by SupremeLending | Jun 10, 2024

When it comes to financing your new home, choosing the right mortgage is so important – FHA loans, Conventional mortgages, down payment assistance – there are several options to choose from. Each loan program has its own set of guidelines, benefits, and considerations. Comparing loan types can help you make an informed decision of what may fit your needs and homeownership goals. Let’s examine the difference between these two popular options: FHA loans and Conventional mortgages.

What Is an FHA Loan?

FHA loans are mortgages insured by the U.S. government’s Federal Housing Administration (FHA) against borrower default. They are designed to help more people who may not qualify for Conventional loans achieve homeownership. Here are some key benefits of FHA loans:

- Lower Credit Score Requirements. FHA loans typically require a minimum credit score of 580, which is lower than Conventional loans.

- Low Down Payment. One of the most attractive highlights of FHA loans is the low down payment requirement. Qualified borrowers can put down as little as 3.5% of the purchase price, plus there may be options to include down payment assistance.

- Flexible Debt-to-Income (DTI) Ratio. FHA loans allow higher DTI ratios, making it more feasible for borrowers with existing debt to qualify.

- Assumable Loans. FHA loans are assumable, meaning if you sell your home, the buyer can take over your existing FHA loan. This could potentially help save buyers money on closing costs and interest.

- More Lenient Qualification Requirements. In general, the qualification criteria for FHA loans is more moderate compared to Conventional loans. This helps a broader range of borrowers become homeowners.

What Are Conventional Loans?

Conventional mortgages are loans not insured or guaranteed by any government agency unlike FHA. They are offered by private lenders. Borrowers typically need to have a higher credit score and lower DTI ratio.

- Lower Mortgage Insurance Costs. While FHA requires mortgage insurance premiums (MIP) for the life of the loan, Conventional loans typically only require private mortgage insurance (PMI) until the borrower buys down 20% of the mortgage.

- Higher Loan Limits. Conventional loan borrowers can generally qualify for higher loan limits compared to FHA. This can help borrowers purchase more expensive homes.

- Variety of Loan Terms. Conventional mortgages offer a wide range of loan terms and options, including fixed-rate and adjustable-rate mortgages (ARMs), providing more flexibility.

- Potential for Lower Interest Rates. Borrowers with higher credit scores and larger down payments can often secure lower interest rates with Conventional loans than FHA.

- Conforming & Non-Conforming Options. Conforming conventional loans meet the guidelines of government-sponsored enterprises (GSE), such as Fannie Mae and Freddie Mac. While non-conforming loans do not and can have higher loan amounts, including Jumbo loans.

Frequently Asked Questions About FHA vs. Conventional Loans

Which loan is better suited for first-time homebuyers?

FHA loans are often a great option for first-time buyers due to their lower credit score and down payment options. They provide a pathway to homeownership for those who may not initially qualify for a Conventional loan.

Can I refinance* my FHA loan into a Conventional mortgage?

Yes! Borrowers can refinance an FHA loan into a Conventional one. This could potentially eliminate the FHA’s mortgage insurance requirement if you have enough equity in the home and lead to more flexible terms.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

Are there income limits for FHA or Conventional?

FHA mortgages don’t have income limits, but they may have loan limits based on the location of the property. Conventional loans don’t have income limits either, however higher income and a better credit profile can help you qualify for a larger loan amount.

How do I decide which loan is right for me?

Take into concentration your credit score, funds you have for down payment and closing costs, and long-term goals. FHA can be ideal for those with lower credit scores, while Conventional loans may be better suited for borrowers with stronger credit profiles. Getting pre-qualified with Supreme Lending can help give you estimated costs for each option.

Whether you opt for an FHA loan or a Conventional, both options provide pathways to owning your dream home. It’s important to review your current situation, consider the benefits of different loan types, and work with a knowledgeable loan officer to help guide you through the mortgage process.

At Supreme Lending, we’re committed to helping you navigate the homebuying process with ease. Contact your local branch to get started today!

by SupremeLending | May 7, 2024

As the weather heats up, it may be the perfect time to consider the possibilities of buying a vacation home or second property. A vacation home can be for more than just a getaway, it’s an investment in relaxation, adventure, and cherished memories. But before you start packing for your own dream retreat, there are several things to consider when buying a vacation home – especially if it will be your second mortgage. Here are some helpful tips and considerations to get started on your journey to buying a vacation home:

Evaluate Your Financial Capacity

Buying a vacation home is a significant financial commitment, so it’s crucial to evaluate your finances and current capacity to take on another mortgage. Consider factors such as your income, existing debts, and credit score. It’s important to determine how much you could comfortably afford for a down payment, a second monthly mortgage payment, property taxes, insurance costs, and Homeowners Association (HOA) fees if applicable. Getting a mortgage pre-qualification or pre-approval can help provide an estimate of potential home financing costs you’re able to cover.

Understand Mortgage Requirements

Mortgage requirements for buying a vacation home can differ than a primary residence. Lenders may have stricter criteria for second homes, including higher down payment requirements and interest rates. Work with experienced mortgage professionals, like the team at Supreme Lending, to help guide you through your vacation home financing process.

Explore Home Loan Options

There are several types of loan programs to be aware of when purchasing a vacation home. Conventional, FHA, VA, or jumbo loans are common options. Depending on the property type, there are also more alternative financing to consider, such as warrantable and non-warrantable condo loans or Debt Service Coverage Ratio (DSCR) if the property will generate rental income.

Factor in Additional Costs

Owning a vacation home comes with more costs beyond the mortgage payments. Consider how much it will cost to adequately furnish the property and any appliances you may need. There are also monthly utilities and on-going maintenance and repairs to keep in mind. If your vacation home has a lush yard or sparkling pool, lawn and pool services may be needed as well.

Choose the Right Location

Location, location, location! It’s key when buying the vacation home of your dreams. Research desired destinations and convenient neighborhoods. Consider factors such as proximity to amenities, attractions, and outdoor activities you may enjoy. Whether it’s your tropical beach escape, serene cabin in the mountains, or high-rise in a popular city, planning a strategic location could help determine how you use the property and influence potential rental income.

Discover Rental Opportunities

If you’re considering renting out your vacation home when you’re not using it, research the rental potential in the area. Look into rental demand, occupancy rates, rental prices, and any possible local regulations or restrictions on short-term rentals. Working with a property management company can help streamline the rental process and maximize rental income.

Plan for Property Management

Owning a vacation home requires ongoing maintenance and management, even when you’re not there. Consider how you’ll handle tasks such as landscaping, cleaning, repairs, and security. If you’re not able to manage these responsibilities yourself, you could budget for hiring a property management company to handle them on your behalf.

Consult with Experts

Navigating the process of buying a vacation home can be complex, so don’t hesitate to seek guidance from local real estate agents who know your preferred location, an experienced mortgage lender like Supreme Lending, and other financial advisors or legal professionals. They can provide valuable insights and expertise to help you make informed decisions and avoid potential pitfalls along the way.

Enjoy the Benefits

Despite the considerations and added responsibilities involved, buying a vacation home can be incredibly rewarding. It provides a place to escape, relax, and create lasting memories with family and friends. With careful planning and the right guidance, buying and owning a vacation home can be the key to unlocking your own personal paradise.

While owning a vacation home is an exciting opportunity, it’s essential to approach the process thoroughly and strategically. The team at Supreme Lending is ready to help make your dream of buying a vacation home a reality – your paradise awaits!

by SupremeLending | Mar 21, 2024

Picture this – you currently own or want to buy a home with good bones, but it needs some TLC. The good news is that you don’t have to handle a home remodel alone. Renovation loans are a great option to help fund home improvements, repairs, and enhancements by rolling the renovation costs into a single mortgage payment. It’s important to understand how renovation or home improvement loans work, types of renovation loan options, and benefits.

What Is a Renovation Loan?

Renovation loans are designed to help borrowers finance home improvement projects that will increase the value of the home. Whether you’re planning a small home makeover or extensive rehab project, a renovation loan combines a traditional purchase or refinance mortgage with the cost of renovations—it is an all-in-one mortgage financing option that covers the upfront costs of large repairs and projects.

Taking on the remodel before moving in can enhance your living space and home functionalities without the pressure of taking out an additional loan or paying out of pocket for costly repairs in the future.

Types of Renovation Loans

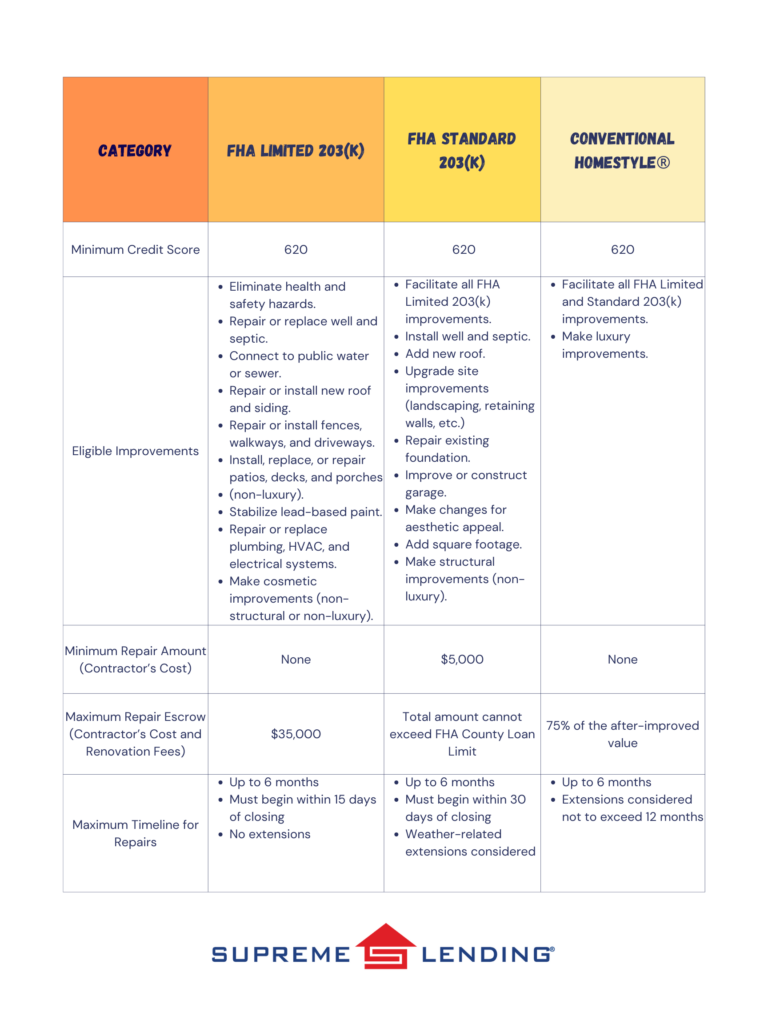

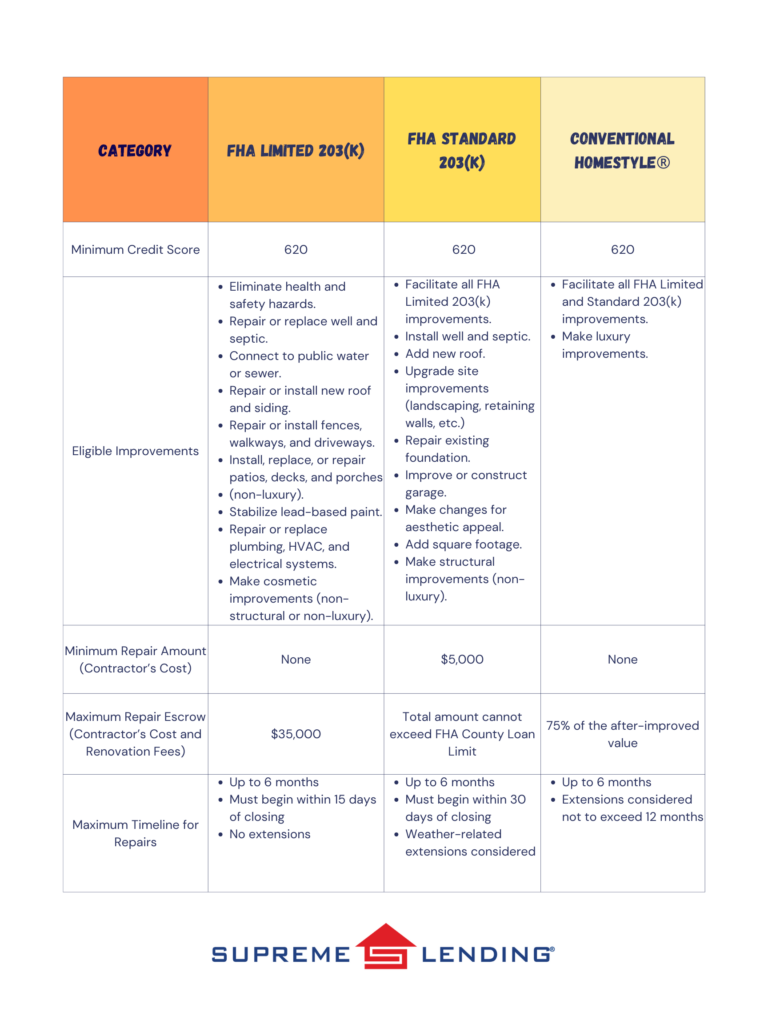

When it comes to renovation loans, there are a few options for prospective homebuyers and homeowners to consider based on eligibility, timing, and the scale of the home improvements needed.

FHA 203(k) Renovation

An FHA 203(k) loan, or an FHA rehab loan, is insured by the Federal Housing Administration and provides two options depending on the scope of the home improvement projects, including Limited 203(k) and Standard 203(k), offering different levels of renovation financing.

The minimum down payment for an FHA 203(k) loan is 3.5%. An FHA 203(k) loan covers common basic home improvements and repairs but excludes larger luxury projects and amenities. The Limited option has no minimum renovation amount and can cover up to $35,000 in renovation costs. The Standard has expanded eligible improvements including some structural upgrades and a minimum renovation cost of $5,000. Typically, all renovations must be completed within 6 months.

VA Renovation

