum home repair amount is 75% of the home’s post-construction appraised value.

More Benefits of Renovation Loans and Remodeling

- Expand Your Home Search. Prospective homebuyers may have a broader range of properties to choose from, including fixer-uppers, knowing that they could finance custom home upgrades or needed repairs with a Renovation loan.

- Save on Upfront Costs. Home renovation projects can be costly. Funding home remodeling projects with your mortgage could help keep you from tapping into your personal savings and avoid hefty upfront repair costs.

- Grow Your Home Value. Renovation loans are intended to increase the value of your home, which may result in a smart, long-term investment and the potential to build more equity.

- Personalize Your Dream Home. Renovation loans offer an affordable option to help make your design visions come to life and beautify your home to fit your character.

- Enhance Comfort and Livability. Whether it’s expanding a kitchen, adding a bathroom, or creating a home office space, upgrading your home can add modern conveniences and improve your overall well-being.

If you’re looking to enhance your living spaces and potentially increase your property value, a Renovation loan could be the answer to creating the home of your dreams. To learn more about renovation financing or other mortgages, contact your local Supreme Lending branch today.

Related Articles: