by SupremeLending | Jul 18, 2024

When it comes to securing a mortgage, a key factor that lenders consider when evaluating a borrower’s lending capacity is Loan-to-Value (LTV) ratio. Understanding mortgage LTV, how it’s calculated, and how it can impact your mortgage can help you make informed decisions during the homebuying process. Let’s dive into the details of LTV ratios and why they matter.

What Is Loan-to-Value (LTV) Ratio?

The LTV ratio is a financial term used by lenders to assess the risk of a loan. It compares the loan amount to the appraised value of the property being purchased or refinanced.* The LTV ratio is expressed as a percentage, demonstrating how much of the property’s value is being financed through the mortgage.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

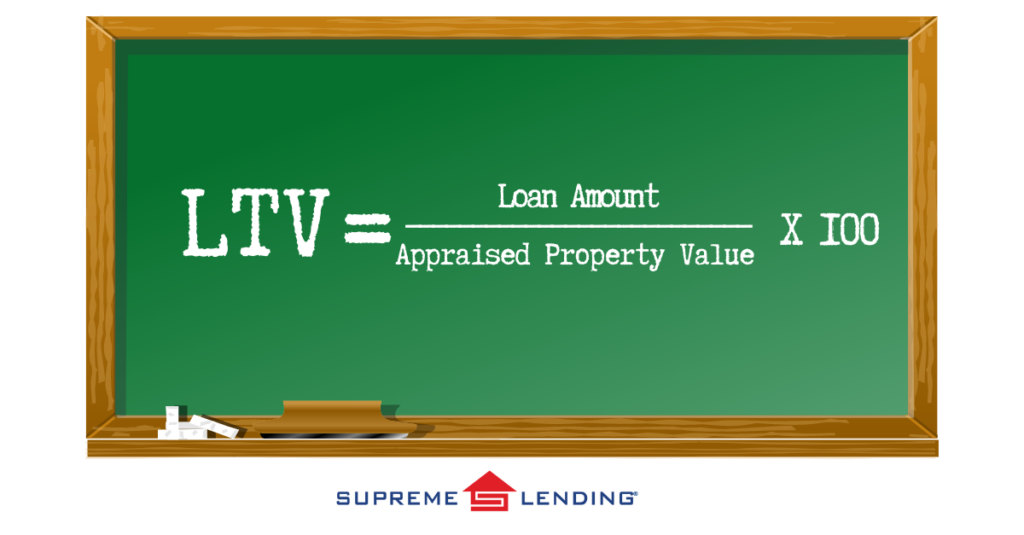

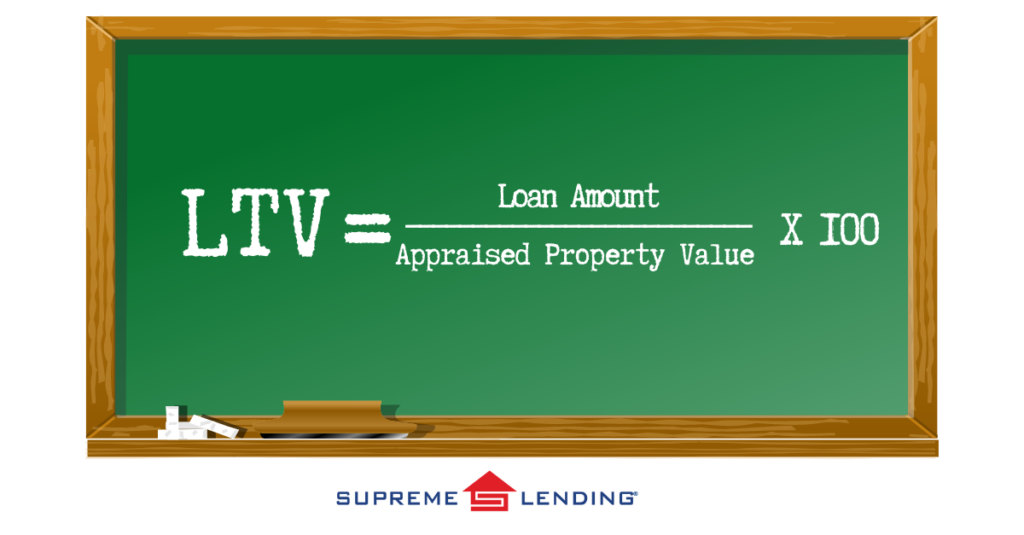

How Is Mortgage LTV Calculated?

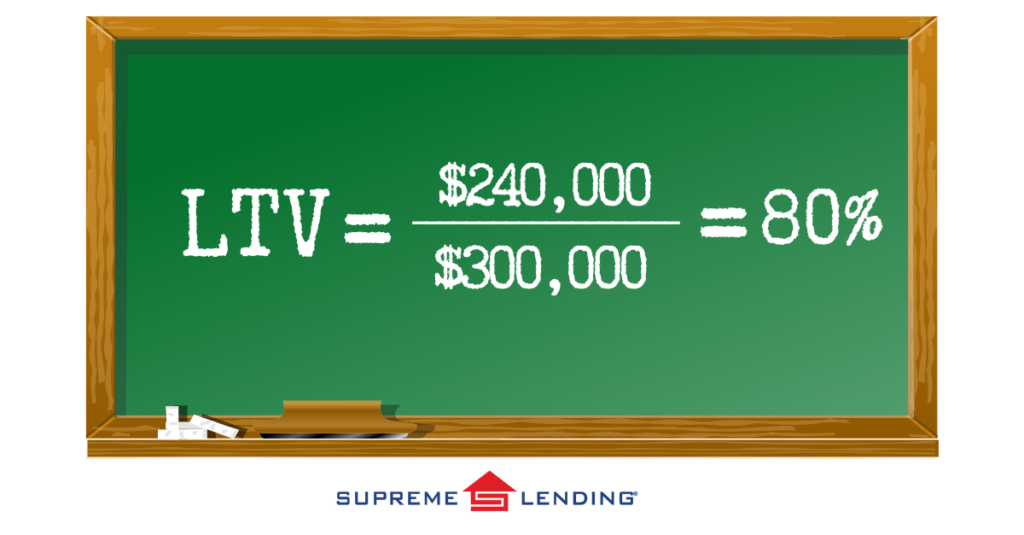

The LTV ratio is calculated using the following formula:

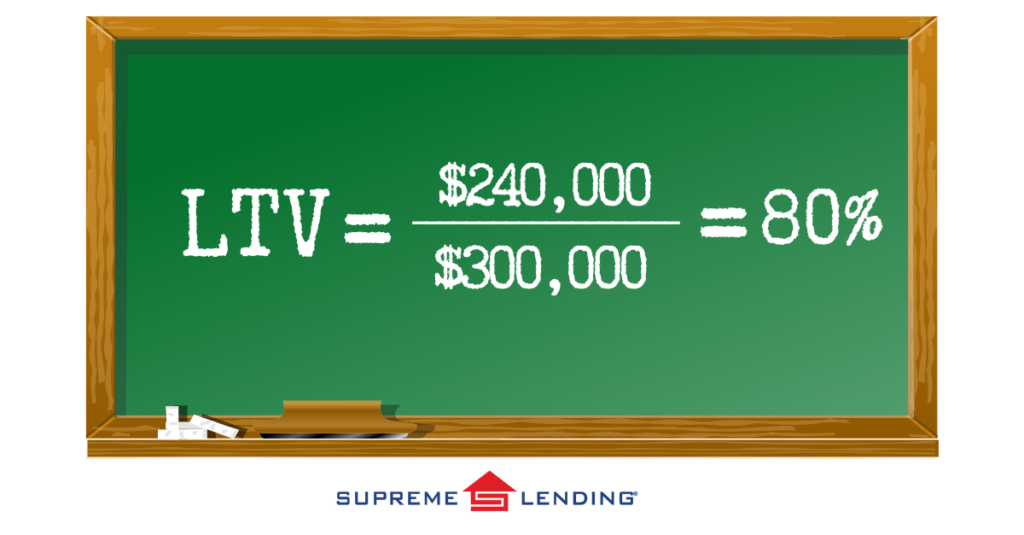

For example, if you’re purchasing a home with an appraised value of $300,000, and you’re borrowing $240,000, the mortgage LTV would be 80%:

How LTV Relates to Mortgage and Homebuying

LTV ratios play a crucial role in the mortgage approval process. Lenders use LTV to determine the level of risk associated with a loan. A lower LTV signifies lower risk, as the borrower has more equity in the property. Consequently, a higher LTV indicates higher risk for the lender, as the borrower has less equity.

How to Measure Mortgage LTV Ratios

A fair LTV ratio is typically 80% or lower. An LTV ratio of 80% or less is favorable because it often means the borrower is not required to pay for private mortgage insurance (PMI), which is usually mandatory for higher LTV ratios. PMI protects the lender in case of default but adds extra cost for the borrower.

LTV Requirements by Common Loan Types

Loan-to-Value criteria depends on the type of loan. Here’s a breakdown of common LTV limits to keep in mind:

- Conventional Loans:

- Maximum LTV: 80% to avoid PMI

- With PMI: Up to 97%

- FHA Loans:

- Maximum LTV: 96.5% for borrowers with a credit score of 580+

- VA Loans:

- Maximum LTV: 100% (no down payment required for eligible Veterans)

- USDA Loans:

- Maximum LTV: 100% (no down payment required for eligible rural properties)

Frequently Asked Questions About LTV Ratios

How Can I Lower My LTV?

You can lower your LTV ratio by making a larger down payment or by choosing a less expensive property relative to the loan amount.

Does a High LTV Affect the Mortgage Interest Rate?

Yes, a higher LTV ratio may result in higher rates because it can be seen as a higher risk for the lender. On the other hand, a lower LTV may qualify for lower rates.

What If My LTV is Above 80%?

If your LTV ratio is more than 80%, you may be required to pay mortgage insurance. This adds protection for the lender and an additional cost to the monthly mortgage payment.

Can LTV Ratios Change?

Yes, Loan-to-Value ratios can change over time as you pay down your loan and as the value of your property increases.

Understanding mortgage LTV is important to making informed decisions about your home financing. By knowing how your Loan-to-Value is calculated and its impact toward your mortgage, you can better navigate the homebuying process and know what to expect.

Our experienced and knowledgeable team at Supreme Lending is committed to helping you achieve your dream of homeownership with confidence and ease. Contact us today to learn more about your loan options and get pre-qualified today.

Related article: Mortgage DTI: What Is Debt-to-Income Ratio?

by SupremeLending | Jul 17, 2024

Download a copy of the refinance checklist here.

If you’re considering refinancing* your mortgage, there are several ways you can prepare beforehand to ensure a smooth, timely transaction. The refinancing process requires careful planning and organization, starting with gathering the necessary documentation. Just like applying for a traditional mortgage, lenders will require several documents to refi your loan. They’ll need to review your existing mortgage, finances, debts, and capacity to repay the loan. Here’s a general breakdown of what you’ll need to prepare along with a refinance checklist.

Understanding Your Goals of Refinancing

To refinance an existing mortgage essentially involves replacing it with a new one. The most important step of refinancing is to understand the outcome of your new home loan. Whether you’re looking to change the loan term, reduce the interest rate, or take out cash from your home equity, using a refinance calculator can help you get an estimate of associated costs and new monthly payment.

Refinance Checklist

When you’re ready to begin the refinancing process, it’s time to collect the documents needed to refinance. These include details to help lenders verify your income, current mortgage, debts, assets, and other documents depending on individual situations. Here’s a refinance checklist of basic documents to help guide you in preparing to refinance.

Income Documents

- Pay stubs, past 30 days

- W-2s, past two years

- Tax returns, past two years, if self-employed

- Profit and loss statement, if self-employed

- Social security, pension, disability, or other income verification, if applicable

Home and Mortgage Documents

- Mortgage statement

- Homeowners insurance declarations page

- Homeowners association (HOA) statements, if applicable

Identification

- Driver’s license or state-issued I.D.

