by SupremeLending | Jun 5, 2024

Understanding a Bank Statement Loan

For entrepreneurs and self-employed individuals, securing a mortgage can often be a challenge. Traditional home loans typically require W-2 tax returns and other documentation that may not accurately reflect the income of self-employed borrowers. This is where Supreme Lending’s bank statement loans come in. Designed for those who run their own businesses, bank statement loans offer an alternative option for self-employed homebuyers without the need for conventional income and tax documentation. Here’s everything you need to know about bank statement mortgages.

What Is a Bank Statement Loan?

A bank statement loan, commonly known as a self-employed mortgage, is a type of home loan designed for those who may have non-traditional sources of income. Simply put, instead of relying on W-2 forms and tax returns, lenders use the borrower’s bank statements to verify their income to approve the loan. This allows self-employed individuals to qualify for a mortgage based on their cash flow rather than their taxable income, which may be reduced by business expenses and tax deductions.

How Do Bank Statement Mortgages Work?

Income Verification

For these types of loans, lenders typically review the past 12 to 24 months of your personal or business bank statements to determine your average monthly income. This provides an accurate picture of your financial health and ability to repay the loan and make monthly mortgage payments.

Down Payment Requirements

The down payment requirements for bank statement loans can vary depending on the lender, but it can generally range from 10% to 20%. A larger down payment amount can sometimes secure more favorable terms and interest rates.

Credit Score and Other Requirements

While these loans are designed to be a more flexible homebuying option, mortgage professionals will still review your credit score, assets, and other financial factors to assess the potential lending risk. A higher credit score may increase your chances of approval for the loan.

Common FAQs and Considerations

Who Can Benefit from a Bank Statement Mortgage?

As mentioned above, these loans are ideal for self-employed borrowers, including small business owners, corporation owners, freelancers, and gig economy workers whose income may be substantial, but not consistently documented like W-2 employees. It’s a great option if you have strong cash flow but your tax returns don’t reflect your true income due to tax write-offs and deductions.

