by SupremeLending | Mar 21, 2024

Picture this – you currently own or want to buy a home with good bones, but it needs some TLC. The good news is that you don’t have to handle a home remodel alone. Renovation loans are a great option to help fund home improvements, repairs, and enhancements by rolling the renovation costs into a single mortgage payment. It’s important to understand how renovation or home improvement loans work, types of renovation loan options, and benefits.

What Is a Renovation Loan?

Renovation loans are designed to help borrowers finance home improvement projects that will increase the value of the home. Whether you’re planning a small home makeover or extensive rehab project, a renovation loan combines a traditional purchase or refinance mortgage with the cost of renovations—it is an all-in-one mortgage financing option that covers the upfront costs of large repairs and projects.

Taking on the remodel before moving in can enhance your living space and home functionalities without the pressure of taking out an additional loan or paying out of pocket for costly repairs in the future.

Types of Renovation Loans

When it comes to renovation loans, there are a few options for prospective homebuyers and homeowners to consider based on eligibility, timing, and the scale of the home improvements needed.

FHA 203(k) Renovation

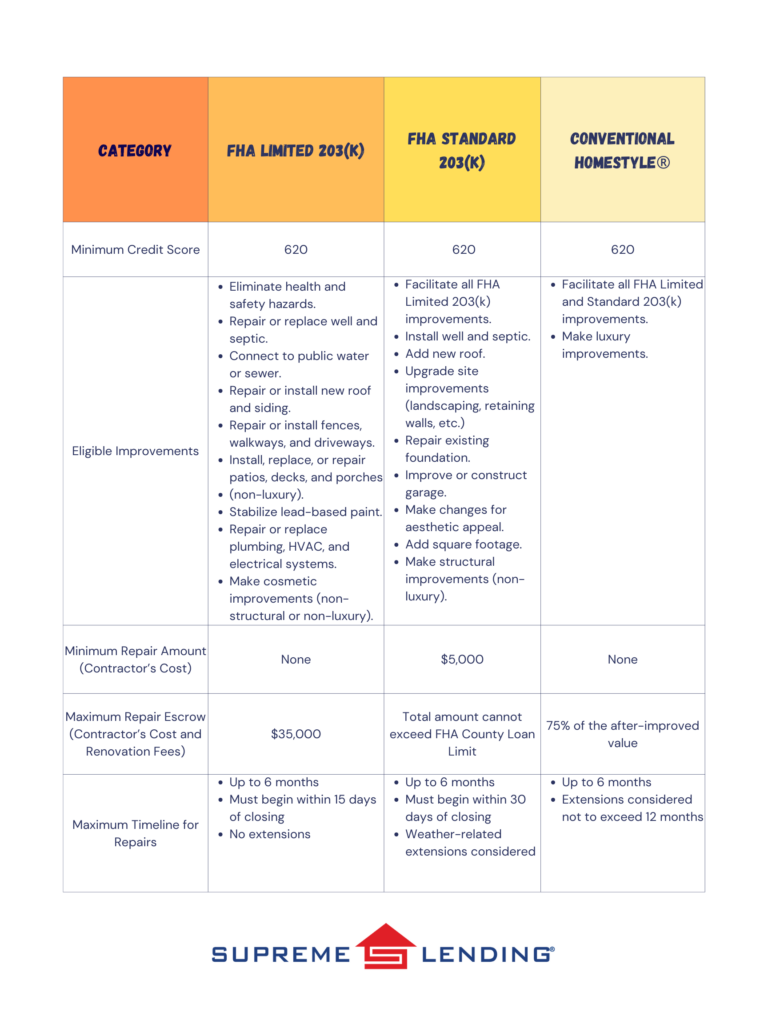

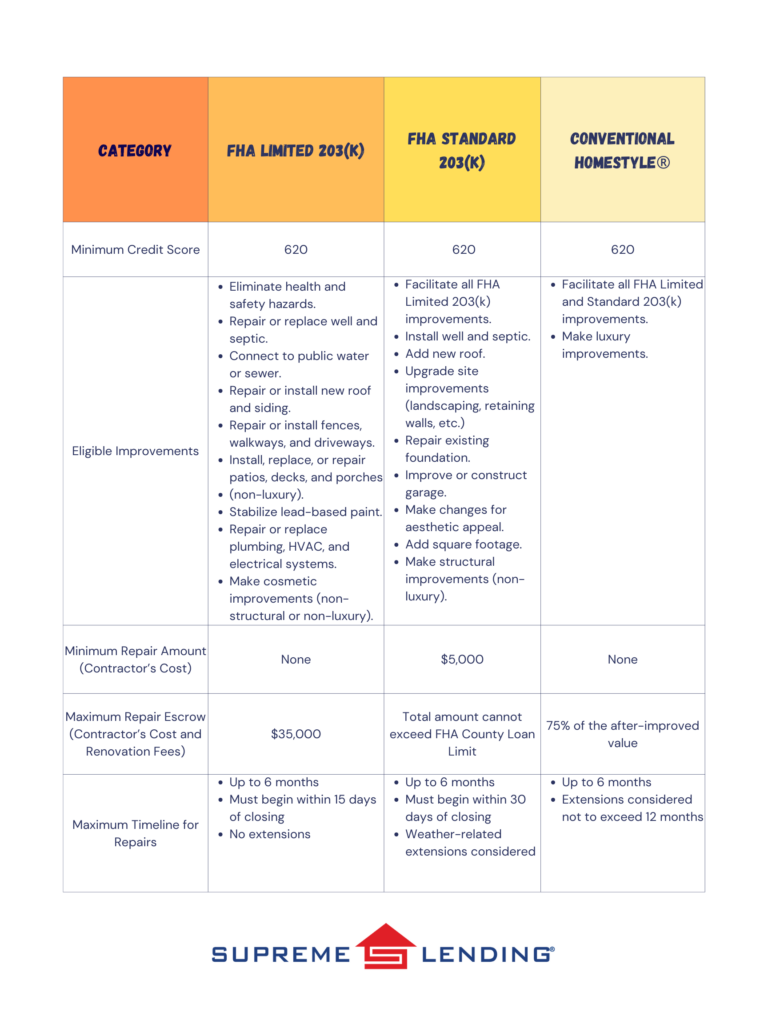

An FHA 203(k) loan, or an FHA rehab loan, is insured by the Federal Housing Administration and provides two options depending on the scope of the home improvement projects, including Limited 203(k) and Standard 203(k), offering different levels of renovation financing.

The minimum down payment for an FHA 203(k) loan is 3.5%. An FHA 203(k) loan covers common basic home improvements and repairs but excludes larger luxury projects and amenities. The Limited option has no minimum renovation amount and can cover up to $35,000 in renovation costs. The Standard has expanded eligible improvements including some structural upgrades and a minimum renovation cost of $5,000. Typically, all renovations must be completed within 6 months.

VA Renovation

The Department of Veterans Affairs (VA) also has a Renovation loan option. A VA Renovation loan offers 100% financing for eligible U.S. Veterans or military personnel to cover a mortgage combined with planned renovation costs into a single loan. Eligible home improvements are similar to FHA 203(k) to cover common upgrades that will make the property safer, healthier, or more functional, excluding luxury projects. VA Renovation loans can finance up to $50,000 in home repair costs.

Conventional Renovation

A Conventional Renovation loan, such as Fannie Mae’s HomeStyle® program, is another financing option that rolls the costs of home renovation projects into a single mortgage and offers more flexibility than a government loan. Conventional Renovation mortgages can cover larger, luxury upgrades, such as creating a high-end bathroom or kitchen with decorative tilework or adding a sparkling backyard pool. The maximum home repair amount is 75% of the home’s post-construction appraised value.

More Benefits of Renovation Loans and Remodeling

- Expand Your Home Search. Prospective homebuyers may have a broader range of properties to choose from, including fixer-uppers, knowing that they could finance custom home upgrades or needed repairs with a Renovation loan.

- Save on Upfront Costs. Home renovation projects can be costly. Funding home remodeling projects with your mortgage could help keep you from tapping into your personal savings and avoid hefty upfront repair costs.

- Grow Your Home Value. Renovation loans are intended to increase the value of your home, which may result in a smart, long-term investment and the potential to build more equity.

- Personalize Your Dream Home. Renovation loans offer an affordable option to help make your design visions come to life and beautify your home to fit your character.

- Enhance Comfort and Livability. Whether it’s expanding a kitchen, adding a bathroom, or creating a home office space, upgrading your home can add modern conveniences and improve your overall well-being.

If you’re looking to enhance your living spaces and potentially increase your property value, a Renovation loan could be the answer to creating the home of your dreams. To learn more about renovation financing or other mortgages, contact your local Supreme Lending branch today.

Related Articles:

by SupremeLending | Mar 13, 2024

The decision to refinance* your mortgage is a strategic move that can have a profound impact on your financial well-being. There are several types of situations when refinancing might provide specific benefits and unlock potential savings. It’s important that homeowners have a clear idea of the possible outcomes when considering a refinance. Let’s dive into a few of the most common reasons people may refinance, some of which may apply to your situation.

Getting a More Favorable Mortgage Rate

A key reason that homeowners refinance is to get a more favorable mortgage interest rate. This can be done by either securing a lower interest rate than your current mortgage or by switching from an adjustable-rate mortgage (ARM) to a fixed-rate loan. In both cases, this may lead to significant savings over the life of the loan and may even reduce the monthly mortgage payments.

When mortgage interest rates drop lower than your current loan, it’s important to note that there are several additional considerations to be aware of, including fees and upfront costs associated with refinancing as well as the amount of time left on your current loan. Working with a trusted lender that provides personalized, transparent refinancing details and costs will help you make an informed decision for your mortgage needs.

Changing the Terms of Your Loan

Another common reason people refinance is to change the terms of their loan. This may involve extending the length of the loan to lower monthly payments or shortening the loan term to pay off the mortgage quicker. Refinancing to a shorter-term loan may increase your monthly mortgage payment, so it’s important to consider your budget before making this decision.

Switching Loan Type

Some homeowners may refinance to opt for another loan type, for example moving from an ARM to a fixed-rate mortgage. Interest rates—and subsequently monthly mortgage payments—for an ARM can increase or decrease based on market conditions, so borrowers may be more comfortable switching to a fixed-rate mortgage that has a steady interest rate and monthly payment that won’t change.

Another scenario could be borrowers wanting to change from a government loan, such as FHA or VA, to a Conventional mortgage. This could be an effective way to save on some loan costs by removing required fees typically associated with government loans.

Removing a Co-Signer

If you required a co-signer to qualify for a mortgage, you may be able to remove them from the loan by refinancing after improving your eligibility to qualify for a loan by yourself. Not only does this free up the co-signer from their financial obligation, but it may also help you qualify for a lower interest rate on your loan, especially if your credit score improves when the co-signer is removed. This could lead to more favorable loan terms. Homeowners may also want to remove a co-signer in the event of a divorce resulting in one spouse assuming sole ownership of the home and full responsibility for the mortgage.

Removing Private Mortgage Insurance or Mortgage Insurance Premium

For those who put down less than 20% down payment for a home, a common requirement is carrying private mortgage insurance or PMI. This protects the lender in case the borrower defaults on the loan, but it also means an additional monthly cost that can add up over time.

With Conventional mortgages, you don’t have to always refinance to remove PMI. It can be removed after you’ve reached a certain equity threshold in the home—usually 20%. However, some mortgage programs, like FHA loans, require a Mortgage Insurance Premium (MIP) for the life of the loan. An FHA borrower would need to refinance to a Conventional mortgage to remove the MIP cost.

Cashing Out Equity

Finally, another popular way homeowners utilize refinancing is to cash out the equity that’s built up in the home. If you refinance an amount greater than what you owe on your home, you can receive the difference in a cash payment to be used as you wish. For example, you may use this cash to fund home improvements, pay off high-interest debts, or for other large expenses. How you use the cash is up to you.

