by SupremeLending | Apr 12, 2024

As anyone who has been through the homebuying process can tell you, there are several important documents that are typically involved. One of the single most vital, and one that all homebuyers will deal with eventually, is known as the mortgage closing disclosure.

While closing on your loan can be the most exciting step in the homebuying process, it’s important to carefully, completely review and understand what you’re agreeing to at the closing table—that’s where the official closing disclosure comes in to provide a transparent summary of all loan details. What is involved in a closing disclosure, when will it typically be sent to you, and why does it matter? Here’s everything you need to know about this important document.

Mortgage Closing Disclosure Basics

When we talk about the closing disclosure, we’re referring to a single document that lays out all the final terms and numbers associated with your mortgage so there are no surprises at the closing table, and you can close with confidence and clarity.

The closing disclosure is typically five pages in length, and includes the following details:

- Loan terms. This is where you’ll find specific information about the interest rate, monthly payments, and other important conditions of your loan agreement.

- Projected payments. Here, you’ll see a breakdown of all the different types of payments that you’ll be responsible for making over the life of the loan. This will include your principal and interest payments, as well as any taxes, insurance, or other fees that are required.

- Closing costs. All the different costs associated with acquiring and closing on your home loan will be itemized here. This can include fees for things like the appraisal, title insurance, or other third-party services.

- Transaction summary. For your reference, this section will provide a summary of all the different financial transactions that are taking place as part of your mortgage. This can include your down payment amount, as well as the total loan amount and any credits that may be applied.

- Other information. The closing disclosure may also include other helpful details about your loan, such as information about escrow accounts or potential prepayment penalties.

Timing of the Closing Disclosure

It’s required that lenders provide you with your closing disclosure no later than three days before your scheduled loan closing date. This is designed to give you sufficient time to review the document ahead of time and raise any questions or concerns that you may have. In practice, most lenders will provide the closing disclosure much earlier than this – often at least a week in advance, if not more.

Why Does the Mortgage Closing Disclosure Matter?

By now you can probably see why the closing disclosure is so important. It’s critical to review this document thoroughly before you close on your loan. This is your last chance to catch any errors or discrepancies in the loan terms or other information that’s been provided. If something doesn’t look right, be sure to bring it up with your loan officer so that it can be corrected quickly and to avoid any delays to your mortgage closing.

Even seemingly minor errors like a misspelled name or an incorrect address can cause major problems down the road. It’s always better to be safe than sorry, so take the time to review your closing disclosure carefully before you sign on the dotted line.

The closing disclosure is also key because it provides you with a clear understanding of what you’re agreeing to when you close on your loan. There’s no such thing as a “standard” mortgage, and loan terms can vary widely from one lender or loan program to the next. By reviewing your closing disclosure, you can be sure that you’re getting the loan that you agreed to, with the terms and conditions that you expected.

How to Check the Closing Disclosure

Once you receive your closing disclosure ahead of your mortgage closing date, it should immediately become one of your top priorities. As noted above, it’s crucial to ensure the details of your loan are accurate, and that all parties involved in the transaction have the proper information.

Here are some basic steps for checking your mortgage closing disclosure:

- Details first. In most cases, it’s recommended to first move through the simple details of the closing disclosure to ensure they’re correct. Check to make sure no names have been misspelled and that the address of the home being purchased is listed correctly, including the zip code. As mentioned, even small errors in areas like these can have a large trickle-down effect during closing, so it’s important to confirm them – and if they’re wrong, quickly send the disclosure back to your lender so it can be corrected.

- Loan terms. Next up, you should review the entire section on your loan terms and confirm accuracy of each detail. Make sure your monthly payment amounts match prior agreed upon documents, for instance, and that your mortgage interest rate percentage is what you expected it to be. Do not let any errors here slide through the cracks.

- Closing costs. Be sure to oversee the closing costs as well, confirming they’re accurate. For example, the document should list the precise amount you’re paying for your down payment, plus any other fees involved in the closing of the home purchase.