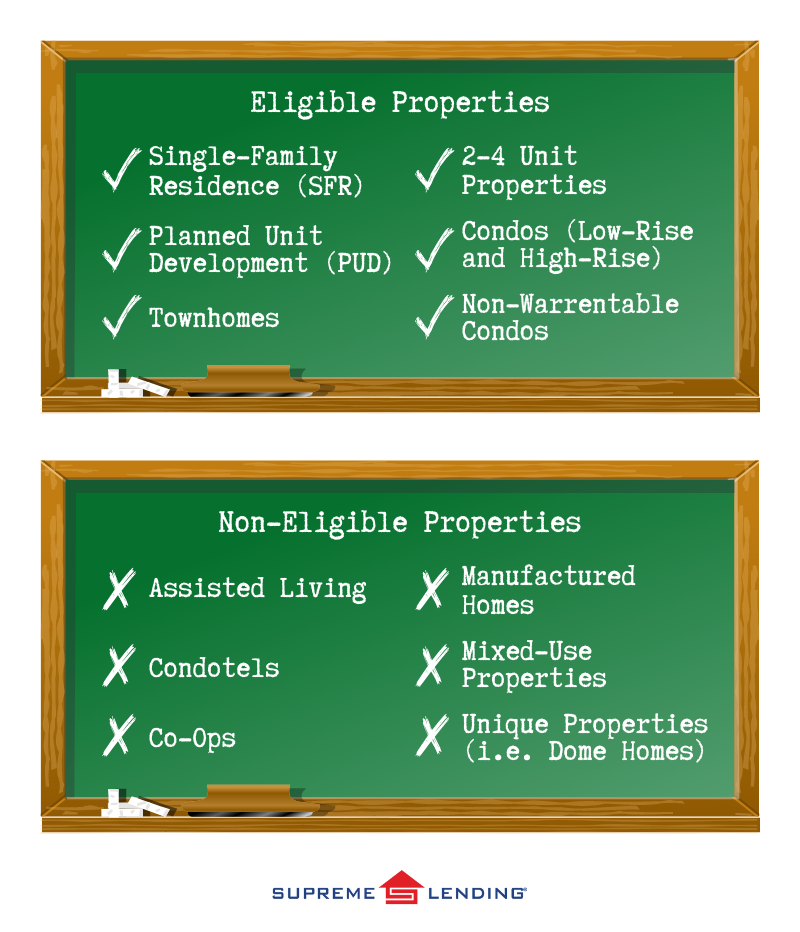

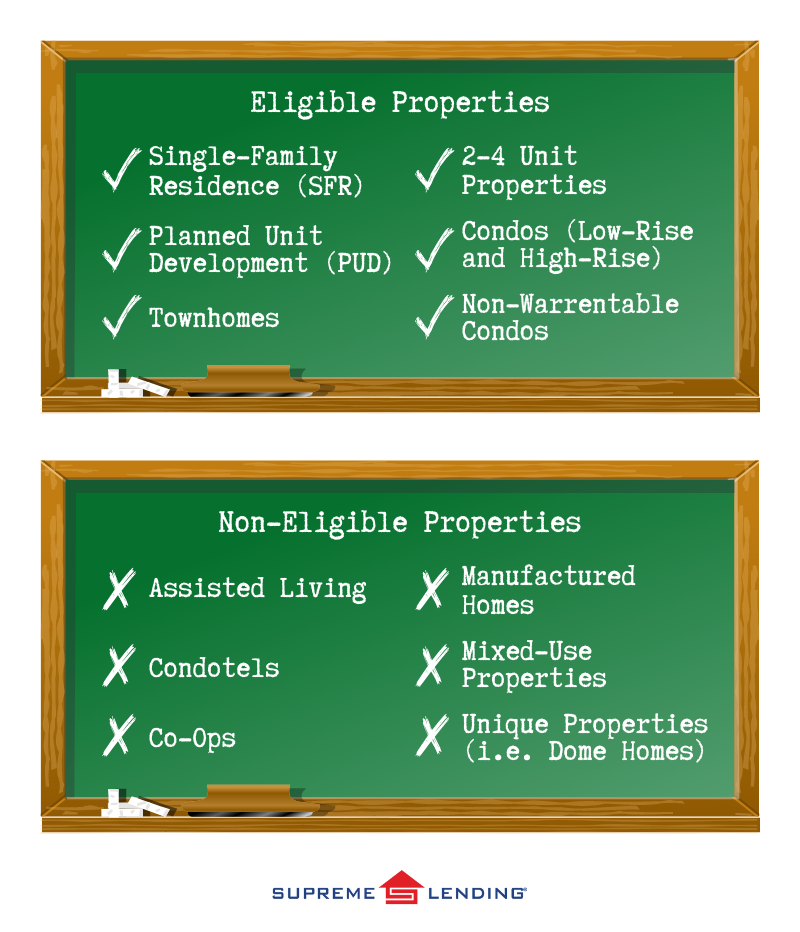

What Types of Properties Can Qualify?

These loans can be used to purchase various types of properties, including single-family homes, condos, townhouses, and in some cases multi-family properties. There are also options for second homes and investment properties depending on the loan type. Each lender has specific property requirements and guidelines, so it’s important to work with a knowledgeable loan officer to help guide you through the process.

What Are Interest Rates?

Interest rates for bank statement loans may be higher than those for Conventional loans due to the potential increased risk to lenders. However, if a borrower has a strong financial profile, it may be possible to lock in a more competitive rate. Additionally, rates are typically lower for a 24-month bank statement loan versus 12 months.

How Is Income Calculated?

For bank statement mortgages, lenders will typically sum up your total deposits over the selected period of time (12 to 24 months) and divide by the number of months to calculate your average monthly income. Business-related expenses and unusual deposits may be excluded to ensure a more accurate income assessment.

What If My Spouse Is a W-2 Employee?

Depending on the loan program and circumstances, lenders may consider a spouse’s income as well when calculating their joint eligibility for a bank statement loan. For example, a business owner’s average monthly income and a spouse’s W2s, paystubs, and employment verification could both be used to determine their combined income.

Benefits of Bank Statement Lending

Owning your own business is part of the American Dream. However, business owners may not qualify for a traditional mortgage to buy their American Dream Home. Bank statement loans offer that freedom. They give self-employed borrowers flexibility to use their true income without being tied down by tax deductions or business expenses. It also opens the door to homeownership for more people in the community—whether it’s their first home or tenth.

If you’re self-employed and ready to explore your mortgage options, contact Supreme Lending today. We’re here to help you navigate the process and find the best loan option to fit your unique needs.

Related Articles:

by SupremeLending | May 31, 2024

The Ultimate Mortgage DTI Handbook

When it comes to securing a mortgage, understanding your finances has never been more important. One of the most important metrics lenders use when evaluating a borrower’s eligibility for a mortgage is Debt-to-Income ratio, commonly known as DTI. Let’s dive into what exactly mortgage DTI is, how it’s used, what sources of debt and income are considered, and what establishes a fair or good DTI. Plus, we’ll offer some helpful tips for potential homebuyers on understanding their DTI.

What Is Debt-to-Income (DTI) Ratio?

