by First Integrity Team Supreme Lending | Mar 20, 2025

Deciding between renting vs. owning a home may be one of the biggest debates when it comes to housing. Both options offer unique advantages, but the key is to find which fits your personal goals and lifestyle. Let’s explore the pros and cons of each option and take a deep dive into the many potential benefits of homeownership and mortgage options that renters may not realize.

Pros and Cons of Renting

Renting offers flexibility and lower upfront costs, making it an appealing option for many. Here are some of the possible benefits and drawbacks of renting.

Pros of Renting

- Renting allows you to move more easily, ideal for those who frequently relocate or prefer not to be tied down to one area.

- Less Responsibility. When renting, your landlord or property management company is typically responsible for maintenance, repairs, and property upkeep. This saves you the headache of managing those tasks and additional costs.

- Lower Upfront Costs. When moving into a new rental, security deposits and first month’s rent are typically more affordable than a down payment for a home and other homebuying costs.

Cons of Renting

- No Home Equity. Making rent payments doesn’t build equity—unlike the potential for a home. No equity means you can’t take advantage of opportunities like cashing out on equity with a refinance.*

- Limited Personalization. Rental properties often have restrictions on renovations or even simple changes like painting walls and installing new fixtures.

- Rising Rents. Unlike a fixed mortgage, rent payments can oftentimes increase every year, sometimes significantly depending on your local market conditions.

Benefits of Owning

While renting may offer short-term convenience, owning a home comes with several potential long-term benefits that renting can’t match. Beyond simply having a place to live, explore these rewards of homeownership:

- Potential to Build Equity. Home values may appreciate over time. Unlike renting, homeownership may allow you to build equity as a future investment.

- Stable Payments. With fixed-rate mortgages, you have the confidence and peace of mind that your monthly payments will remain the same throughout the life of the loan.

- When you own your home, you have the creative freedom to really make it your own. You can make as many home renovations as you want to fit your unique style.

- Possible Tax Benefits. Homebuyers may qualify for potential tax deductions. Work with your tax advisor to learn more and see if owning a home could save you tax dollars.

- Pride of Ownership. There’s a unique sense of accomplishment and pride that comes with owning a home, allowing you to put down roots in a community.

Renting vs. Buying: Seven Key Questions to Consider

- How long do you plan to stay in one place? If you’re planning to stay in one location for several years, buying may be a smarter option.

- What’s your financial situation? Do you have enough savings for a down payment and closing costs? Evaluate your finances and get pre-qualified to determine your options.

- Are you ready for the responsibilities of homeownership? Owning a home comes with additional responsibilities than renting such as on-going maintenance, repairs, and upkeep.

- What’s your credit score? Your credit score plays a significant role in qualifying for a mortgage and getting favorable loan terms.

- What are the housing market trends in your desired area? Depending on your local area, it may make more sense to rent if housing prices are too high or out of your budget.

- Do you value flexibility or stability more? Consider your current lifestyle preferences. If you’re not ready to settle down, renting may offer the flexibility you need. However, if you’re drawn to a more stable living situation, homeownership may be the better option.

- What are your long-term goals? How could homeownership fit in with your broader financial and lifestyle goals, such as the potential to building equity, undergoing home renovations, investing in real estate, or creating a family home.

Down Payment Assistance & First-time Homebuyers

Don’t forgot to explore down payment assistance and first-time homebuyer programs that may help open the door to homeownership sooner than you think! FHA loans offer several benefits for first-time buyers, including lower down payment and credit requirements. While Conventional loans may only require as low as 3% down for qualified first-time buyers.

Ready to Stop Paying Your Landlord’s Mortgage?

Deciding between renting vs. owning a home is a big decision that depends on several factors such as your mortgage qualification, long-term plans, and personal preferences. While renting offers flexibility, homeownership may offer long-lasting benefits.

Ready to explore your homebuying options? Contact our team at Supreme Lending to discuss how to make your mortgage work for you!

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by First Integrity Team Supreme Lending | Feb 10, 2025

A reverse mortgage* is a unique loan designed to help eligible homeowners and homebuyers aged 62 or older convert some of their home equity into cash. This program may offer greater flexibility and financial independence, especially for those entering retirement. Reverse mortgages allow qualified senior homeowners to tap into their home’s value to meet other financial needs without having to sell their property or make monthly mortgage payments. What is a reverse mortgage, how does it work, and who may benefit from one? Here’s a breakdown.