- Sign and submit back. Once thoroughly assessed and any issues or errors have been fixed, it’s time to sign the closing disclosure and return it to your lender, which can be done either in-person or virtually. Congratulations, you’re ready for closing day!

For more on closing disclosures within your homebuying process, or to learn about our wide variety of home loan options, contact your local Supreme Lending branch.

by SupremeLending | Apr 9, 2024

When considering buying a home and what your mortgage payment will look like, it’s important to be familiar with private mortgage insurance (PMI). All parties in the mortgage and homebuying process must be protected from certain risks, and this includes not only buyers and sellers, but also mortgage lenders. That’s where PMI comes in.

What exactly is private mortgage insurance, when is it required, what types are there, and when can it be removed? Here’s a breakdown of PMI and how it may impact your mortgage.

Private Mortgage Insurance Basics

PMI is an insurance that homebuyers are typically required to have when they pay less than 20 percent down payment for a home with a Conventional loan. The purpose of PMI is to protect the lender in case the borrower defaults on the loan and fails to make payments. This mitigates risk for the loan provider. If a property goes into foreclosure, PMI can reimburse the lender for a portion of their losses.

The cost for PMI is typically rolled into the monthly mortgage payment and funneled to the insurance provider—in the event the lender needs to make a claim.

It’s important to note that PMI is not homeowners insurance, which protects against things like fire damage or theft. PMI is required by lenders, and it only covers the lender in case of default. It’s not used to protect homebuyers’ interests. However, having PMI may allow borrowers to buy a home sooner than later, without having to save up for a larger down payment.

Types of PMI

While private mortgage insurance plans have the same goals, there are a few different ways to structure the PMI payments applied to a mortgage depending on specific circumstances or preferences. These options include:

- Buyer-Paid PMI: By far the most common type of PMI, buyer-paid private mortgage insurance involves the homebuyer or borrower paying a monthly insurance premium, which is added on to the monthly loan payment and paid to the insurance provider, though the charge can sometimes be rolled into the mortgage itself if applicable.

- Lender-Paid PMI: A much less common option is when the lender pays the monthly premiums, however as a result, the borrower would pay a higher interest rate to make up for the lender’s investment.

- Single-Premium PMI: This type of private mortgage insurance consists of the borrower paying for the full PMI policy upfront in a single lump sum, often at closing. Once this is paid, it eliminates monthly PMI payments.

- Split-Premium PMI: Borrowers may also have the option to combine the PMI payment options listed above by paying an upfront lump sum at closing that doesn’t cover the entire insurance policy, so a lower monthly premium is still required in addition to the mortgage payment.

Benefits of PMI

When lenders have the appropriate protections in place to provide loans, like requiring PMI in certain cases, they can offer mortgages to more families and individuals than if they were faced with taking on more risk.

Similar to how car insurance can protect both the owner of the car and the lender in case of an accident, private mortgage insurance is just another way to ensure that things go smoothly for all parties involved in a home loan. It gives more people the opportunity to buy homes with lower down payment options, while also making sure that lenders have protection against borrowers defaulting on their loans.

When PMI Is Required and How to Get Rid of It?

As noted above, the most common PMI requirement is when a homebuyer puts down less than 20 percent for a Conventional loan. However, this isn’t a set-in-stone rule. There can be loan programs with lower down payment requirements that may not require PMI. Always discuss with your loan officer to go over your qualified options.

Additionally, in most cases, PMI can be removed at some point during the life of the loan. Generally, once the borrower reaches 22 percent equity built in the home through things like paying down the mortgage or appreciation of the home’s value, PMI can be removed. This is done by request so if you think you may have reached this point, it’s important to contact your lender and ask about removal of the insurance. In other situations, PMI may automatically be removed once the homeowner reaches a certain agreed upon equity threshold.