- Social Security card

Debt Statements, If Applicable

- Credit card statements

- Student loan balance

- Car loan balance

- Personal loan balance

- Home equity loan

Asset Documents

- Bank statements (checking and/or savings accounts)

- Investment account statements

- Retirement account statements

- Proof of any large deposits or gift funds, if applicable

- Other asset statements

Other Situational Documents, If Applicable

- Bankruptcy documentation

- Divorce decree

- Child support or alimony payments

- Credit or employment gap explanation letter, if requested

- Proof of any rental income collected from investment properties

Simplify Your Refinancing with Supreme Lending

Navigating the refinancing process may seem overwhelming at first, but with Supreme Lending by your side, our experienced mortgage professionals can help guide you every step of the way. From ensuring you gather all necessary documents on the refinance checklist to providing timely updates on your loan status, we’re committed to providing a seamless mortgage experience.

Ready to take the next step in refinancing? Contact your local Supreme Lending branch to get started.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | Jul 11, 2024

Are you interested in investment property loans, but not sure where to begin? Investing in real estate may offer exciting and rewarding opportunities, including rental income. In fact, HousingWire reported that investment returns for single-family rental homes are expected to rise in 2024 due to rent increasing quicker than home prices.

As you can imagine, financing an investment property differs from securing a traditional mortgage for a primary residence. Here’s an overview of investment home financing, unique aspects of investment property loans versus traditional mortgages, and other considerations. Additionally, discover highlights from Supreme Lending’s investment mortgage options.

What Is Investment Property Financing?

Investment property loans are specialized mortgages designed to finance the purchase, renovation, or refinancing* of properties intended for investment purposes. There are several mortgage options to finance investment homes, such as DSCR loans and Conventional options. Common investment properties may offer short-term rentals, fix and flip, or longer-term ventures.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

Types of Investment Properties

Eligible properties for investment financing can vary depending on the lender and the mortgage program. However, common property types include single-family residences, townhomes, 2-4 unit properties, and condos.

What’s the Difference Between Investment Property Loans and Primary Home Loans?

Investment properties may require a higher down payment due to potentially higher lending risk versus a primary home. Unlike a primary residence, an investment property is not occupied by the borrower. Additionally, lenders often require a higher credit score for investment loans than other mortgages such as FHA loans, which are designed for primary residences.

Supreme Lending’s Popular Investment Property Loans

- DSCR Loans. Debt Service Coverage Ratio (DSCR) financing is intended specifically for investors looking to purchase income-generating properties. Lenders review the property’s ability to generate adequate income to cover the mortgage payments. This means no personal employment verification or income analysis is required.

- The RISE Program. Supreme Lending’s RISE (Real Estate Investment Strategy and Expansion) loan is a DSCR option that offers flexible financing with competitive rates and terms. A key feature includes no limit to the number of investment properties and eligible Foreign National borrowers are accepted.

- Conventional Investment Property Loans. Investors may opt for Conventional financing for a lower down payment requirement and credit score minimum. This could also be a good option for first-time buyers to get their foot in the door of real estate investing.

- The Investment Edge Program. Supreme Lending’s Investment Edge is a Conventional option that frequently offers more competitive rates if the property meets additional criteria. This includes only purchases with 75% Loan-to-Value (LTV) or lower. Standard Conventional underwriting guidelines apply.

- Bank Statement Loans. A bank statement loan can be a great alternative for self-employed borrowers looking to purchase investment properties. Borrowers can elect to use personal or business bank statements for 12- or 24-months. The more bank statements provided the better the rate.