It’s important to remember that cashing out equity will increase the amount you owe on your home and may also lead to a higher interest rate—factors that should not be overlooked.

As you can see, there are a variety of reasons why homeowners may choose to refinance their mortgage. It’s important to carefully consider your individual circumstances and financial goals before making a decision, as refinancing may not be right for everyone.

For more information on reasons to refinance, or to learn more about any of our mortgage programs and services, reach out to your local Supreme Lending team or contact us today.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | Feb 20, 2024

When it comes to buying a home, which could be one of the biggest investments you make, it’s important to understand your financing options. While a Conventional loan is more traditional, FHA loans have seen a rise in popularity due to more flexible guidelines. Let’s dive into a few of the FHA loan benefits and features for homebuyers to consider when choosing a mortgage.

What is an FHA loan?

The Federal Housing Administration (FHA) knows the tremendous value homeownership can bring to people’s lives and communities, which is why it was founded in 1934 to boost home sales and the economy. The government organization offers special mortgage insurance to lenders as an option to help more people who may not qualify for a Conventional or other type of home loan, qualify through an FHA loan.

When applying for a home loan, an FHA loan may be a practical option, especially if you:

- Are a first-time homebuyer.

- Have a lower credit score.

- Want a lower down payment.

- Are refinancing a high-cost mortgage.

FHA loan benefits and features include:

- Low down payment requirements with a minimum of 3.5%. Mortgage insurance is required.

- Credit scores as low as 580 may be accepted.

- Gift funds can be used for 100% of the down payment or closing costs.

- Fixed-rate and adjustable-rate mortgage options are available.

- Flexible qualification guidelines.

Now you might be asking, what properties are eligible for FHA loans? In addition to single family homes, FHA loans could also finance other qualified properties, such as 2- to 4-unit complexes and condos. Properties with an FHA loan will require an FHA appraisal to ensure the living space is safe and meets proper standards.

FHA loans could be a great option as a steppingstone into homeownership. Could these FHA loan benefits match your mortgage needs?

If you’re ready to see if an FHA loan or other home loan program is right for you, Supreme Lending is ready to help. Contact us to get started today!

by SupremeLending | Feb 12, 2024

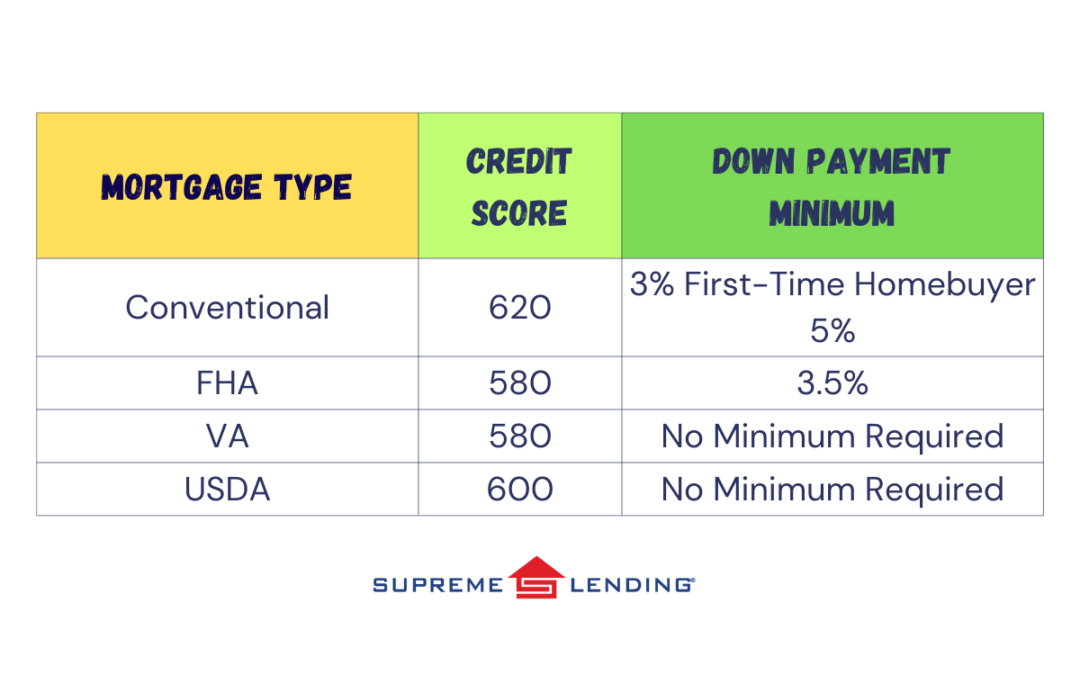

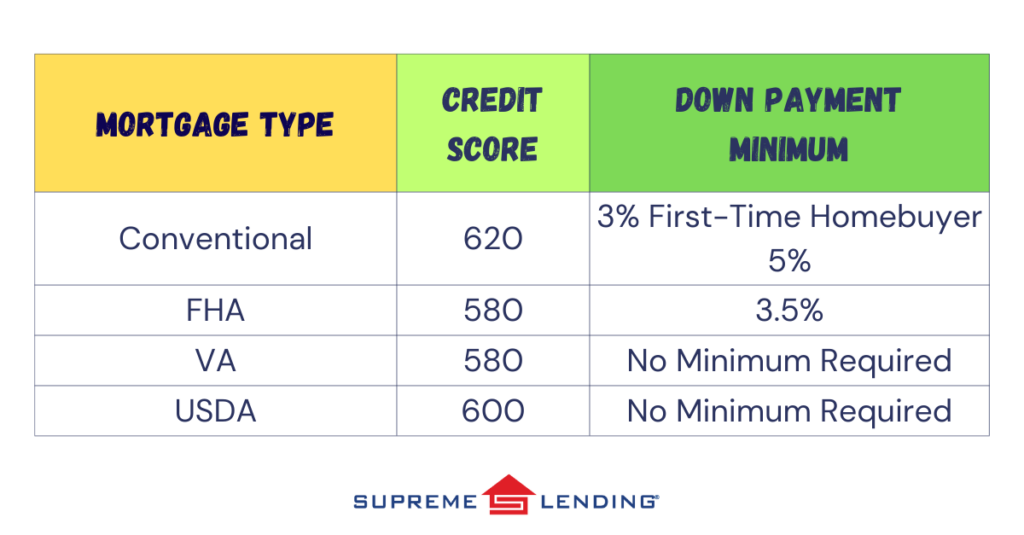

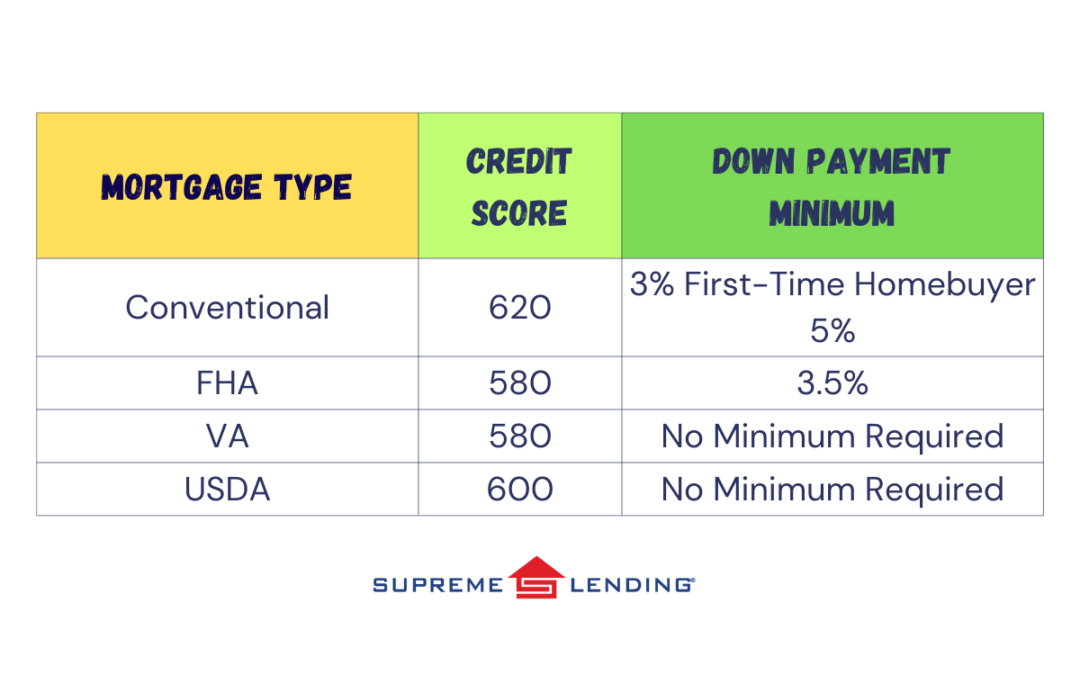

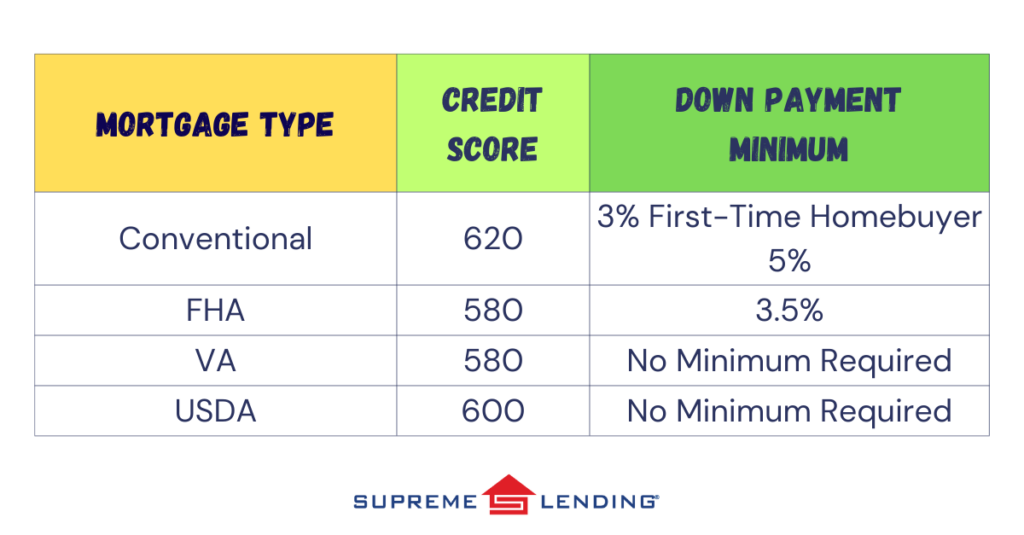

For aspiring homeowners and first-time buyers, many questions can arise about the mortgage process. What credit score do you need to qualify? How much down payment is required? Answers are based on several factors including the property, purchase price, and, most importantly, the mortgage type.

Here’s a breakdown to simplify the numbers and help you understand what you need to open the door to your dream home depending on common mortgage types:

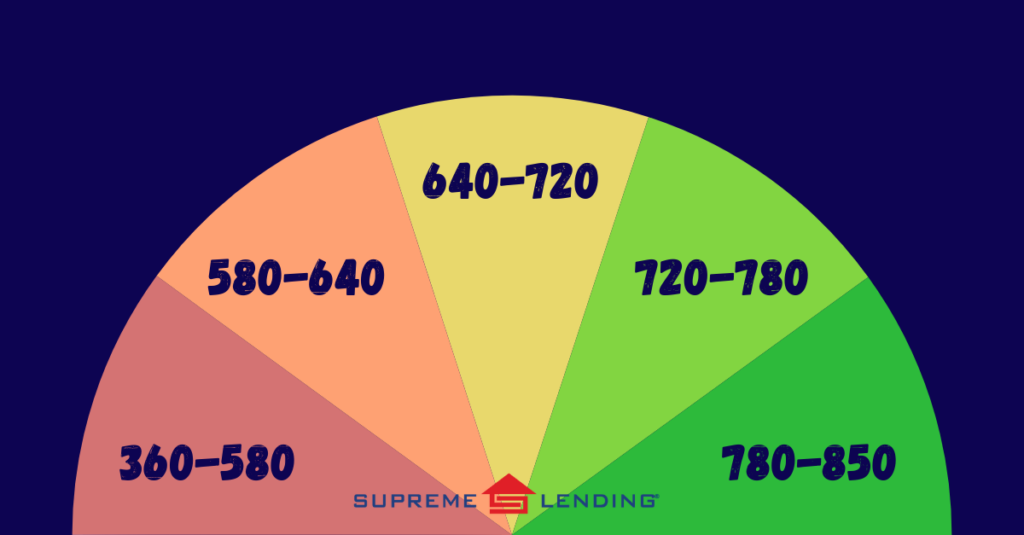

What Is a Credit Score?

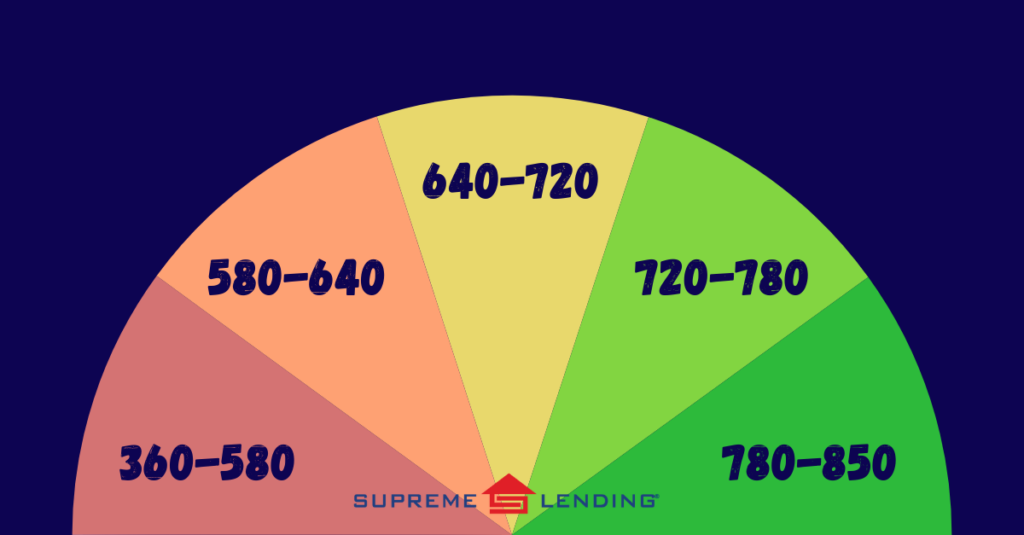

Commonly determined by FICO® score, credit scores are calculated using the borrower’s financial background information such as payment history, credit utilization, length of credit history, types of credit in use, and recent credit behavior. The average credit score in the United States in 2023 was 715, according to Experian data.

Down Payment Assistance Options

If a homebuyer doesn’t have the required minimum down payment or would like to access more financing, Supreme Lending offers several down payment assistance options for qualified buyers. This can also help first-time buyers open the door to homeownership. Guidelines and eligibility vary depending on the program. For example, the Supreme Dream program offers down payment assistance in the form of a fully forgivable second loan and requires a minimum credit score of 620. Ask your Supreme Lending Loan Officer about qualified assistance programs.

Understanding credit score and down payment requirements for different types of mortgages is crucial for prospective homebuyers. While each loan type has its own guidelines, maintaining a good credit score and having sufficient funds for upfront costs at closing remains a common denominator for securing favorable terms and interest rates. By proactively managing your credit and staying informed about your options, you can navigate the mortgage process with confidence on your journey to homeownership.

Contact your local Supreme Lending branch to get pre-qualified and learn about your home financing options.