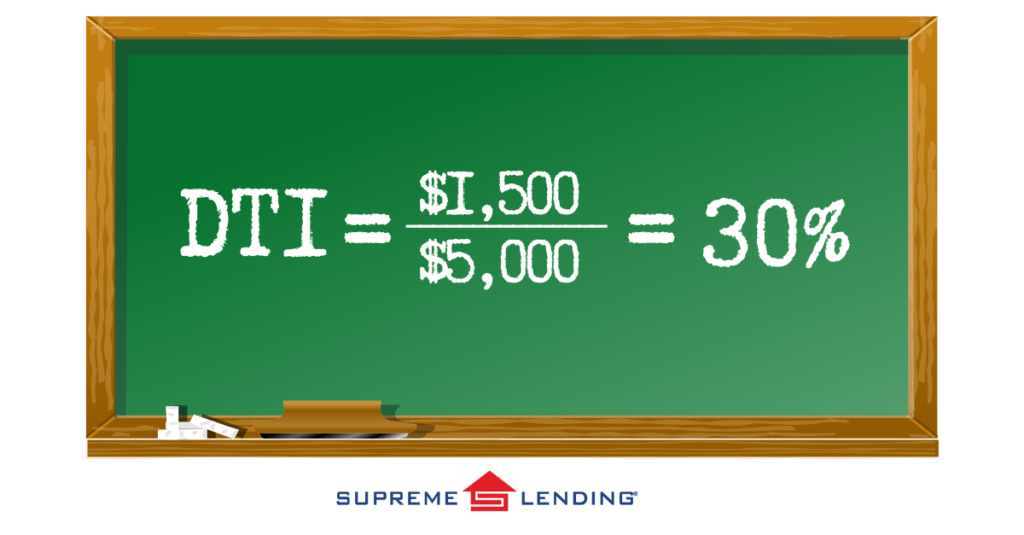

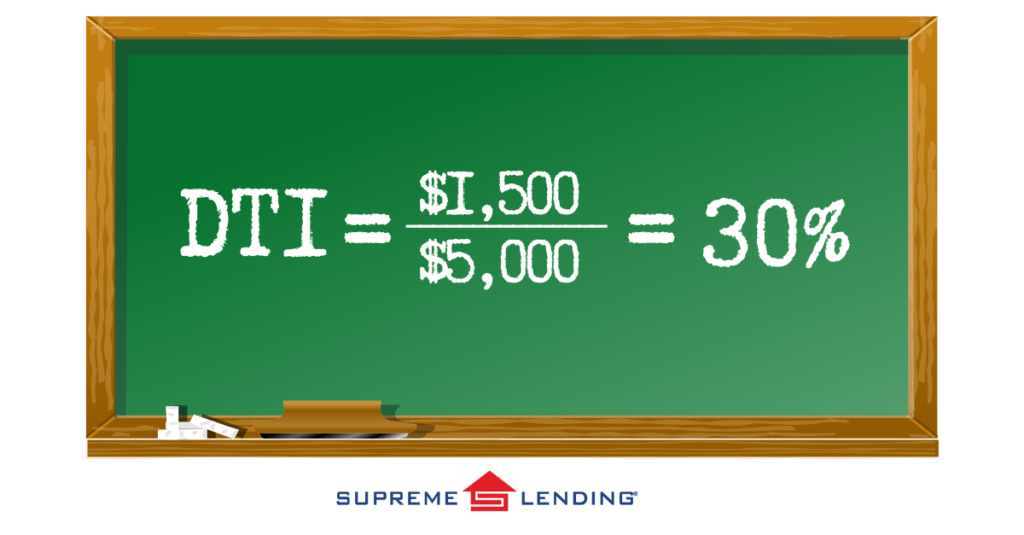

DTI is a financing metric that compares an individual’s monthly debt payments to their gross monthly income. Essentially, it measures the percentage of your income that goes toward paying off debts. Lenders use DTI to assess a borrower’s ability to make monthly payments to repay the loan. DTI is calculated by dividing your total monthly debt payments by your gross monthly income and multiplying the result by 100 to get the ratio percentage.

For example, if you have $1,500 in monthly debt payments and a gross monthly income of $5,000, your DTI would be 30%, as calculated below:

How DTI Is Used to Determine Mortgage Eligibility

Lenders look at your DTI to evaluate your ability to take on additional debt in the form of a mortgage. A lower DTI indicates that you have a good balance between debt and income, resulting in a more attractive and capable buyer. There are DTI thresholds that borrowers will need to meet, which can vary by lender or specified by the loan program guidelines.