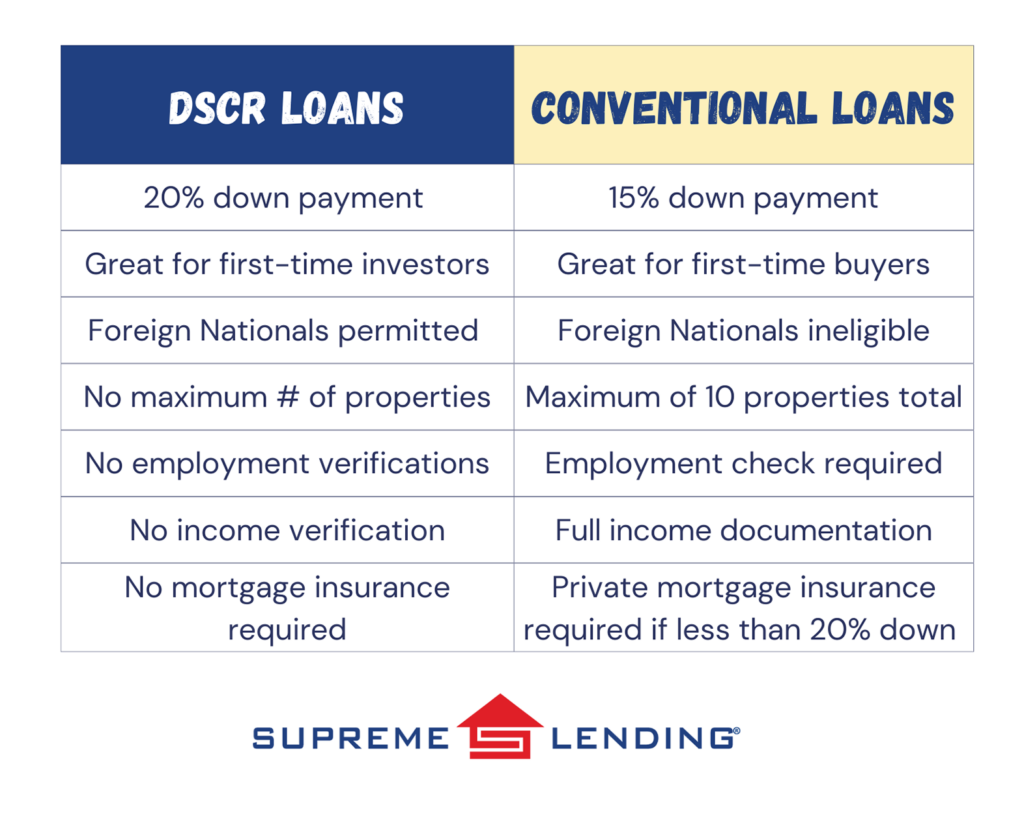

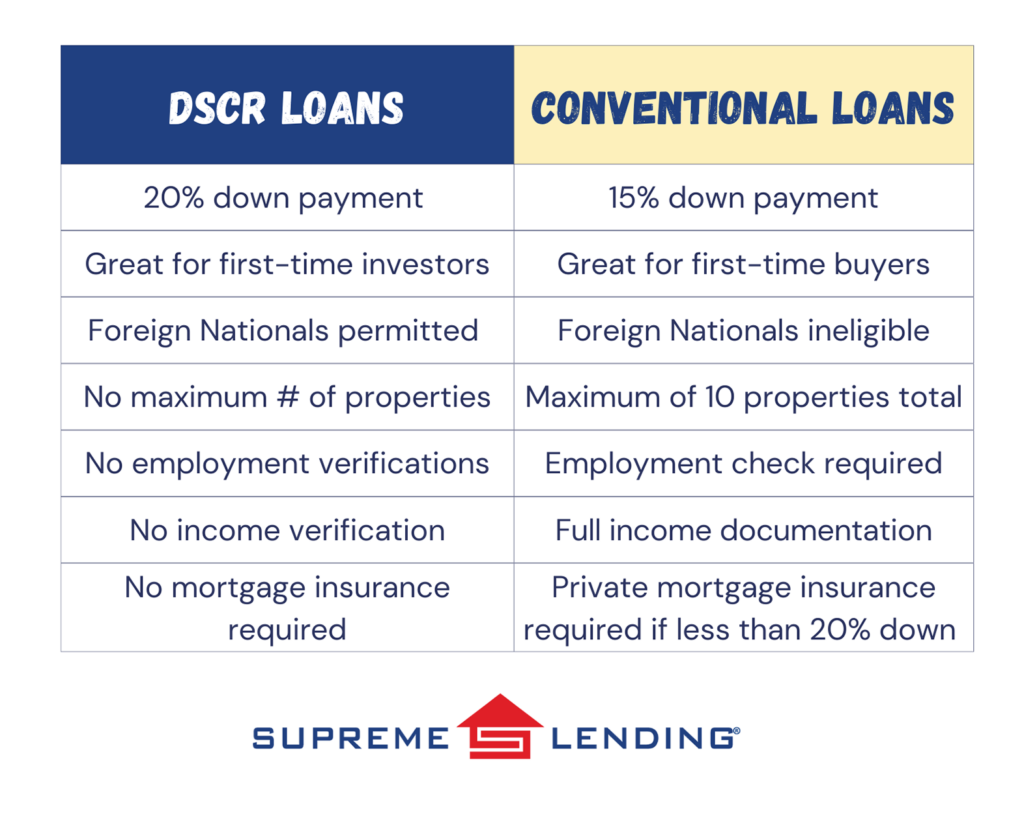

Investment Property Financing: Conventional vs. DSCR

Here’s a side-by-side comparison of DSCR and Conventional features for investment property loans.

Investment Property Considerations

In addition to the mortgage, when looking to purchase a residential investment property, it’s important to consider other key factors that could impact your investment. Here are some considerations to keep in mind:

- Location, location, location. It’s important to find out if there’s market demand for rental properties or people moving to the area. You may consider if the property is within a sought-after school district, centrally located for accessible transportation, or near desired lifestyle amenities and entertainment.

- Property condition. Review the home appraisal and inspection to determine any issues. Evaluate any potential repairs that may be needed. If you’re planning to renovate, understand and calculate possible rehab costs.

- Property management. Be sure to determine how the investment property will be managed. Whether self-managed or through a third-party property management firm, factor in any associated costs. Additionally, consider any on-going home maintenance you may need to be responsible for to keep your investment home safe and habitable.

Investing in residential real estate is a significant move, and securing the right financing for your home is imperative. Supreme Lending is here to help you navigate the complexities of investment property loans with ease and confidence. Whether you’re a seasoned investor or just starting out, our team of experienced mortgage professionals is ready to assist you every step of the way. Contact your local branch today to get started.

by SupremeLending | Jul 8, 2024

Learn about Supreme Lending’s BEYOND Program, an ITIN Loan Option.

Did you or someone you know just miss out on becoming eligible for a mortgage? Supreme Lending may have the solution with the BEYOND mortgage program, commonly known for being an ITIN loan option. However, it’s so much more than that!

Whether a gig worker, recent college graduate, or multi-generational family, the BEYOND program provides more opportunities for prospective homebuyers who may not yet qualify for an FHA loan. What is the BEYOND mortgage program, who can benefit from it, and how does it work? Read on to discover if this loan option could unlock the door to homeownership.