For more on private mortgage insurance or to learn about other home loan programs, contact the team at Supreme Lending today.

by SupremeLending | Mar 21, 2024

Picture this – you currently own or want to buy a home with good bones, but it needs some TLC. The good news is that you don’t have to handle a home remodel alone. Renovation loans are a great option to help fund home improvements, repairs, and enhancements by rolling the renovation costs into a single mortgage payment. It’s important to understand how renovation or home improvement loans work, types of renovation loan options, and benefits.

What Is a Renovation Loan?

Renovation loans are designed to help borrowers finance home improvement projects that will increase the value of the home. Whether you’re planning a small home makeover or extensive rehab project, a renovation loan combines a traditional purchase or refinance mortgage with the cost of renovations—it is an all-in-one mortgage financing option that covers the upfront costs of large repairs and projects.

Taking on the remodel before moving in can enhance your living space and home functionalities without the pressure of taking out an additional loan or paying out of pocket for costly repairs in the future.

Types of Renovation Loans

When it comes to renovation loans, there are a few options for prospective homebuyers and homeowners to consider based on eligibility, timing, and the scale of the home improvements needed.

FHA 203(k) Renovation

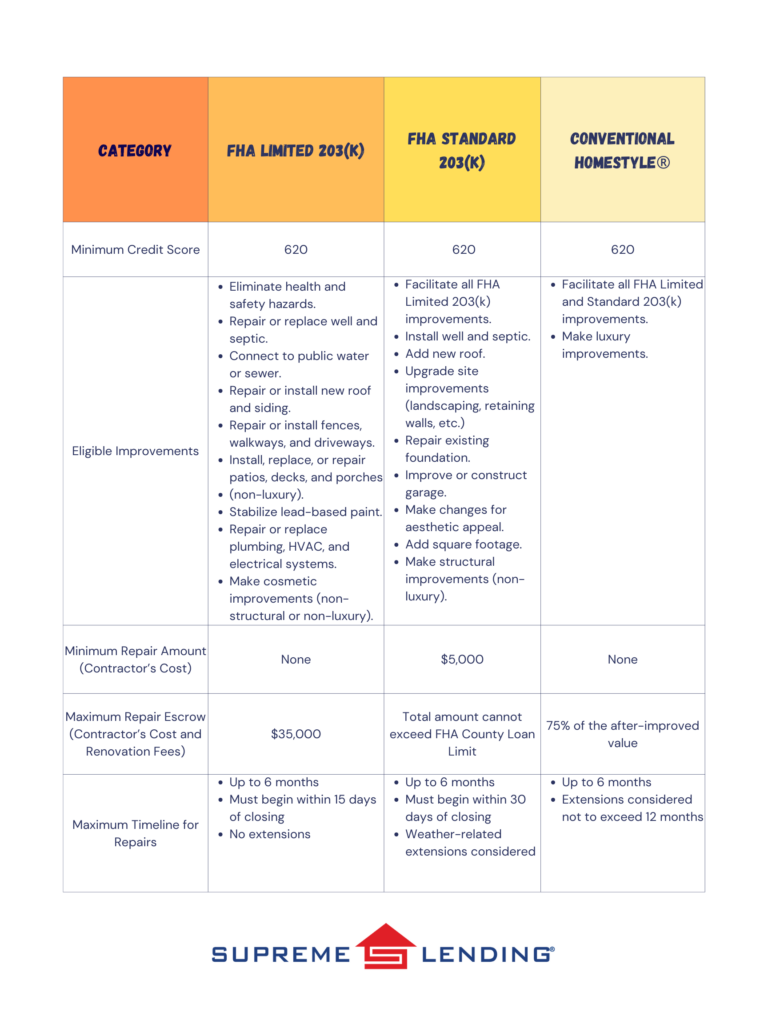

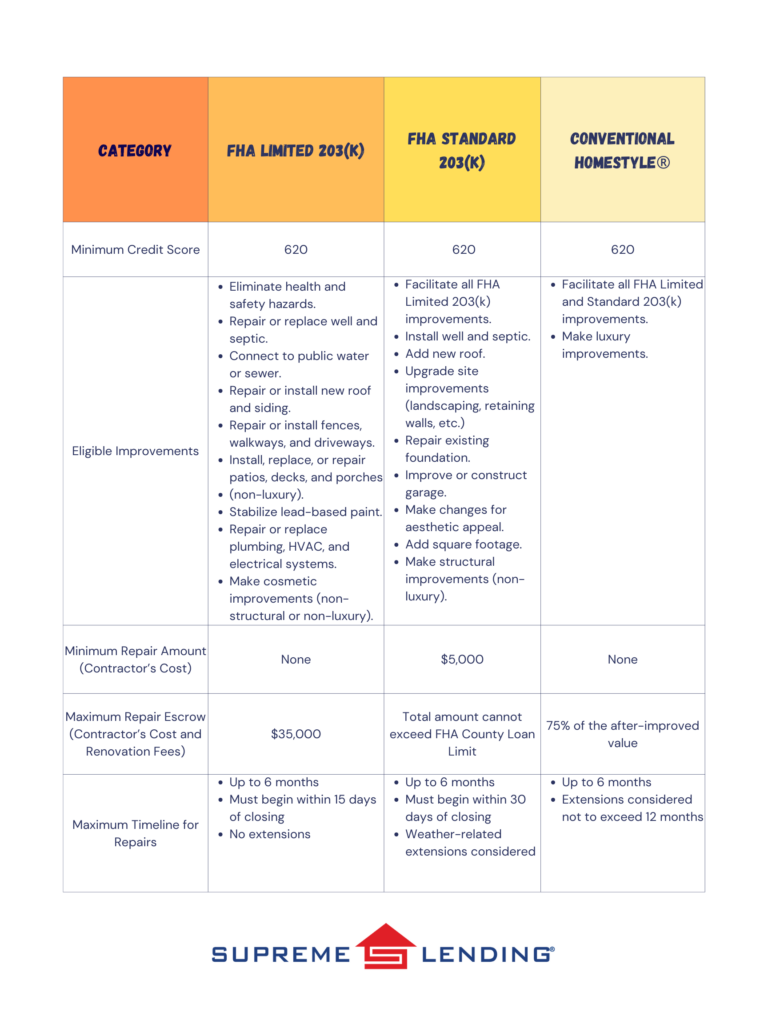

An FHA 203(k) loan, or an FHA rehab loan, is insured by the Federal Housing Administration and provides two options depending on the scope of the home improvement projects, including Limited 203(k) and Standard 203(k), offering different levels of renovation financing.