The Department of Veterans Affairs (VA) also has a Renovation loan option. A VA Renovation loan offers 100% financing for eligible U.S. Veterans or military personnel to cover a mortgage combined with planned renovation costs into a single loan. Eligible home improvements are similar to FHA 203(k) to cover common upgrades that will make the property safer, healthier, or more functional, excluding luxury projects. VA Renovation loans can finance up to $50,000 in home repair costs.

Conventional Renovation

A Conventional Renovation loan, such as Fannie Mae’s HomeStyle® program, is another financing option that rolls the costs of home renovation projects into a single mortgage and offers more flexibility than a government loan. Conventional Renovation mortgages can cover larger, luxury upgrades, such as creating a high-end bathroom or kitchen with decorative tilework or adding a sparkling backyard pool. The maximum home repair amount is 75% of the home’s post-construction appraised value.

More Benefits of Renovation Loans and Remodeling

- Expand Your Home Search. Prospective homebuyers may have a broader range of properties to choose from, including fixer-uppers, knowing that they could finance custom home upgrades or needed repairs with a Renovation loan.

- Save on Upfront Costs. Home renovation projects can be costly. Funding home remodeling projects with your mortgage could help keep you from tapping into your personal savings and avoid hefty upfront repair costs.

- Grow Your Home Value. Renovation loans are intended to increase the value of your home, which may result in a smart, long-term investment and the potential to build more equity.

- Personalize Your Dream Home. Renovation loans offer an affordable option to help make your design visions come to life and beautify your home to fit your character.

- Enhance Comfort and Livability. Whether it’s expanding a kitchen, adding a bathroom, or creating a home office space, upgrading your home can add modern conveniences and improve your overall well-being.