Types of Mortgage DTI

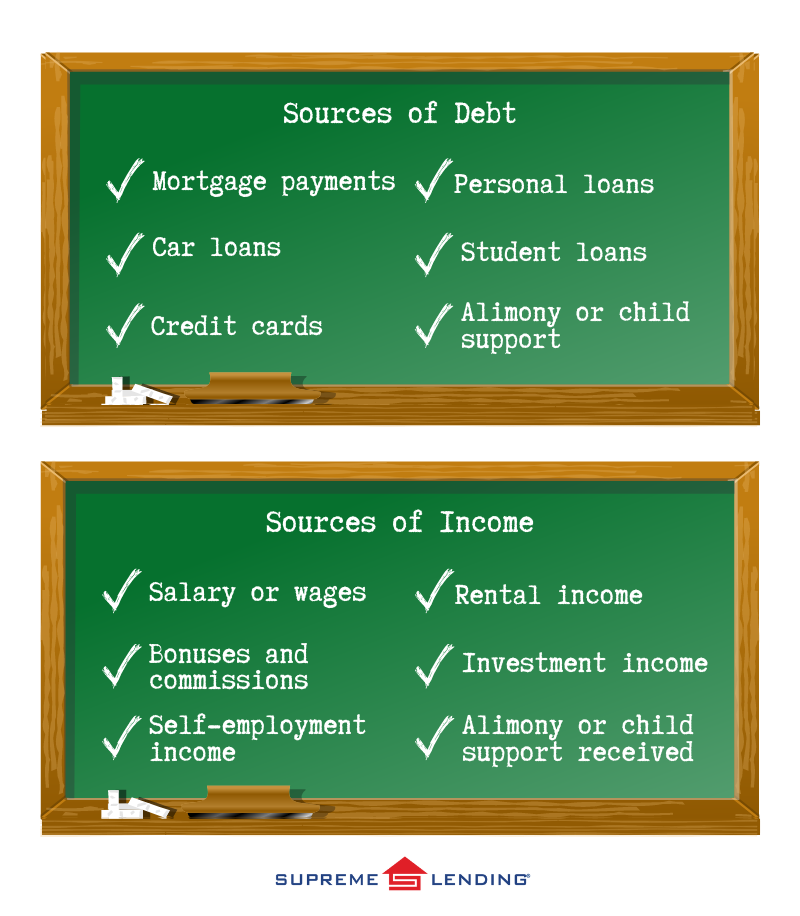

- Front-end DTI: Also called a housing ratio or mortgage-to-income, this ratio only calculates housing-related expenses, such as the monthly mortgage payment, property taxes, homeowners’ insurance premiums, and homeowners association fees, if applicable, relative to your gross monthly income.

- Back-end DTI: This ratio includes all your monthly debt obligations, such as credit card payments, car loan payments, and student loan debt, in addition to the housing-related debt. Lenders typically focus more on back-end DTI when evaluating a buyer’s capability to repay a loan as it provides a clearer picture of their financial responsibilities.

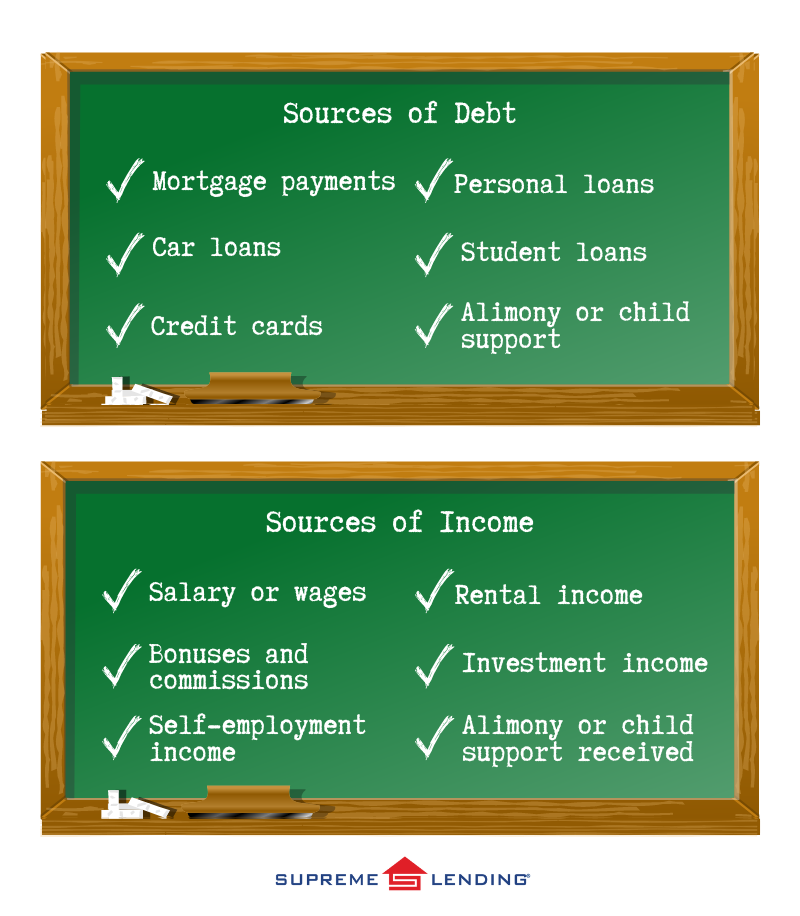

Sources of Debt and Income Considered

What Is Considered a Favorable DTI?

A good DTI ratio for a mortgage depends on the type of loan and the lender. Most lenders prefer a back-end DTI of around 36% or less, though some may accept higher ratios, especially for borrowers with strong credit scores or significant assets.

Helpful Mortgage DTI Tips for Potential Homebuyers

1. Avoid New Debt

Before applying for a mortgage, calculate your current DTI to give you a rough understanding of where you stand. This will help identify if you need to make any adjustments to potentially improve your DTI ratio before deciding to purchase a home.