The minimum down payment for an FHA 203(k) loan is 3.5%. An FHA 203(k) loan covers common basic home improvements and repairs but excludes larger luxury projects and amenities. The Limited option has no minimum renovation amount and can cover up to $35,000 in renovation costs. The Standard has expanded eligible improvements including some structural upgrades and a minimum renovation cost of $5,000. Typically, all renovations must be completed within 6 months.

VA Renovation

The Department of Veterans Affairs (VA) also has a Renovation loan option. A VA Renovation loan offers 100% financing for eligible U.S. Veterans or military personnel to cover a mortgage combined with planned renovation costs into a single loan. Eligible home improvements are similar to FHA 203(k) to cover common upgrades that will make the property safer, healthier, or more functional, excluding luxury projects. VA Renovation loans can finance up to $50,000 in home repair costs.

Conventional Renovation

A Conventional Renovation loan, such as Fannie Mae’s HomeStyle® program, is another financing option that rolls the costs of home renovation projects into a single mortgage and offers more flexibility than a government loan. Conventional Renovation mortgages can cover larger, luxury upgrades, such as creating a high-end bathroom or kitchen with decorative tilework or adding a sparkling backyard pool. The maximum home repair amount is 75% of the home’s post-construction appraised value.

More Benefits of Renovation Loans and Remodeling

- Expand Your Home Search. Prospective homebuyers may have a broader range of properties to choose from, including fixer-uppers, knowing that they could finance custom home upgrades or needed repairs with a Renovation loan.