What Is a Reverse Mortgage?

Reverse mortgages allow homeowners to borrow money using their home as security for the loan. Unlike traditional home loans where the borrower makes monthly payments to the lender, with a reverse mortgage, the lender makes payments to the homeowner. Reverse mortgages are experiencing a surge in popularity as more retirees may be considering them to supplement their retirement income.

How It Works?

The funds received with a reverse mortgage are based on the equity that’s been built in the home. Payments can be made to the homeowner in several ways:

- A lump sum

- A line of credit

- Fixed monthly payments

- A combination of all three options outlined above

The loan does not have to be repaid until the borrower sells or no longer lives in the home. However, the borrower must still meet all loan obligations including living in the house as a primary residence, keeping up with all property payments such as insurance and taxes, and maintaining the home’s condition.

What Can Reverse Mortgage Funds Be Used For?

A reverse mortgage may be a way for seniors to turn their home’s equity into cash to meet their financial needs while maintaining ownership of the property. The funds may serve various purposes, such as paying off other existing mortgages; covering healthcare, taxes, or insurance expenses; funding home renovations; and serving as a safety net for unexpected emergencies.

It may be an ideal option for seniors who:

- Want to stay in their home long-term.

- Need additional income to maintain their quality of life during retirement.

- Have significant equity built in their property but don’t want to sell or cash-out refinance** and take on monthly mortgage payments.

- Need to pay for in-house healthcare.

- Get a later in life silver divorce but want to stay in their home.

- Want to buy a home but are unable to pay all cash.

Frequently Asked Questions About Reverse Mortgage

1. Do I still own my home with a reverse mortgage?

Yes. When you obtain a reverse mortgage, you still retain ownership of your home. Your name remains on the title and the home is yours—just as it would be with any mortgage. You’re still responsible for paying property taxes, homeowners insurance, and maintaining the home.

2. When does the mortgage need to be repaid?

Once you no longer live in the home as your primary residence, the loan balance, including interest and fees, must be repaid. This is usually done by the homeowner or their estate that is selling the house

3. Will I owe more than my home is worth or leave my heirs with debt?

No. A HECM (Home Equity Conversion Mortgage) reverse mortgage is insured by the Federal Housing Administration. This insurance feature guarantees that you will never owe more than the value of your home when the loan becomes due. No debt will be left to your heirs. And if the loan balance is less than the market value of the home, the additional equity is retained by the homeowner or heirs if the home is sold.

4. What types of homes qualify for a reverse mortgage?

Single-family homes, FHA-approved condos, and multi-family homes (up to four units) are typically eligible, as long as the property is the borrower’s primary residence.

*A reverse mortgage increases the principal mortgage loan amount and decreases home equity (it is a negative amortization loan). When the loan is due and payable, some or all of the equity in the property no longer belongs to borrowers, who may need to sell the home or otherwise repay the loan with interest from other proceeds. Lender charges an origination fee, closing costs and servicing fees (added to the balance of the loan). Monthly service fees are not assessed in Texas. The balance of the loan grows over time and Lender charges interest on the balance. The borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges, including property taxes, fees, hazard insurance. The borrower must maintain the home according to FHA requirements. Failure to meet these requirements can trigger a loan default that may result in foreclosure. This material has not been reviewed, approved or issued by HUD, FHA or any government agency. The company is not affiliated with or acting on behalf of or at the direction of HUD/FHA or any other government agency

**By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by First Integrity Team Supreme Lending | Jan 9, 2025

All You Need to Know About the FHA 203(h) Disaster Relief Loan Program

When natural disaster strikes, the devastation it leaves behind can be overwhelming, especially if your home is damaged or destroyed. At Supreme Lending, we know how difficult it can be to rebuild after such destruction. That’s where the FHA 203(h) Disaster Relief Loan may be able to help as an affordable option for those in eligible areas.

If you’ve been affected by disaster and are looking to rebuild or purchase a new home for a fresh start, Supreme Lending is here to help you navigate the challenging time with care and expertise. This guide will walk you through the FHA 203(h) loan, how it works, benefits, and why it may be a valuable program for helping disaster victims get back on their feet.

What Is the FHA 203(h) Disaster Relief Loan?

The FHA 203(h) is a government-insured mortgage program that provides financial assistance to individuals whose homes have been damaged or destroyed in federally declared disaster areas. This is designed to help homeowners and renters alike rebuild or purchase new homes in the wake of devastating events like hurricanes, floods, tornadoes, and wildfires.

What makes the FHA 203(h) Disaster Relief Loan unique is the ability to help make homeownership more attainable after such tragedy by offering flexible guidelines and 100% financing.

How Does FHA 203(h) Work?

The FHA 203(h) Disaster Relief Loan works similarly to other FHA programs but comes with added benefits and provisions specifically for disaster victims. Here’s a breakdown of how it works.

What Properties Are Eligible?

To qualify, your current home must be in a Presidentially Declared Major Disaster Area (PDMDA) and must have been damaged to the point where it is no longer livable. The loan must be secured within one year of the disaster declaration, offering you plenty of time to regroup and take the next step towards recovery.

Program Benefits

- No down payment required. One of the biggest benefits of this program is that there is no down payment requirement for eligible borrowers. This makes it easier to secure financing without the burden of saving for large upfront costs, especially after facing potential hardships caused by a disaster.

- Minimum credit score of 580. While there are still credit parameters in place, the FHA 203(h) offers more lenient requirements than other financing options. This may help borrowers whose credit was negatively impacted due to the natural disaster.

- Available for single-family or FHA-approved condos. The home must be a primary residence – either a single-family home or approved condominium project. This program is not designed for second homes or investment properties but is focused on truly helping homeowners get back on their feet.

- Purchase location flexibility. Through this program, it allows you to purchase a new home anywhere in the United States. The replacement home doesn’t have to be in a designated disaster area.

Combining FHA 203(h) with 203(k) Renovation

The FHA 203(h) program also offers the option to combine with an FHA 203(k) Standard or Limited Renovation loan. This involves adding renovation costs into a single mortgage to cover repairs and remodel projects ranging from minor updates to structural if approved. Plus, the damaged property is eligible regardless of the age of the home. It only needs to have been a habitable residence prior to the disaster.

Ready to Relocate or Rebuild?

Supreme Lending is here to help you move forward and rebuild when disaster strikes. To learn more about the FHA 203(h) Disaster Relief Loan or to go over other mortgage options, contact your local Supreme Lending branch today!

More Resources from the U.S. Department of Housing and Urban Development:

Related Articles:

by First Integrity Team Supreme Lending | Oct 17, 2024

Discover the Program Highlights of an FHA 203(k) Renovation Loan

Are you ready to turn a fixer-upper into your dream home? Whether it’s a home you’ve just bought or already own, renovation loans like the FHA 203(k) program may help you finance both the purchase and necessary repairs or updates all in one mortgage. Plus, the U.S. Department of Housing and Urban Development (HUD) announced that it is increasing the loan amount for Limited FHA 203(k) loans to $75,000 on all FHA case numbers effective November 4, 2024—that’s up from $35,000 which is huge news!

Here’s an in-depth look at how the FHA 203(k) renovation loan works, the differences between the Limited and Standard options, and what types of renovations may be covered.

What Is an FHA 203(k) Loan?

Insured by the Federal Housing Administration, the FHA 203(k) renovation loan allows homeowners to finance the cost of both the property and its renovations in a single loan. Whether you’re purchasing a home that needs updates or making repairs to your current home, this loan program may help make those dreams a reality. It offers the similar benefits of FHA loans for first-time buyers and repeat buyers alike. To qualify, eligible borrowers only need 3.5% down payment and there’s more lenient credit score requirements than other renovation loans.

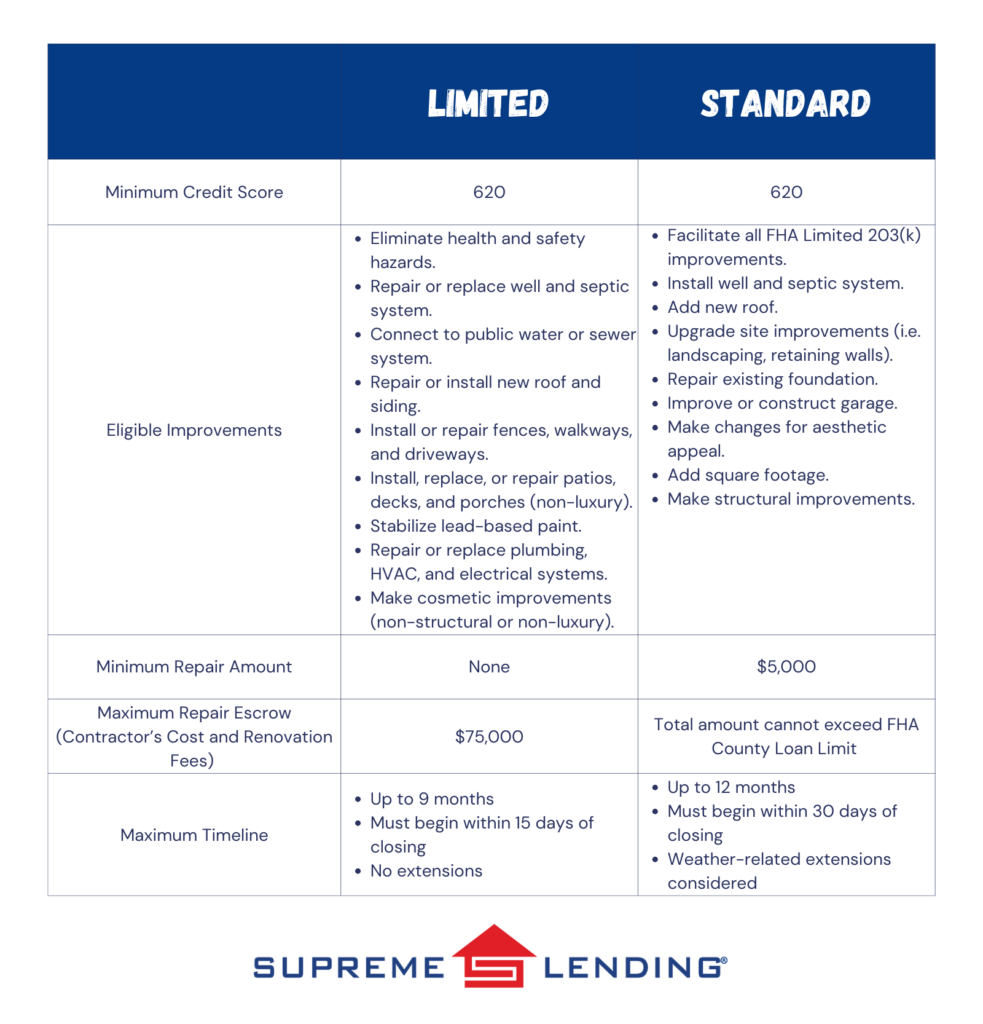

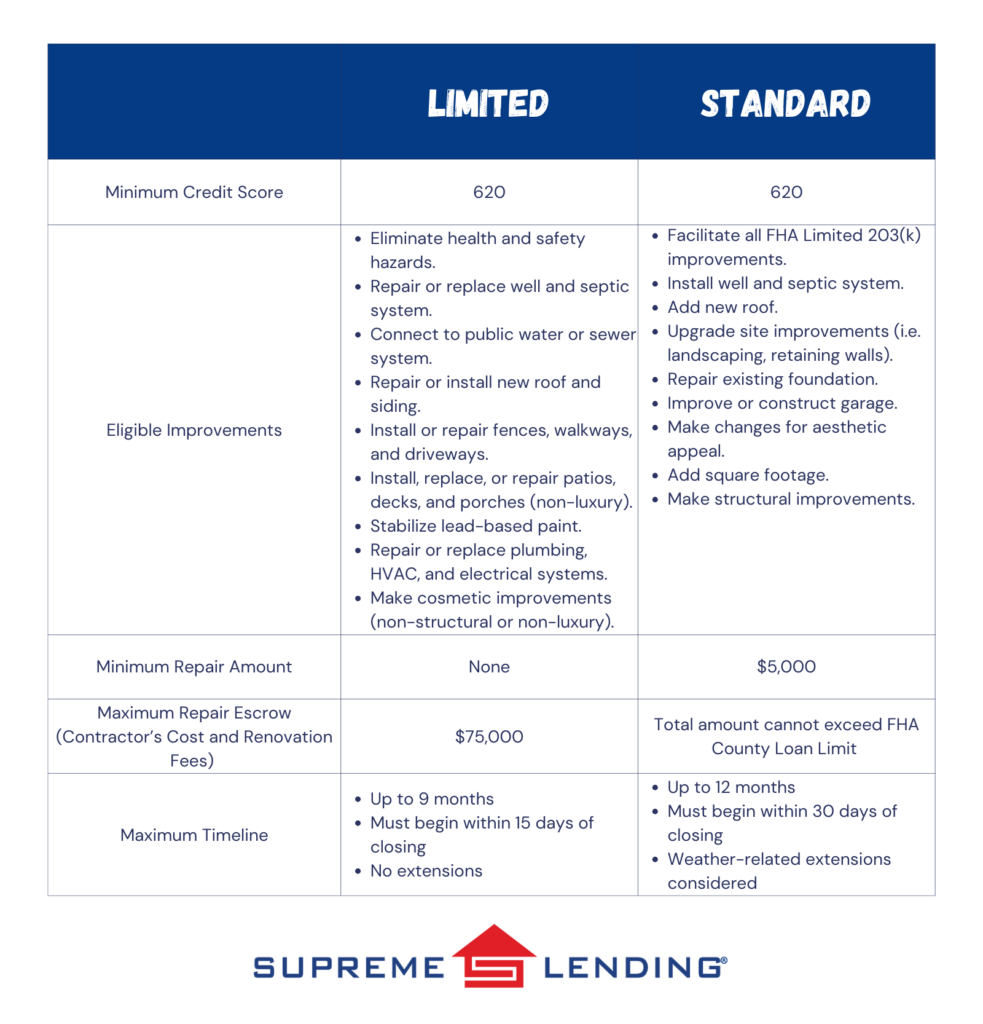

Limited vs. Standard FHA 203(k) Renovation Loan

There are two types of FHA 203(k) loans—Standard and Limited. Each has specific uses and limits depending on the scope of renovations you can make.

Limited FHA 203(k) Loan

The Limited 203(k) option is commonly used for smaller repairs and cosmetic upgrades. As mentioned, the loan amount will increase to $75,000 in November 2024, an exciting enhancement that will help open the door to renovations for more people. This loan covers non-structural projects such as remodeling kitchen fixtures, replacing flooring, painting, and minor landscaping. Unlike the Standard, the Limited program doesn’t require working with an HUD consultant or have a minimum loan amount.

Common Projects the Limited Covers

- Minor remodeling (i.e. updating kitchens or bathrooms)

- Replacing appliances or flooring

- Repainting or refinishing surfaces

- Energy-efficient improvements (i.e. installing new windows or insulation)

- Repairing roofs and gutters

Standard FHA 203(k) Loan

The Standard FHA 203(k) Renovation loan is more ideal for homes needing larger renovations and structural repairs. These may include adding rooms, replacing outdated plumbing or electrical systems, and fixing major structural issues. It has a minimum of $5,000 that must be used for renovations and the total loan amount must be within the FHA County Loan Limit. Because these projects are typically more complex, you’re required to work with an HUD-approved consultant.

Common Projects the Standard Covers

- Structural repairs or additions (i.e. adding on square footage or fixing foundation issues)