2. Reduce Outstanding Debts

Paying down existing debts can significantly improve your DTI. Consider focusing on reducing or eliminating higher interest debts like credit card balances first.

3. Increase Your Income

Look for opportunities to boost your income. This could be through a salary increase, getting a higher-paying job, adding a part-time gig, or exploring other income sources.

4. Avoid New Debt

Refrain from taking on new debt before applying for a mortgage and during the loan approval process. New loans or credit lines may have an impact on your DTI and mortgage eligibility.

5. Seek Professional Advice

Consult with a financial professional for personalized guidance or a loan officer to get a better understanding of your DTI and loan program requirements. There may be other mortgage options better suited for you depending on your goals, such as Debt Service Coverage Ratio (DSCR) loans for investment properties that don’t use DTI.

6. Consider a Co-Signer

If your DTI is in the higher range, you may benefit from having a co-signer who has a higher income or less debt to contribute.

7. Understand Loan Programs

Guidelines and criteria to qualify for a mortgage vary depending on the program and lender. For example, FHA loans typically have more lenient DTI requirements than Conventional loans. Work with our team at Supreme Lending to explore a variety of different mortgage options and find the one best fit for you.

Managing Your Debt-to-Income Ratio

Understanding mortgage DTI and your Debt-to-Income ratio is essential for navigating the loan process. By managing your DTI and making informed decisions, you may potentially improve your mortgage eligibility and chances of securing your dream home.

Contact Supreme Lending to learn more about how we can help you achieve your homeownership goals with confidence.

Related articles:

by SupremeLending | May 21, 2024

Undergoing home renovation projects can not only enhance your living space but, if done right, may increase the value of your home. Whether you’re looking to attract buyers before selling your home or want to modernize your space, here are eight popular home renovation projects to consider that may add value and pay off in the long-term. Plus, with renovation loans or refinancing,* funding these projects may be easier than you think.

1. Upgrade the Front Door

The front door of your home is the first thing people see, and first impressions matter. Replacing an old, worn-out door with a new, sleek one can instantly boost your home’s curb appeal. Opt for a steel or fiberglass door for durability. For a lower budget option, a fresh coat of paint and new hardware can also do wonders.

2. Enhance Landscaping

The exterior yard is crucial when it comes to selling a home, and well-maintained landscaping can make a big difference. Simple tasks such as trimming bushes, planting flowers, and adding fresh mulch can create an inviting environment. Consider adding attractive features such as a stone walkway, small fountain, or boxwood bushes.

3. Remodel the Kitchen

The kitchen is the heart of the home and is oftentimes a key deciding factor for people looking to buy a property. Even minor updates like replacing outdated appliances, installing new countertops, or refreshing cabinet hardware can make a big impact. If you have a larger budget, consider a complete kitchen overhaul including modern cabinetry, a marble island, or a luxurious backsplash.

4. Remake the Bathroom

Updating bathrooms can significantly boost your home’s value. Start with easy fixes like re-caulking the tub, replacing outdated fixtures, upgrading to a modern mirror, or adding a fresh coat of paint. Depending on the condition, it may be worth to completely renovate the bathroom by updating the shower or tub and retiling the space.

5. Add or Upgrade a Deck or Patio

Outdoor space has always been an appealing feature to homebuyers. Adding a deck or patio can extend the living space and create an enjoyable area for entertaining and relaxation. If you already have a deck, ensure it’s in good condition by making any repairs or replacements. You can even add unique features like an outdoor kitchen or elegant lighting.

6. Add Fresh Paint

A fresh coat of paint is a simple, cost-effective way to update your home. Choose neutral colors that would appeal to a wide range of buyers and make spaces feel larger and brighter. Painting can cover up any scuffs and marks, making your home look cleaner and well-maintained.

7. Improve Energy Efficiencies

Energy efficiency can be a top priority for many homebuyers. Simple upgrades like adding insulation or installing programable smart home technology can make your home more attractive. Larger investments, such as replacing old windows and converting to Energy Star-rated appliances, may also add significant value.

8. Increase Spare Footage

If you have the budget, increasing your home’s square footage may considerably raise its market value. Options include finishing a basement, converting an attic, or adding on an extension. The new space could be marketed as an extra bedroom, bathroom, or home office, making your home more appealing to a wider range of buyers.

Financing Home Renovation Projects

While remodeling a home may add significant value, it can also be costly. Fortunately, there are financing options available to help fund home renovation projects, such as a renovation loan, home equity loans, or cash-out refinancing.

Have any home renovation projects in mind? Contact us today to learn how we can help you finance the home of your dreams.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | May 17, 2024

If you’re a homeowner looking to gain access to the equity you’ve built in your home, you’ve most likely heard about cash-out refinancing,* also commonly known as cash-out refi loans. These offer a useful way to access cash by refinancing your current mortgage. But there’s more to the process than that! What exactly are cash-out refinance loans, and when do they make the most sense? Here’s an overview to gain a comprehensive understanding of cash-out refinancing, potential benefits, and different scenarios to consider.