- Save on Upfront Costs. Home renovation projects can be costly. Funding home remodeling projects with your mortgage could help keep you from tapping into your personal savings and avoid hefty upfront repair costs.

- Grow Your Home Value. Renovation loans are intended to increase the value of your home, which may result in a smart, long-term investment and the potential to build more equity.

- Personalize Your Dream Home. Renovation loans offer an affordable option to help make your design visions come to life and beautify your home to fit your character.

- Enhance Comfort and Livability. Whether it’s expanding a kitchen, adding a bathroom, or creating a home office space, upgrading your home can add modern conveniences and improve your overall well-being.

If you’re looking to enhance your living spaces and potentially increase your property value, a Renovation loan could be the answer to creating the home of your dreams. To learn more about renovation financing or other mortgages, contact your local Supreme Lending branch today.

Related Articles:

by SupremeLending | Mar 15, 2024

When considering buying a home, it’s highly recommended that the first step in your homeownership journey is to work with a lender to get pre-qualified or pre-approved for a mortgage. While the two terms sound similar and both help give buyers an understanding of how much they may qualify for a loan, there are distinctions between getting a mortgage pre-qualification and pre-approval. Let’s dive into the differences between these crucial first steps and benefits of each in your homebuying experience.

Mortgage Pre-Qualification: A Preliminary Evaluation

Pre-qualification is an early step in the homebuying and mortgage process. It offers buyers and lenders alike a high-level snapshot of a borrower’s finances and potential buying power. When getting pre-qualified, lenders will typically collect basic financial information provided by the buyer, including income, debts, assets, and any amount of savings or cash they may have available for a down payment. It’s a valuable starting point, giving you an idea of your budget before you start house hunting.

During the pre-qualification process, borrowers may be able to opt for a soft pull credit inquiry. This means your information would remain confidential, with no impact on your credit score and avoids unwanted credit solicitations and third-party trigger lead calls. Ask your loan officer about your credit reporting options.

While a mortgage pre-qualification is less detailed than a pre-approval, this step can be quicker and involves less documents to help busy homebuyers hit the ground running and start their home search. A pre-qualification letter can also show sellers your interest in buying a home and that you can afford an estimated mortgage.

Mortgage Pre-Approval: A Deeper Dive

A mortgage pre-approval takes a more detailed approach and provides an even clearer, more accurate picture of a borrower’s finances and capacity for a mortgage. This is because the loan estimate is based on validated details.

In this step, prospective homebuyers will need to provide their lender with thorough documentation of their financial history for verification, including records like pay stubs, tax returns, and bank statements. Lenders will also run the borrower’s credit score and verification of employment if applicable.

Once pre-approved, the borrower will receive the estimated loan amount they may qualify for based on the verified information—verified being the key differentiator between a pre-approval and a pre-qualification. A pre-approval also gives you, the buyer, a more competitive edge because it demonstrates to sellers that you’re serious and eager to buy a home.

Other Reasons to Get Pre-Qualified or Pre-Approved

- Determine Affordability. It gives you an idea of how much you can afford based on your credit, income, debt, and potential down payment funds. This will help guide your home search within your budget.

- Understand Monthly Payments. With the estimated loan amount you can qualify for, you can get a breakdown of your monthly principal, interest, taxes, and insurance costs to help set expectations for planning your mortgage.

- Find the Right Loan Program. Evaluating your financial details and knowing how much you can qualify for can also help you determine the loan type best fit for your needs and if you could benefit from programs such as first-time homebuyer or down payment assistance.

- Strengthen Your Offer. As mentioned, having a pre-qualification or pre-approval can show sellers you’re a credible buyer and strengthen your offer on a home, which is especially helpful in a competitive market.

- Save Time. Being prepared in advance with a pre-qualification or pre-approval helps identify and avoid any potential roadblocks that could arise during the mortgage process, setting you up for a smooth closing.