- Major systems replacements (i.e. plumbing, electrical, or HVAC systems)

- Roof repairs or replacements

- Modernization and improvements to the home’s function

- Accessibility improvements for people with disabilities

How Does the FHA 203(k) Renovation Loan Work?

The process for applying for an FHA 203(k) loan is similar to a regular FHA mortgage but comes with a few additional steps. Here’s an overview of how this loan program works.

- Find a property. Whether it’s a home you already own and want to refinance* or one you’re planning to purchase, identify a property that needs renovations.

- Get an appraisal. The home appraisal will assess both the home’s current market value as well as it’s “as-completed” value after the renovations are completed.

- Contractor and Estimates. Work with a licensed contractor to obtain the estimated costs for the repairs and improvements.

- Loan Application. You’ll apply for the loan based on the combined cost of the home and repairs.

- Renovation Timeline. Once the loan is approved, the renovation funds are placed into an escrow account and work begins. The renovation timeline can typically range from six months to one year.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

FHA 203(k) Combined with FHA 203(h) Disaster Relief Loan

Did you know that eligible borrowers affected by federally declared disaster areas may be able to combine the FHA 203(k) renovation loan with the FHA 203(h) disaster relief loan? This means adding the renovation costs into a new mortgage if your home was destroyed and deemed unlivable. Plus, the damaged property is eligible regardless of the age of the home. It only needs to have been a habitable residence prior to the disaster.