How Cash-Out Refinancing Works

A cash-out refi loan is a refinancing option where you replace your existing mortgage with a new, larger loan than what you currently owe. The difference between the new loan amount and your existing mortgage balance is paid to you in cash. This allows you to tap into your home equity, which is the portion of your property’s value that you own outright.

Scenarios When Cash-Out Refinancing May Be Beneficial

1. Home Improvements

A popular reason homeowners opt for cash-out refi loans is to fund home renovation projects and upgrades. For example, if your home needs a new roof, a modernized kitchen, or an additional bathroom, using the equity in your home to finance these projects may be a smart move. Home improvements can not only enhance your living space but may increase your property’s value.

2. Pay Off High Interest Debt

Another practical use for a cash-out refinance is to pay off other high-interest debt, such as credit card balances or personal loans, potentially allowing you to roll it into a new mortgage with a lower rate.

3. Education Expenses

If you or a family member is planning to attend college, a cash-out refinance may help provide funds to cover tuition and other education-related expenses. This may offer a more affordable, manageable option compared to student loans, while helping build a brighter future.

4. Emergency Funds

Life is unpredictable, and having access to emergency savings can provide peace of mind. Cash-out refi loans could be used to create that financial safety net set aside for unforeseen expenses, such as medical bills or urgent vehicle or home repairs, offering a potential alternative to using high-interest personal loans or credit cards.

When Cash-Out Refi Loans May Not Be Ideal

1. High Closing Costs

Doing a cash-out refinance comes with associated closing costs, which can typically range from 2% to 6% of the loan amount. If the closing costs outweigh the benefits of refinancing, it may not be the best option. It’s important to ensure that the cash-out amount or potential return on investment can justify the closing cost amount.

2. Increased Monthly Payments

Refinancing into a larger loan amount may increase your monthly mortgage payments, especially if you do not secure a lower interest rate. It’s important to know how your monthly payment may change and be prepared to handle any increases.

3. Extended Loan Term

In some cases, a cash-out refinance can extend your mortgage term,. This may offset the potential increase in your monthly payment. However, it also means you might be paying more interest over a longer period of time.

As there are several common reasons to refinance a mortgage, cash-out refi loans may be a strategic way to gain access to your home equity and fund several initiatives. It’s important to understand what all goes into the refinancing process, such as closing costs, potentially increased monthly payments, and extended loan terms.

Ready to explore if a cash-out refinance is right for you? Getting pre-qualified can provide an estimate on how much cash you can take out and a breakdown of your potential refinancing expenses to help you make an informed decision. Contact our expert team today to discuss your mortgage options.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | May 13, 2024

An Investor’s Guide for DSCR loans

Whether you’re just getting started with your investment portfolio or are a seasoned investor, navigating real estate is all about strategy. Supreme Lending is proud to offer a program to help investors easily finance dream investment homes without a traditional mortgage: the Debt Service Coverage Ratio (DSCR) loan. Here’s a guide for everything you need to know about DSCR loans, how they work, and the benefits they offer for investors looking to maximize returns.

DSCR Loan Basics

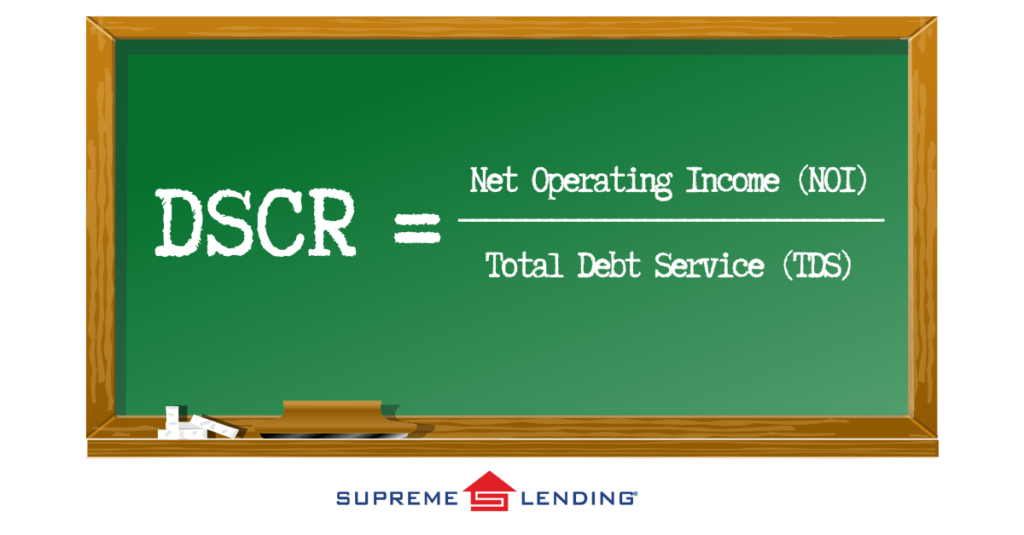

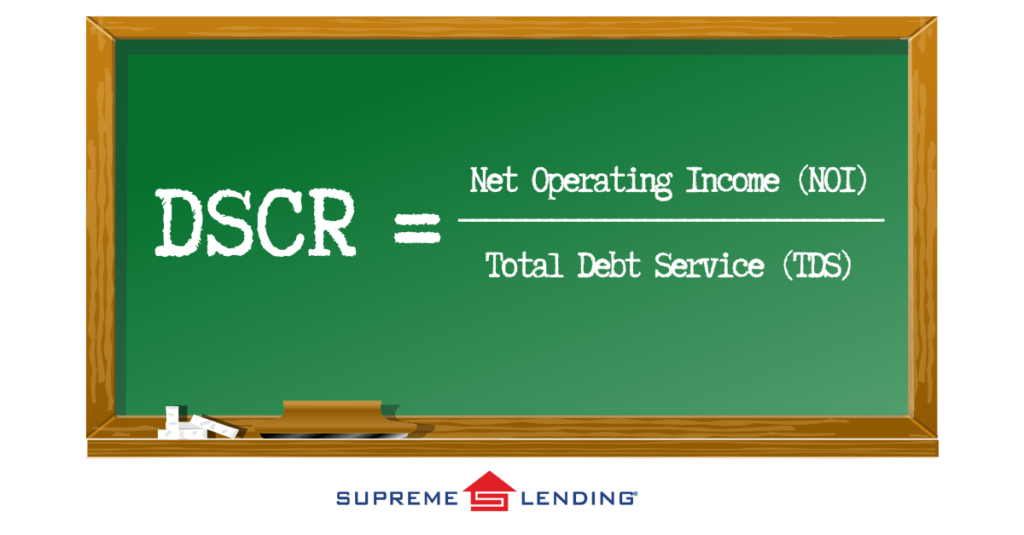

Simply put, DSCR is the ratio of a property’s rental income to its mortgage payment, taxes, and insurance. This helps lenders measure an investor’s ability to cover the mortgage from the cash flow generated from the property.

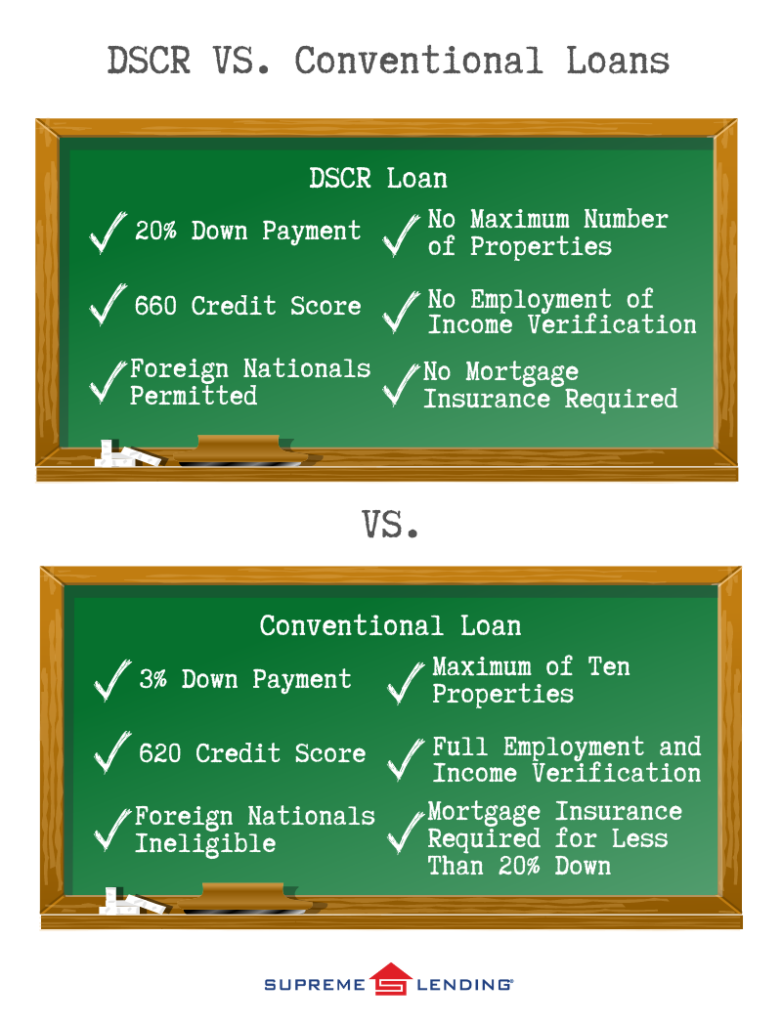

DSCR is similar to Debt-to-Income (DTI) for typical mortgages. However, the difference is that for a traditional loan, the percentage to service the debt is dependent on the borrower’s personal income, whereas for income-producing properties, it’s based on the property’s income. No income or employee verification is needed.