If you’re looking to enhance your living spaces and potentially increase your property value, a Renovation loan could be the answer to creating the home of your dreams. To learn more about renovation financing or other mortgages, contact your local Supreme Lending branch today.

Related Articles:

by SupremeLending | Mar 13, 2024

The decision to refinance* your mortgage is a strategic move that can have a profound impact on your financial well-being. There are several types of situations when refinancing might provide specific benefits and unlock potential savings. It’s important that homeowners have a clear idea of the possible outcomes when considering a refinance. Let’s dive into a few of the most common reasons people may refinance, some of which may apply to your situation.

Getting a More Favorable Mortgage Rate

A key reason that homeowners refinance is to get a more favorable mortgage interest rate. This can be done by either securing a lower interest rate than your current mortgage or by switching from an adjustable-rate mortgage (ARM) to a fixed-rate loan. In both cases, this may lead to significant savings over the life of the loan and may even reduce the monthly mortgage payments.

When mortgage interest rates drop lower than your current loan, it’s important to note that there are several additional considerations to be aware of, including fees and upfront costs associated with refinancing as well as the amount of time left on your current loan. Working with a trusted lender that provides personalized, transparent refinancing details and costs will help you make an informed decision for your mortgage needs.

Changing the Terms of Your Loan

Another common reason people refinance is to change the terms of their loan. This may involve extending the length of the loan to lower monthly payments or shortening the loan term to pay off the mortgage quicker. Refinancing to a shorter-term loan may increase your monthly mortgage payment, so it’s important to consider your budget before making this decision.

Switching Loan Type

Some homeowners may refinance to opt for another loan type, for example moving from an ARM to a fixed-rate mortgage. Interest rates—and subsequently monthly mortgage payments—for an ARM can increase or decrease based on market conditions, so borrowers may be more comfortable switching to a fixed-rate mortgage that has a steady interest rate and monthly payment that won’t change.

Another scenario could be borrowers wanting to change from a government loan, such as FHA or VA, to a Conventional mortgage. This could be an effective way to save on some loan costs by removing required fees typically associated with government loans.

Removing a Co-Signer

If you required a co-signer to qualify for a mortgage, you may be able to remove them from the loan by refinancing after improving your eligibility to qualify for a loan by yourself. Not only does this free up the co-signer from their financial obligation, but it may also help you qualify for a lower interest rate on your loan, especially if your credit score improves when the co-signer is removed. This could lead to more favorable loan terms. Homeowners may also want to remove a co-signer in the event of a divorce resulting in one spouse assuming sole ownership of the home and full responsibility for the mortgage.

Removing Private Mortgage Insurance or Mortgage Insurance Premium

For those who put down less than 20% down payment for a home, a common requirement is carrying private mortgage insurance or PMI. This protects the lender in case the borrower defaults on the loan, but it also means an additional monthly cost that can add up over time.

With Conventional mortgages, you don’t have to always refinance to remove PMI. It can be removed after you’ve reached a certain equity threshold in the home—usually 20%. However, some mortgage programs, like FHA loans, require a Mortgage Insurance Premium (MIP) for the life of the loan. An FHA borrower would need to refinance to a Conventional mortgage to remove the MIP cost.

Cashing Out Equity

Finally, another popular way homeowners utilize refinancing is to cash out the equity that’s built up in the home. If you refinance an amount greater than what you owe on your home, you can receive the difference in a cash payment to be used as you wish. For example, you may use this cash to fund home improvements, pay off high-interest debts, or for other large expenses. How you use the cash is up to you.

It’s important to remember that cashing out equity will increase the amount you owe on your home and may also lead to a higher interest rate—factors that should not be overlooked.

As you can see, there are a variety of reasons why homeowners may choose to refinance their mortgage. It’s important to carefully consider your individual circumstances and financial goals before making a decision, as refinancing may not be right for everyone.

For more information on reasons to refinance, or to learn more about any of our mortgage programs and services, reach out to your local Supreme Lending team or contact us today.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.