Ready to Rebuild?

At Supreme Lending, we understand how important it is to transform a home into one that truly meets your needs. Whether you’re fixing up a new property or renovating your current home, the FHA 203(k) renovation loan offers an excellent way to finance those improvements. We’re proud to offer both Standard and Limited options to fit the scope of your home projects.

Want to learn more about FHA 203(k) renovation loans or other mortgage options? Contact our team at Supreme Lending today and get pre-qualified!

Looking for other renovation loan options? Read more:

by First Integrity Team Supreme Lending | Sep 30, 2024

Buying a home is a major milestone, and while most prospective buyers are focused on saving for the down payment, there are additional homebuying costs to consider. From closing costs to ongoing home maintenance expenses, it’s important to understand the costs beyond the down payment. Let’s dive into those homebuying costs so you can be well prepared.

Down Payment: The First Major Cost

The down payment is often the largest upfront cost when buying a home. The down payment requirements depend on the type of loan to determine what you may qualify for.

- Conventional loans typically require at least 5% for eligible borrowers. For first-time homebuyers, the minimum requirement can be as low as 3%.

- FHA loans require as little as 3.5% down, making them a popular choice for borrowers looking for more flexible guidelines.

- VA and USDA loans offer no down payment requirement for eligible military veterans, active military, or buyers in defined rural areas.

Plus, there are several down payment assistance programs available to help more people achieve their dream of homeownership. While the down payment is a key part of purchasing a home, it’s not the only cost to keep in mind.

Closing Costs: Hidden Homebuying Fees

Beyond the down payment, closing costs are another significant upfront expense buyers must account for. These are fees and expenses necessary to finalize your home purchase and close the loan. Closing costs typically range from 2% to 6% of the home’s purchase price. Here’s a breakdown of common closing costs:

- Loan origination fee is charged by your lender for processing your mortgage.

- Appraisal fee covers the cost of having your home professionally appraised to determine its market value.

- Home inspection fee is paid to inspect the home for any necessary repairs or safety hazards.

- Title insurance and search fees ensure the property’s title is clear of any disputes or liens.

- Escrow fee is charged by the third party handling the closing process.

- Property taxes and homeowners insurance are typically prepaid for a portion of the costs at closing so they’re included in your mortgage escrow account.

Ongoing Costs of Homeownership

After closing on your mortgage, owning a home comes with ongoing expenses that many new buyers often overlook. These homebuying costs are essential to consider when planning for the long-term.

- Utilities include monthly bills such as electricity, gas, water, and internet. These are widely dependent on the size and location of your home.

- Landscaping and yard maintenance, whether you hire a service or handle it by yourself, keeping up with lawn care, tree trimming, and other outdoor maintenance can add up.

- Homeowners Association (HOA) fees are required when your property is in a community with an HOA. These fees may be monthly or annual and cover community maintenance and amenities.

- Property taxes are ongoing local government taxes based on the assessed value of your home. Property taxes may increase over time, so review your tax bills carefully.

- Homeowners and mortgage insurance are often required. Homeowners insurance helps protect the home in the event of potential damages, while mortgage insurance protects the lender in the event of a loan default.

- Ongoing maintenance and repairs will occur over time, from replacing appliances to fixing the roof or plumbing. It’s smart to set aside funds for common home upkeep expenses to avoid hidden costs surprising you.

What’s Next?

We hope these additional homebuying costs are not so hidden anymore! The journey to homeownership comes with several financial considerations beyond the down payment. By understanding these homebuying costs, you can be prepared to buy with confidence.

If you’re ready to explore your mortgage options, contact Supreme Lending today. We’re here to help guide you through the loan process and beyond.

by First Integrity Team Supreme Lending | Sep 12, 2024

Your Quick Home Appraisal Checklist

When buying or selling a home, it’s important to understand the importance of a home appraisal during the mortgage process. Appraisals determine the value of a property based on various factors, ensuring buyers, sellers, and lenders are aligned on what the home is worth. Knowing what appraisers look for can help ensure a smooth mortgage process and avoid last-minute surprises or delays. Read on for an overview of the appraisal process including a home appraisal checklist for homeowners, buyers, and real estate agents to consider.

What Is an Appraisal?