How To Calculate DSCR

To calculate the DSCR, divide the property’s net operating income (NOI) by its total debt service (TDS). The formula is as follows:

A DSCR of 1.0 indicates that the property’s net operating income is exactly equal to its debt obligations. A DSCR greater than 1.0 signifies that the property generates more income than needed to cover its debt payments, while a DSCR below 1.0 indicates insufficient income to cover debt payments. Typically, rates of 1.25 or greater are ideal and borrowers may receive better pricing with a higher ratio.

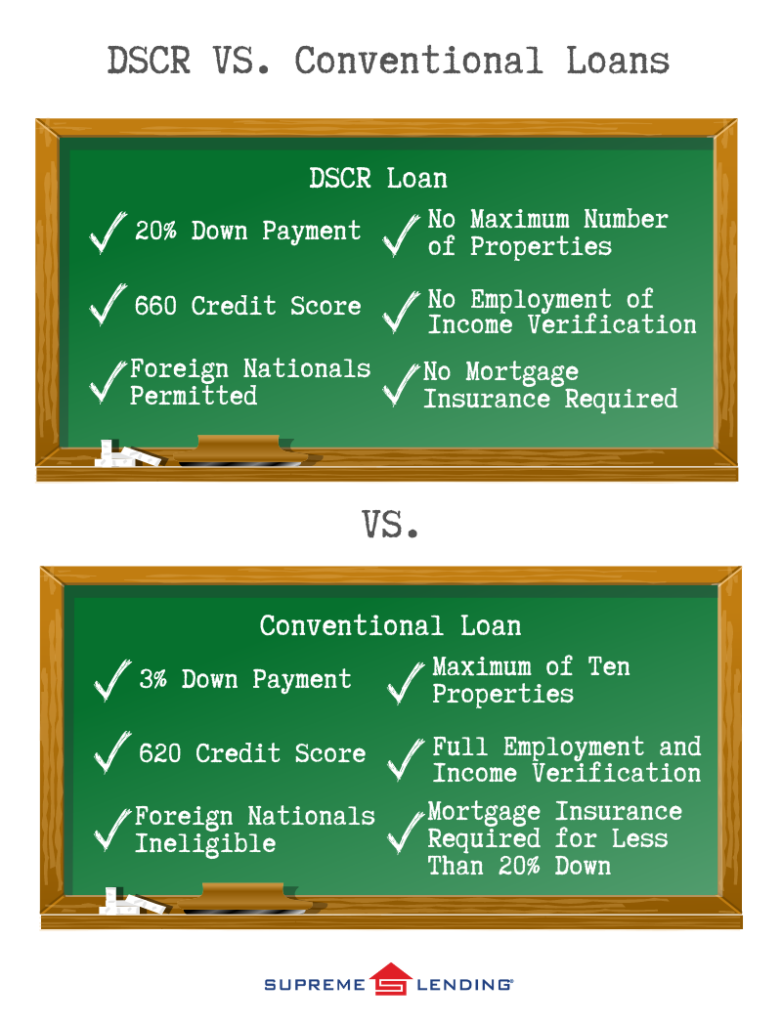

Eligibility for DSCR Loans

While guidelines to qualify for DSCR loans vary by lender, here’s an overview of common program highlights of Supreme Lending’s DSCR offering.

- Eligible borrowers include both first-time and experienced investors, but first-time homebuyers do not qualify.

- Foreign Nationals can qualify if eligible.

- First-time investors allowed at 75% Loan-to-Value (LTV).

- 20% down payment required; 25% for first-time investors.

- Vesting in entities permitted such as partnerships or LLCs (Limited Liability Company).

- Purchase and refinance options available.

- Investment, income-producing properties only.

Why Choose a DSCR Loan?

Prospective borrowers for DSCR loans may be looking to take advantage of home investments and generate rental income. For example:

- Borrowers looking to start their real estate investment portfolio.

- Investors looking to expand their current real estate portfolio.

- Eligible Foreign Nationals looking for an investment opportunity in the U.S.

- Borrowers in an LLC looking to invest in a property with their business partner.

- Investors pursuing niche strategies like short-term rentals or the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method.

Benefits of DSCR Loans for Investors

- No documentation of income or employee verification versus conventional investment property loans, saving time and less documentation.

- No maximum number of properties—the sky is the limit!

- No mortgage insurance required compared to other loan options.

By evaluating a property’s ability to generate income relative to its debt obligations, DSCR loans provide valuable insights and savvy financing for investors—both first-time and seasoned investment professionals.

Contact your local Supreme Lending branch to learn more about DSCR loans and other mortgage options