In conclusion, getting a mortgage pre-qualification or pre-approval offers invaluable knowledge and opportunities in your homebuying journey. Ready to take the first step? Our Supreme Lending loan officers are ready to serve you! Contact your local branch today.

by SupremeLending | Mar 13, 2024

The decision to refinance* your mortgage is a strategic move that can have a profound impact on your financial well-being. There are several types of situations when refinancing might provide specific benefits and unlock potential savings. It’s important that homeowners have a clear idea of the possible outcomes when considering a refinance. Let’s dive into a few of the most common reasons people may refinance, some of which may apply to your situation.

Getting a More Favorable Mortgage Rate

A key reason that homeowners refinance is to get a more favorable mortgage interest rate. This can be done by either securing a lower interest rate than your current mortgage or by switching from an adjustable-rate mortgage (ARM) to a fixed-rate loan. In both cases, this may lead to significant savings over the life of the loan and may even reduce the monthly mortgage payments.

When mortgage interest rates drop lower than your current loan, it’s important to note that there are several additional considerations to be aware of, including fees and upfront costs associated with refinancing as well as the amount of time left on your current loan. Working with a trusted lender that provides personalized, transparent refinancing details and costs will help you make an informed decision for your mortgage needs.

Changing the Terms of Your Loan

Another common reason people refinance is to change the terms of their loan. This may involve extending the length of the loan to lower monthly payments or shortening the loan term to pay off the mortgage quicker. Refinancing to a shorter-term loan may increase your monthly mortgage payment, so it’s important to consider your budget before making this decision.

Switching Loan Type

Some homeowners may refinance to opt for another loan type, for example moving from an ARM to a fixed-rate mortgage. Interest rates—and subsequently monthly mortgage payments—for an ARM can increase or decrease based on market conditions, so borrowers may be more comfortable switching to a fixed-rate mortgage that has a steady interest rate and monthly payment that won’t change.

Another scenario could be borrowers wanting to change from a government loan, such as FHA or VA, to a Conventional mortgage. This could be an effective way to save on some loan costs by removing required fees typically associated with government loans.

Removing a Co-Signer

If you required a co-signer to qualify for a mortgage, you may be able to remove them from the loan by refinancing after improving your eligibility to qualify for a loan by yourself. Not only does this free up the co-signer from their financial obligation, but it may also help you qualify for a lower interest rate on your loan, especially if your credit score improves when the co-signer is removed. This could lead to more favorable loan terms. Homeowners may also want to remove a co-signer in the event of a divorce resulting in one spouse assuming sole ownership of the home and full responsibility for the mortgage.

Removing Private Mortgage Insurance or Mortgage Insurance Premium

For those who put down less than 20% down payment for a home, a common requirement is carrying private mortgage insurance or PMI. This protects the lender in case the borrower defaults on the loan, but it also means an additional monthly cost that can add up over time.

With Conventional mortgages, you don’t have to always refinance to remove PMI. It can be removed after you’ve reached a certain equity threshold in the home—usually 20%. However, some mortgage programs, like FHA loans, require a Mortgage Insurance Premium (MIP) for the life of the loan. An FHA borrower would need to refinance to a Conventional mortgage to remove the MIP cost.

Cashing Out Equity

Finally, another popular way homeowners utilize refinancing is to cash out the equity that’s built up in the home. If you refinance an amount greater than what you owe on your home, you can receive the difference in a cash payment to be used as you wish. For example, you may use this cash to fund home improvements, pay off high-interest debts, or for other large expenses. How you use the cash is up to you.

It’s important to remember that cashing out equity will increase the amount you owe on your home and may also lead to a higher interest rate—factors that should not be overlooked.

As you can see, there are a variety of reasons why homeowners may choose to refinance their mortgage. It’s important to carefully consider your individual circumstances and financial goals before making a decision, as refinancing may not be right for everyone.

For more information on reasons to refinance, or to learn more about any of our mortgage programs and services, reach out to your local Supreme Lending team or contact us today.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.