An appraisal is an independent assessment of a property’s market value led by a licensed appraiser. The value is based on evaluating several aspects of the home, such as the condition, location, and recent sales of comparable properties in the area. The appraisal is an essential step of the mortgage process required by most lenders to verify that they’re not lending more than the home is worth. For buyers, a home appraisal can also offer reassurance that they are paying a fair price.

The Home Appraisal Checklist: What Appraisers Look For

Here’s a quick look at some key elements appraisers may consider when evaluating a property. You can use this guide when searching for a home or preparing to sell.

1. Home Size and Layout

- What is the total square footage and number of bedrooms and bathrooms?

- Is the layout of the rooms and spaces functional.

- Is there a finished basement or attic that adds to the livable space?

2. Exterior Condition

- Roof: Are there any missing shingles, leaks, wear and tear, etc.?

- Foundation: Are there visible cracks or settling issues?

- Siding, windows, and doors: Check for any damage, peeling paint, or outdated fixtures.

- Landscaping: Is it overgrown or neglected?

3. Interior Condition

- Walls, ceilings, and floors: Are there any cracks, stains, or general wear and tear?

- Kitchens and bathrooms: Is there any damage, outdated appliances, or broken equipment? Are there luxury upgrades that may boost the home’s value?

- Plumbing and electrical: Are the systems up-to-code, functional, and safe?

4. Lot Size and Usability

- How large is the lot?

- Is it safe and functional?

5. Upgrades and Amenities

- Are there any recent home improvements, such as a kitchen remodel, energy-efficient updates, or a new roof?

- Are there unique amenities such as a pool, outdoor kitchen, or wine cellar?

6. Safety and Compliance

- Appraisers will check for safety hazards or code violations.

- Factors like missing handrails, faulty wiring, or broken windows can negatively impact the appraisal.

7. Location & Neighborhood

- Appraisers will examine the property’s location, including proximity to schools, parks, shopping centers, and other amenities.

- Neighborhood conditions, crime rates, and overall desirability can also impact the value.

8. Comparable Sales (Comps)

- Appraisers will compare the home to the sales of similar properties in the neighborhood.

- Factors such as home size, condition, and location are considered to provide a rough benchmark.

Preparing a Home for an Appraisal: Tips for Sellers and Agents

Keeping the home appraisal checklist in mind, there are some measures that sellers or listing agents may consider to prepare for an appraisal and potentially maximize a home’s value.

- Make Minor Repairs As Needed. Fix any small but noticeable issues, such as leaky faucets, old paint, stained carpet, and broken hardware. Minor fixes may go a long way in improving a home’s appraisal value.

- Clean and Declutter. A clean, organized home allows the appraiser to focus on the property’s key features rather than clutter. This step can also enhance the home’s overall appearance.

- Highlight Recent Upgrades. If the home has undergone significant improvements, provide the appraiser with a list of updates, including the dates and cost of renovations.

- Provide Easy Access. Make sure that the appraiser can navigate to all areas of the home, including the basement, attic, and other outdoor structures.

Frequently Asked Questions About Appraisals

1. What is the difference between a home appraisal and a home inspection?

A home appraisal determines the market value of the property, which is essential for lenders to approve the loan amount. A home inspection, on the other hand, assesses the condition of the home and identifies any potential issues or repairs that may need to be addressed. While an appraisal focuses on value, an inspection focuses on the home’s livability.

2. What happens if the home appraises for less than the sale price?

If the appraisal comes in lower than the agreed-upon sale price, the buyer and seller may need to renegotiate. The buyer could request the seller to lower the price, or the buyer may need to pay the difference out of pocket.

3. Do you need an appraisal when refinancing?

Yes. When refinancing,* it’s essential to understand the home’s current market value, especially if you’re taking cash out of your home equity. The appraisal also plays a key role in determining the Loan-to-Value ratio, which can affect loan terms, interest rate, and whether private mortgage insurance may be required.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

What’s Next?

A home appraisal is one of the most important steps in the mortgage process. Once the appraisal is complete, the report is submitted to the lender for review. The lender reviews the appraisal report to verify the property’s appraised value aligns with the loan amount. When all loan conditions are met, it’s smooth sailing to closing.

Whether buying, selling, or listing a home, understanding the home appraisal checklist can help make the mortgage process smooth and seamless.

For more information about mortgages and steps of the loan process, contact your local Supreme Lending team today!

Related articles: