by First Integrity Team Supreme Lending | Oct 17, 2024

Discover the Program Highlights of an FHA 203(k) Renovation Loan

Are you ready to turn a fixer-upper into your dream home? Whether it’s a home you’ve just bought or already own, renovation loans like the FHA 203(k) program may help you finance both the purchase and necessary repairs or updates all in one mortgage. Plus, the U.S. Department of Housing and Urban Development (HUD) announced that it is increasing the loan amount for Limited FHA 203(k) loans to $75,000 on all FHA case numbers effective November 4, 2024—that’s up from $35,000 which is huge news!

Here’s an in-depth look at how the FHA 203(k) renovation loan works, the differences between the Limited and Standard options, and what types of renovations may be covered.

What Is an FHA 203(k) Loan?

Insured by the Federal Housing Administration, the FHA 203(k) renovation loan allows homeowners to finance the cost of both the property and its renovations in a single loan. Whether you’re purchasing a home that needs updates or making repairs to your current home, this loan program may help make those dreams a reality. It offers the similar benefits of FHA loans for first-time buyers and repeat buyers alike. To qualify, eligible borrowers only need 3.5% down payment and there’s more lenient credit score requirements than other renovation loans.

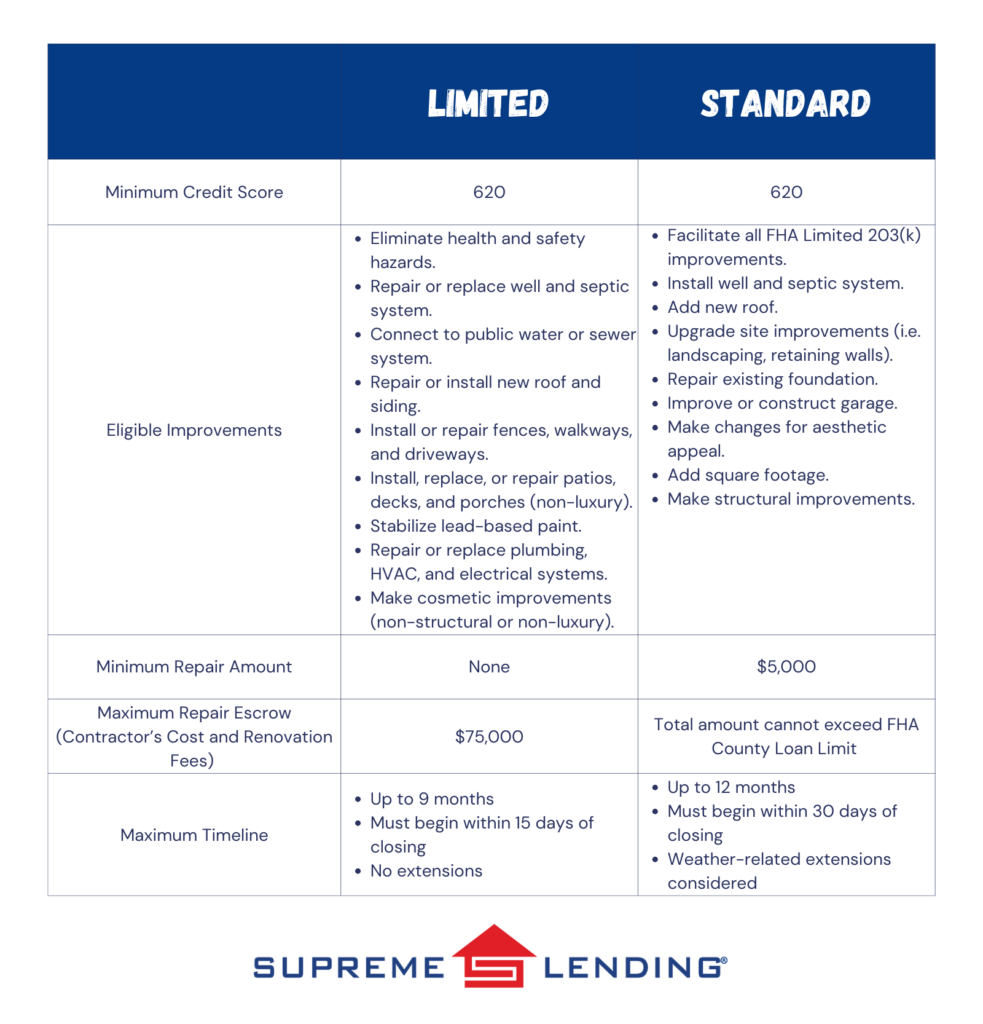

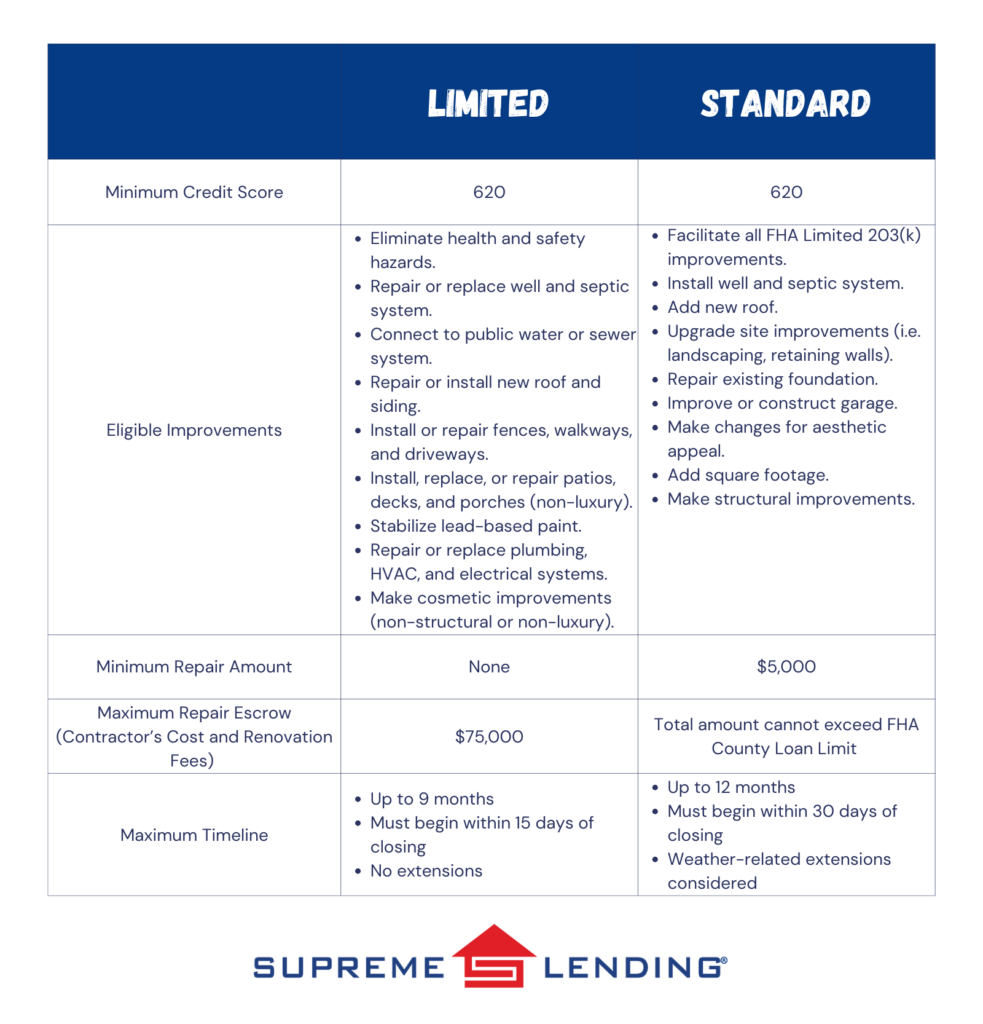

Limited vs. Standard FHA 203(k) Renovation Loan

There are two types of FHA 203(k) loans—Standard and Limited. Each has specific uses and limits depending on the scope of renovations you can make.

Limited FHA 203(k) Loan

The Limited 203(k) option is commonly used for smaller repairs and cosmetic upgrades. As mentioned, the loan amount will increase to $75,000 in November 2024, an exciting enhancement that will help open the door to renovations for more people. This loan covers non-structural projects such as remodeling kitchen fixtures, replacing flooring, painting, and minor landscaping. Unlike the Standard, the Limited program doesn’t require working with an HUD consultant or have a minimum loan amount.

Common Projects the Limited Covers

- Minor remodeling (i.e. updating kitchens or bathrooms)

- Replacing appliances or flooring

- Repainting or refinishing surfaces

- Energy-efficient improvements (i.e. installing new windows or insulation)

- Repairing roofs and gutters

Standard FHA 203(k) Loan

The Standard FHA 203(k) Renovation loan is more ideal for homes needing larger renovations and structural repairs. These may include adding rooms, replacing outdated plumbing or electrical systems, and fixing major structural issues. It has a minimum of $5,000 that must be used for renovations and the total loan amount must be within the FHA County Loan Limit. Because these projects are typically more complex, you’re required to work with an HUD-approved consultant.

Common Projects the Standard Covers

- Structural repairs or additions (i.e. adding on square footage or fixing foundation issues)

- Major systems replacements (i.e. plumbing, electrical, or HVAC systems)

- Roof repairs or replacements

- Modernization and improvements to the home’s function

- Accessibility improvements for people with disabilities

How Does the FHA 203(k) Renovation Loan Work?

The process for applying for an FHA 203(k) loan is similar to a regular FHA mortgage but comes with a few additional steps. Here’s an overview of how this loan program works.

- Find a property. Whether it’s a home you already own and want to refinance* or one you’re planning to purchase, identify a property that needs renovations.

- Get an appraisal. The home appraisal will assess both the home’s current market value as well as it’s “as-completed” value after the renovations are completed.

- Contractor and Estimates. Work with a licensed contractor to obtain the estimated costs for the repairs and improvements.

- Loan Application. You’ll apply for the loan based on the combined cost of the home and repairs.

- Renovation Timeline. Once the loan is approved, the renovation funds are placed into an escrow account and work begins. The renovation timeline can typically range from six months to one year.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

FHA 203(k) Combined with FHA 203(h) Disaster Relief Loan

Did you know that eligible borrowers affected by federally declared disaster areas may be able to combine the FHA 203(k) renovation loan with the FHA 203(h) disaster relief loan? This means adding the renovation costs into a new mortgage if your home was destroyed and deemed unlivable. Plus, the damaged property is eligible regardless of the age of the home. It only needs to have been a habitable residence prior to the disaster.

Ready to Rebuild?

At Supreme Lending, we understand how important it is to transform a home into one that truly meets your needs. Whether you’re fixing up a new property or renovating your current home, the FHA 203(k) renovation loan offers an excellent way to finance those improvements. We’re proud to offer both Standard and Limited options to fit the scope of your home projects.

Want to learn more about FHA 203(k) renovation loans or other mortgage options? Contact our team at Supreme Lending today and get pre-qualified!

Looking for other renovation loan options? Read more:

by First Integrity Team Supreme Lending | Oct 1, 2024

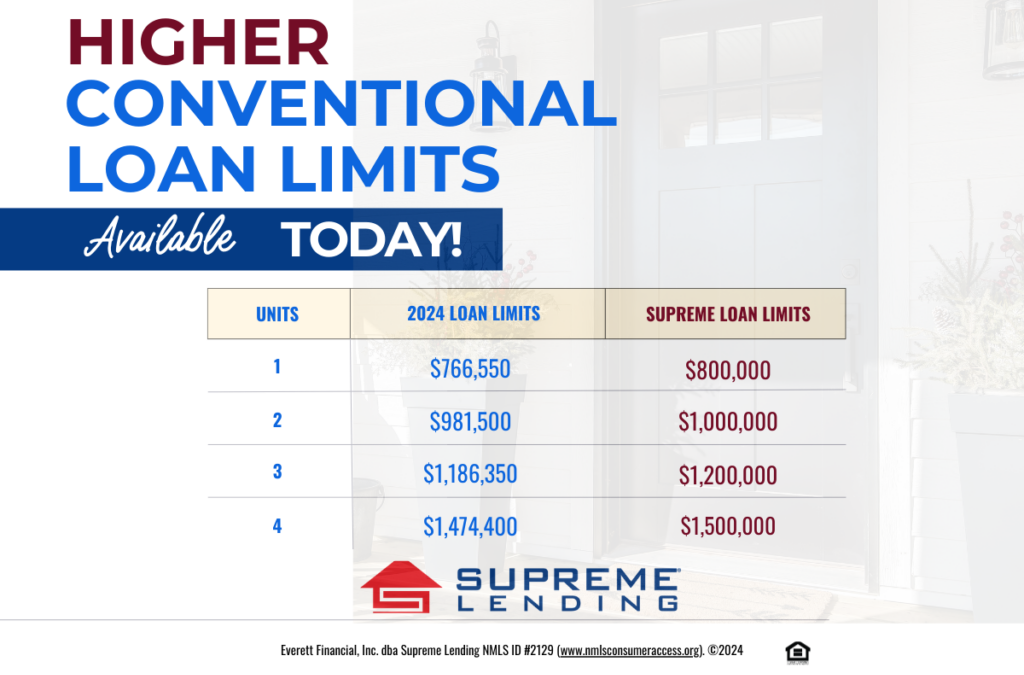

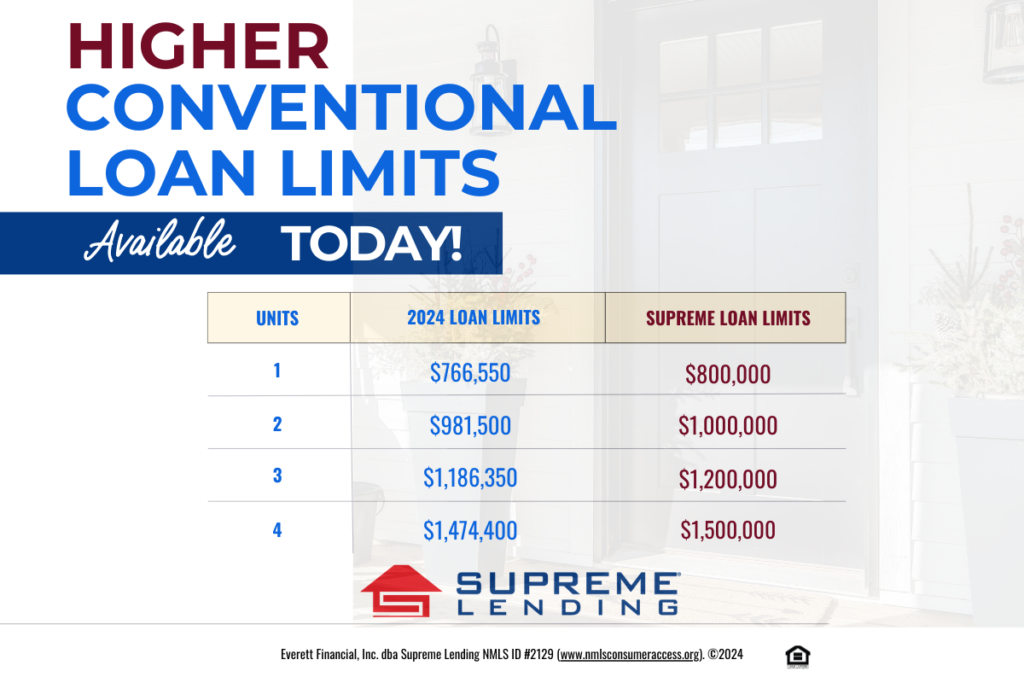

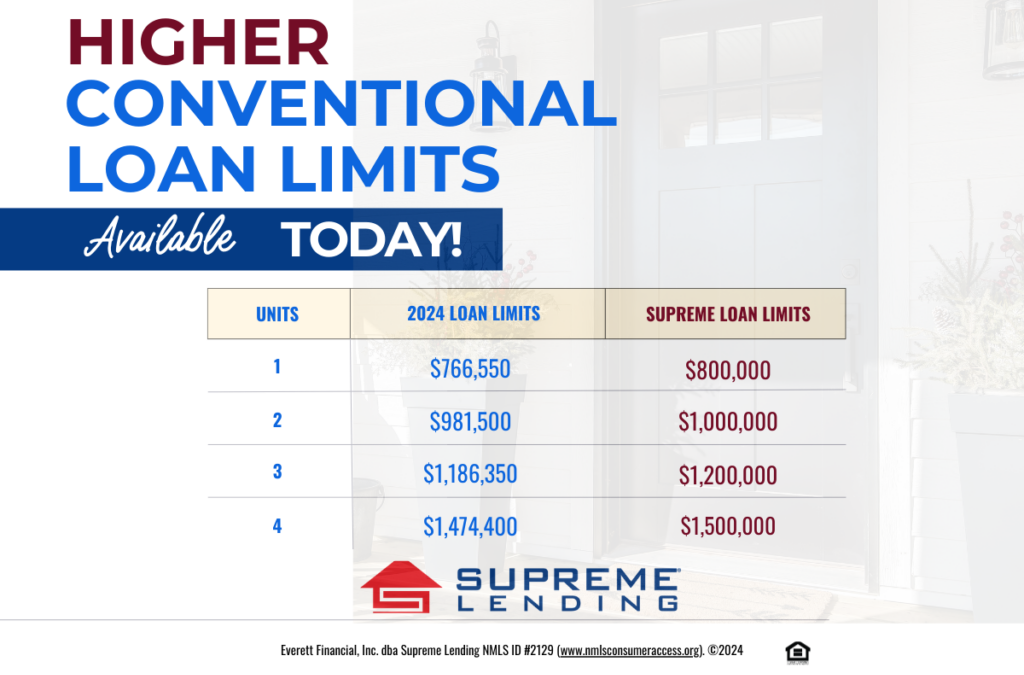

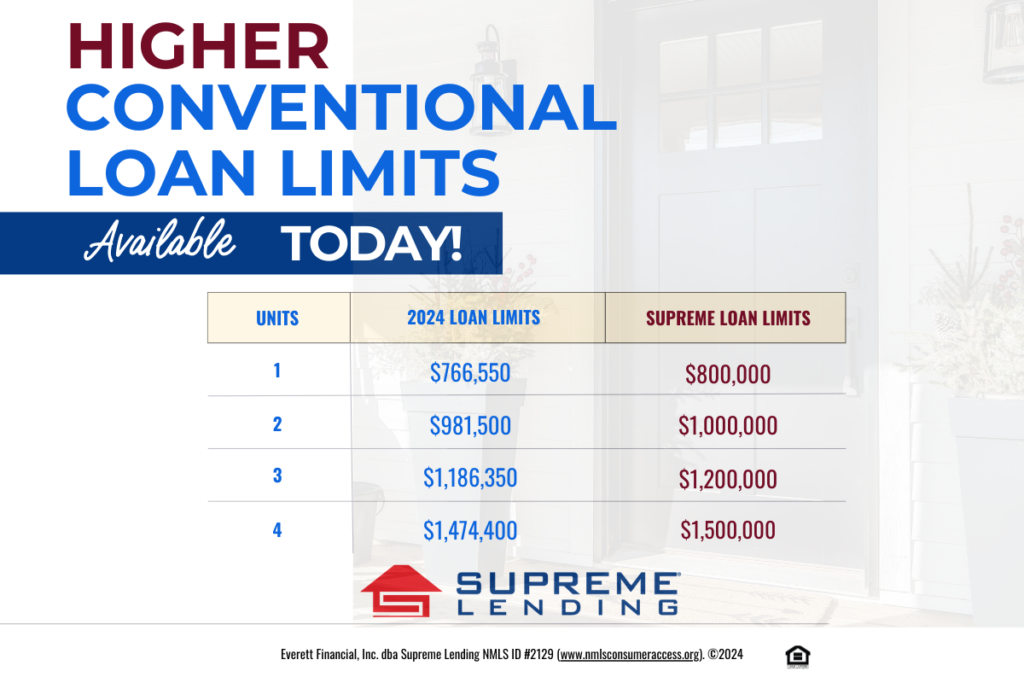

Supreme Lending is proud to announce the conforming 2025 loan limits have increased and, the best part, the company is offering the raised loan limits today. For single unit properties, the conforming limit is now $800,000, up from $766,550.

While Fannie Mae and Freddie Mac will not officially announce the 2025 conventional loan limits until the end of November, we’re pleased to honor these new limits now – empowering more people to achieve homeownership as home prices rise. You may not have to wait until next year to make your homeownership dreams come true!

Supreme Lending 2025 Loan Limits Available Now

- 1-unit property – $800,000

- 2-unit property – $1,000,000

- 3-unit property – $1,200,000

- 4-unit property – $1,500,000

The increase is effective on all new loan applications taken on or after Wednesday, September 25, 2024.

What Are Conforming Loan Limits?

Conforming loan limits set the maximum amount borrowers can finance their home while still qualifying for a conventional loan backed by Fannie Mae or Freddie Mac. Why does this matter? Staying within these limits may result in more favorable terms, including competitive rates, easier qualification standards, and lower down payment requirements.

What Happens When You Exceed Loan Limits?

If you need a loan higher than the conforming limits, you may consider a Jumbo loan. This is a good option for larger home purchases—especially in high-cost housing markets. Jumbo loans can typically require a higher credit score or larger down payment amount.

Ready to Get Started?

The increased conforming 2025 loan limits are designed to keep pace with rising home prices, making homeownership more attainable for borrowers looking to finance higher amounts while still benefiting from conventional loan advantages.

Whether you’re a first-time homebuyer or looking to upgrade, these new limits may open doors to more flexible financing options. If you have any questions or want to see if you qualify for the new, higher loan limits, contact us today to get started! We’re here to help guide you through the loan process every step of the way.

by First Integrity Team Supreme Lending | Sep 30, 2024

Buying a home is a major milestone, and while most prospective buyers are focused on saving for the down payment, there are additional homebuying costs to consider. From closing costs to ongoing home maintenance expenses, it’s important to understand the costs beyond the down payment. Let’s dive into those homebuying costs so you can be well prepared.

Down Payment: The First Major Cost

The down payment is often the largest upfront cost when buying a home. The down payment requirements depend on the type of loan to determine what you may qualify for.

- Conventional loans typically require at least 5% for eligible borrowers. For first-time homebuyers, the minimum requirement can be as low as 3%.

- FHA loans require as little as 3.5% down, making them a popular choice for borrowers looking for more flexible guidelines.

- VA and USDA loans offer no down payment requirement for eligible military veterans, active military, or buyers in defined rural areas.

Plus, there are several down payment assistance programs available to help more people achieve their dream of homeownership. While the down payment is a key part of purchasing a home, it’s not the only cost to keep in mind.

Closing Costs: Hidden Homebuying Fees

Beyond the down payment, closing costs are another significant upfront expense buyers must account for. These are fees and expenses necessary to finalize your home purchase and close the loan. Closing costs typically range from 2% to 6% of the home’s purchase price. Here’s a breakdown of common closing costs:

- Loan origination fee is charged by your lender for processing your mortgage.

- Appraisal fee covers the cost of having your home professionally appraised to determine its market value.

- Home inspection fee is paid to inspect the home for any necessary repairs or safety hazards.

- Title insurance and search fees ensure the property’s title is clear of any disputes or liens.

- Escrow fee is charged by the third party handling the closing process.

- Property taxes and homeowners insurance are typically prepaid for a portion of the costs at closing so they’re included in your mortgage escrow account.

Ongoing Costs of Homeownership

After closing on your mortgage, owning a home comes with ongoing expenses that many new buyers often overlook. These homebuying costs are essential to consider when planning for the long-term.

- Utilities include monthly bills such as electricity, gas, water, and internet. These are widely dependent on the size and location of your home.

- Landscaping and yard maintenance, whether you hire a service or handle it by yourself, keeping up with lawn care, tree trimming, and other outdoor maintenance can add up.

- Homeowners Association (HOA) fees are required when your property is in a community with an HOA. These fees may be monthly or annual and cover community maintenance and amenities.

- Property taxes are ongoing local government taxes based on the assessed value of your home. Property taxes may increase over time, so review your tax bills carefully.

- Homeowners and mortgage insurance are often required. Homeowners insurance helps protect the home in the event of potential damages, while mortgage insurance protects the lender in the event of a loan default.

- Ongoing maintenance and repairs will occur over time, from replacing appliances to fixing the roof or plumbing. It’s smart to set aside funds for common home upkeep expenses to avoid hidden costs surprising you.

What’s Next?

We hope these additional homebuying costs are not so hidden anymore! The journey to homeownership comes with several financial considerations beyond the down payment. By understanding these homebuying costs, you can be prepared to buy with confidence.

If you’re ready to explore your mortgage options, contact Supreme Lending today. We’re here to help guide you through the loan process and beyond.

by First Integrity Team Supreme Lending | Sep 12, 2024

Your Quick Home Appraisal Checklist

When buying or selling a home, it’s important to understand the importance of a home appraisal during the mortgage process. Appraisals determine the value of a property based on various factors, ensuring buyers, sellers, and lenders are aligned on what the home is worth. Knowing what appraisers look for can help ensure a smooth mortgage process and avoid last-minute surprises or delays. Read on for an overview of the appraisal process including a home appraisal checklist for homeowners, buyers, and real estate agents to consider.

What Is an Appraisal?

An appraisal is an independent assessment of a property’s market value led by a licensed appraiser. The value is based on evaluating several aspects of the home, such as the condition, location, and recent sales of comparable properties in the area. The appraisal is an essential step of the mortgage process required by most lenders to verify that they’re not lending more than the home is worth. For buyers, a home appraisal can also offer reassurance that they are paying a fair price.

The Home Appraisal Checklist: What Appraisers Look For

Here’s a quick look at some key elements appraisers may consider when evaluating a property. You can use this guide when searching for a home or preparing to sell.

1. Home Size and Layout

- What is the total square footage and number of bedrooms and bathrooms?

- Is the layout of the rooms and spaces functional.

- Is there a finished basement or attic that adds to the livable space?

2. Exterior Condition

- Roof: Are there any missing shingles, leaks, wear and tear, etc.?

- Foundation: Are there visible cracks or settling issues?

- Siding, windows, and doors: Check for any damage, peeling paint, or outdated fixtures.

- Landscaping: Is it overgrown or neglected?

3. Interior Condition

- Walls, ceilings, and floors: Are there any cracks, stains, or general wear and tear?

- Kitchens and bathrooms: Is there any damage, outdated appliances, or broken equipment? Are there luxury upgrades that may boost the home’s value?

- Plumbing and electrical: Are the systems up-to-code, functional, and safe?

4. Lot Size and Usability

- How large is the lot?

- Is it safe and functional?

5. Upgrades and Amenities

- Are there any recent home improvements, such as a kitchen remodel, energy-efficient updates, or a new roof?

- Are there unique amenities such as a pool, outdoor kitchen, or wine cellar?

6. Safety and Compliance

- Appraisers will check for safety hazards or code violations.

- Factors like missing handrails, faulty wiring, or broken windows can negatively impact the appraisal.

7. Location & Neighborhood

- Appraisers will examine the property’s location, including proximity to schools, parks, shopping centers, and other amenities.

- Neighborhood conditions, crime rates, and overall desirability can also impact the value.

8. Comparable Sales (Comps)

- Appraisers will compare the home to the sales of similar properties in the neighborhood.

- Factors such as home size, condition, and location are considered to provide a rough benchmark.

Preparing a Home for an Appraisal: Tips for Sellers and Agents

Keeping the home appraisal checklist in mind, there are some measures that sellers or listing agents may consider to prepare for an appraisal and potentially maximize a home’s value.

- Make Minor Repairs As Needed. Fix any small but noticeable issues, such as leaky faucets, old paint, stained carpet, and broken hardware. Minor fixes may go a long way in improving a home’s appraisal value.

- Clean and Declutter. A clean, organized home allows the appraiser to focus on the property’s key features rather than clutter. This step can also enhance the home’s overall appearance.

- Highlight Recent Upgrades. If the home has undergone significant improvements, provide the appraiser with a list of updates, including the dates and cost of renovations.

- Provide Easy Access. Make sure that the appraiser can navigate to all areas of the home, including the basement, attic, and other outdoor structures.

Frequently Asked Questions About Appraisals

1. What is the difference between a home appraisal and a home inspection?

A home appraisal determines the market value of the property, which is essential for lenders to approve the loan amount. A home inspection, on the other hand, assesses the condition of the home and identifies any potential issues or repairs that may need to be addressed. While an appraisal focuses on value, an inspection focuses on the home’s livability.

2. What happens if the home appraises for less than the sale price?

If the appraisal comes in lower than the agreed-upon sale price, the buyer and seller may need to renegotiate. The buyer could request the seller to lower the price, or the buyer may need to pay the difference out of pocket.

3. Do you need an appraisal when refinancing?

Yes. When refinancing,* it’s essential to understand the home’s current market value, especially if you’re taking cash out of your home equity. The appraisal also plays a key role in determining the Loan-to-Value ratio, which can affect loan terms, interest rate, and whether private mortgage insurance may be required.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

What’s Next?

A home appraisal is one of the most important steps in the mortgage process. Once the appraisal is complete, the report is submitted to the lender for review. The lender reviews the appraisal report to verify the property’s appraised value aligns with the loan amount. When all loan conditions are met, it’s smooth sailing to closing.

Whether buying, selling, or listing a home, understanding the home appraisal checklist can help make the mortgage process smooth and seamless.

For more information about mortgages and steps of the loan process, contact your local Supreme Lending team today!

Related articles:

by First Integrity Team Supreme Lending | Aug 30, 2024

An Overview of Supreme Lending Credit Score Requirements

When you’re preparing to buy a home, understanding the mortgage credit score requirements is essential. Your credit plays a significant role in determining your eligibility for various loan programs, as well as interest rates you may qualify for. Our goal at Supreme Lending is to provide the smoothest mortgage experience possible, that includes guiding you with transparent information to help you to make an informed, confident decision. Here’s an overview of Supreme Lending’s credit score requirements for common loan programs and frequently asked questions.

Conventional Loans

Conventional loans are popular among homebuyers due to their flexibility and competitive interest rates. As a general rule of thumb, Supreme Lending requires a minimum credit score of 620 for Conventional loans. However, a higher score typically results in securing more favorable rates and terms.

FHA Loans

Insured by the Federal Housing Administration, FHA loans are another common mortgage option –especially for first-time homebuyers or borrowers with lower credit. These loans have more lenient credit score requirements, accepting as low as 580.

VA Loans

For eligible military Veterans and active-duty personnel, VA loans offer affordable options as they don’t require a down payment or mortgage insurance premiums. Like FHA loans, Supreme Lending’s credit score requirement for VA loans is a minimum of 580.

USDA Loans

Guaranteed by the U.S. Department of Agriculture, USDA loans provide affordable financing designed for homebuyers in designated rural areas with no down payment required. In general, Supreme Lending’s credit score requirement for this program is 600.

Jumbo Loans

Jumbo loans are used to purchase high-value properties with a loan amount greater than conforming loan limits, which is $766,550 for one-unit homes in 2024. Due to potential higher lending risk, Jumbo loans typically have stricter qualifications. Supreme Lending has jumbo programs with a minimum credit score of 680, but depending on the loan guidelines, some may require at least a 720 credit score or higher.

Frequently Asked Questions

Now that you have a snapshot of common credit score requirements at Supreme Lending, here’s some more insight on how your credit can impact your mortgage.

How is a credit score determined?

A credit score, often represented by a FICO® score, is a numerical assessment of a borrower’s financial health. It is calculated based on several key factors:

- Payment History: Your record of on-time payments versus late or missed payments.

- Credit Utilization: The amount of credit you’re using compared to your total credit limits.

- Length of Credit History: The duration of time you’ve had credit accounts open.

- Types of Credit in Use. The variety of credit accounts you have, such as credit cards, mortgages, and car loans.

- Recent Credit Behavior. This includes how many new credit accounts you’ve opened recently and credit inquiries.

Combining these factors provides a numerical score to help reflect your creditworthiness.

What qualifies as a generally “good” credit score?

In general, a credit score of 670 to 739 is considered good according to FICO® standards. Scores in this range suggest that you are a responsible borrower with a solid history of managing credit well. 740 or higher is considered very good or exceptional. Remember, a higher the credit score usually results in more favorable mortgage rates and terms.

Additionally, a credit score between 580 and 669 is considered fair. This range aligns with many of the credit score requirements outlined above depending on the loan type. So don’t fall victim to the common mortgage myth that you need perfect credit to qualify for a home loan.

What’s the difference between a soft credit pull and hard credit pull?

When applying for a mortgage, lenders need to pull your credit report. There are two ways to do this:

- A soft credit pull is a credit check that doesn’t affect your credit score. It’s typically used for pre-qualifications or when you check your own credit. Supreme Lending has this option when you get pre-qualified for a mortgage.

- A hard credit pull, on the other hand, occurs when a lender reviews your credit score as a formal credit application during the loan approval process. Hard pulls can temporarily lower your credit score by just a few points. However, there’s no significant impact, which is another mortgage myth to debunk.

Here to Help

Don’t navigate the mortgage process alone! Our experienced and knowledgeable team at Supreme Lending is here to help you understand all aspects of your homebuying journey. From understanding credit score requirements and determining which loan program may work for you to our seamless underwriting process, we help you close your loan with confidence.

Contact us today to get started!

Related articles:

Common Credit Score and Down Payment Requirements by Mortgage Type

FHA Loans vs. Conventional Mortgage: Which One Is Right for You?

by First Integrity Team Supreme Lending | Aug 12, 2024

Unlocking Homeownership With Mortgage Gift Funds

When it comes to purchasing a home, the down payment is often a big hurdle for borrowers, especially first-time homebuyers. However, there may be an opportunity to help make homeownership a reality through mortgage gift funds. If you’re offered gift funds to use toward a home’s down payment or closing costs, it’s important to understand how the process works and what is needed. At Supreme Lending, we’re committed to guiding you through the mortgage process to achieve your dream of owning a home—that includes navigating gift funds.

What Are Mortgage Gift Funds?

Gift funds are sums of money given by family members, friends, or other eligible benefactors that can be used for the down payment or closing costs on a home purchase. These funds are a generous way for loved ones to help you invest in your homeownership journey without any expectation of repayment.

How Do Gift Funds Work?

Using gift funds for a mortgage is straightforward but requires adherence to certain rules to ensure they’re accepted by lenders. Here’s what you need to know:

- Documentation. The donor must provide a gift letter stating the amount of the gift, the relationship to the recipient, and that no repayment of the money is expected or required.

- Source Verification. Lenders will require proof of the donor’s ability to give the gift, often in the form of bank statements.

- Transfer Trail. It’s also crucial to provide documents verifying the transfer of funds from the donor to the borrower to satisfy lender requirements.

Lenders require these factors as confirmation that the gift isn’t in fact a loan, which would impact the borrower’s Loan-to-Value (LTV).

Guidelines for Loan Types

Depending on the type of loan you’re considering, there are specific guidelines to follow when using gift funds. These specify who may be eligible to provide the money and how much.

Conventional Loans

For conventional loans, gift funds may be used for some or all the down payment, closing costs, and financial reserves—as long as it’s from an acceptable source. The gift can be provided by a defined family member, including relatives by blood, marriage, adoption, legal guardianship, or domestic partner. The donor may not be or have an affiliation with the real estate agent, builder, developer, or any other interested party to the transaction.

Gift funds can be used for a primary residence and second home. Investment properties are not eligible. Minimum borrower contributions may apply depending on the down payment amount.

FHA Loans

Insured by the Federal Housing Administration, FHA loans offer a little more flexibility when it comes to mortgage gift funds. Donors can be family and other eligible givers such as a close friend, an employer or labor union, and charitable organization. A governmental agency or public entity that provides down payment assistance programs may also be eligible. However, cousins, nieces, and nephews are not qualified to provide gift funds for FHA.

VA and USDA Loans

While these government-insured loan options do not have down payment requirements, gift funds can still be used to cover closing costs. The gift can be provided by anyone that does not have an affiliation with the transaction. However, gift funds cannot be used to meet reserve requirements for VA and USDA loans.

Advantages of Mortgage Gift Funds

Ultimately, gift funds can help open doors to homeownership if you may not have qualified without the funds for a down payment or closing costs. Potential benefits of receiving gift funds include:

- Lower the financial burden of a down payment

- Improve your Loan-to-Value ratio

- May help you qualify for a more favorable mortgage

- Allow you to maintain savings for other expenses or emergency funds

Down Payment Assistance Alternatives

If you don’t have the option to receive gift funds, there may be other options to consider buying a home with less upfront costs. For example, FHA loans require a lower 3.5% down while VA and USDA loans offer no down payment requirement. For Conventional loans, eligible first-time homebuyers may put down just 3%.

There are also several down payment assistance programs designed to help more people achieve homeownership. Supreme Lending offers the Supreme Dream Down Payment Assistance that offers a fully forgivable second loan to cover the down payment and closing costs. There are also several local, regional, or state-specific programs available to provide aid. Eligibility typically depends on factors such as income, credit score, and location.

Our team at Supreme Lending believes that informed homebuyers make empowered homeowners. Understanding gift funds and alternatives for down payment assistance can help open doors to homeownership that might otherwise seem closed.

Ready to take the next step to buying a home? We’re here to guide you every step of the way. Contact your local branch to get started.