What Is Supreme Lending’s BEYOND Loan Program?

Essentially, the BEYOND program offers a lower down payment option for homebuyers who may be just beyond eligibility for an FHA loan, including non-permanent resident aliens with an Individual Taxpayer Identification Number (ITIN) or U.S. citizens and individuals who don’t have an established work or tax history.

Through this program, eligible borrowers can buy a primary residence with a purchase sales agreement. Then, they can refinance* down the road into direct ownership if they meet the qualifications in the future. This allows borrowers to get mortgage-ready while holding the equitable title interest.

Who Is the BEYOND Program Designed for?

Supreme Lending’s BEYOND program may be a good ITIN loan option for foreign national borrowers who do not have work authorization or a Social Security Number (SSN). However, ITIN borrowers are not the only people who may benefit from this unique loan program. Gig workers who may not have an established W2 income or newly self-employed people may qualify. Here’s an overview of borrowers who may be eligible for this program:

- Non-permanent resident aliens with an Individual Taxpayer Identification Number (ITIN); no work authorization or SSN required

- For example, ITIN mortgages typically require a higher down payment of 10-20%, so this program offers a more affordable ITIN loan option

- Deferred Action for Childhood Arrivals (DACA)

- 1099 or gig workers

- Borrowers who are relocating or awaiting citizenship

- Borrowers with a new job

- College graduates; deferred student loans do not need to be included in Debt-to-Income (DTI) ratio

- Multi-generational households

- Borrowers with credit issues preventing mortgage approval

How It Works?

- The first step of the BEYOND program is simply determining if the homebuyer qualifies. They will need to meet the program guidelines and get pre-approved for the purchase price limit based on income qualifications. An important starting point is to determine if the borrower has proof of successfully making rental payments within the last year. Several other criteria will also need to be considered.

- Once approved and the buyer makes an offer to buy a qualified property, they’ll enter into a sales contract. The contact is then assigned to a third-party government entity approved by the U.S. Department of Housing and Urban Development (HUD) to purchase the home as an investment.

- The buyer must pay at least a 3.5% down payment along with additional administrative fees.

- An FHA appraisal and home inspection are required.

- The government entity buys the home using an FHA loan.

- The homebuyer also signs a seller-financing agreement with the third-party entity, which gives them a recorded equity interest in the property. This agreement acts similar to a standard mortgage or deed of trust.

BEYOND Loan FAQs

What Proof of Rental History Is Accepted?

A key requirement is for the borrower to provide proof of successfully paying rent for the past year. This could be through checks, money orders, or reviewing bank statements. Living for free with family members will not qualify.

Are There Credit Requirements?

For ITIN borrowers, no credit score is required. For non-ITIN borrowers, a minimum credit score of 600 is required.

What Form of Identification Is Needed?

The borrower will need to present two forms of unexpired government-issued identification. One must be a picture ID (i.e. driver’s license or passport). ITIN borrowers must provide proof of ITIN documentation. Valid IDs from other countries are accepted.

What Upfront Costs Are Required?

Qualified borrowers will need to pay at least the minimum down payment of 3.5% along with program administration fees and the first monthly payment.

Does the Borrower Own the House?

They will have equitable title interest, which is legal ownership. This means borrowers can benefit from any equity gains. However, the title of the home hasn’t been fully transferred. Additionally, for borrowers who do qualify on their own in the future, the loan may be refinanced* into the borrower’s name and have the title transferred.

Homeownership In Reach

With programs like BEYOND, Supreme Lending is committed to providing affordable, flexible mortgages for all. Contact your local branch to see if you may qualify and take the leap into homeownership.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

by SupremeLending | Jun 28, 2024

Understanding How to Use a Refinance Calculator

Refinancing a mortgage can be a strategic tool for many homeowners, but determining whether it’s the right move requires careful consideration and calculation. A refinance calculator can help you understand the potential costs and benefits of refinancing. Here’s an overview of what refinancing is, common reasons homeowners may consider refinancing, and how to use a refinance calculator to get an initial idea of potential related costs.

What Is Refinancing?

Refinancing a mortgage involves replacing an existing home loan with a new one, usually with different terms. The primary goals of refinancing are to change the loan term, reduce the interest rate, or tap into your home’s equity for cash. By refinancing, homeowners can potentially lower their monthly payments, pay off the mortgage sooner, or secure funds to use for other significant expenses. A refinance calculator can help breakdown the costs of refinancing and new estimated monthly payments.

Why Refi Today?

Even in today’s higher interest rate environment, there are still several reasons people may consider refinancing.

- Shorten Loan Term. Refinancing to a shorter loan term, for example going from a 30-year to a 15-year term, can help pay off the mortgage faster and save in interest over the life of the loan.

- Change Loan Type. Switching from an adjustable-rate mortgage (ARM) to a fixed-rate can provide more stability with consistent monthly payments. Borrowers may also refinance to change from a government-insured FHA loan to a Conventional mortgage or other eligible loan type.

- Cash-out Refinancing. This option allows borrowers to use the equity they’ve built in their home and receive the difference in cash to use for other expenses, such as home renovation projects, tuition, or additional large expenses.

- Lower Interest Rates. Securing a lower interest rate can reduce monthly payments and potentially save thousands of dollars in the long term.

- Life Changes. Major life events such as divorce or death may require refinancing to remove a co-signer from a loan. It’s important for married homebuyers to understand spousal states and ownership rights.

Using a Refinance Calculator**

A refinance calculator is a useful tool to help you understand and estimate potential costs associated with refinancing your current mortgage. Here are general steps to use a refinance calculator effectively.

1. Go to Supreme Lending’s online refinance calculator at www.SupremeLending.com > Learn > Calculators > Mortgage Refinance Calculator.

2. Input Current Loan Details, including the original loan balance, appraised value, interest rate, and loan terms.

3. Enter New Loan Information, including the proposed new mortgage terms, interest rate, and closing costs.

4. Calculate Monthly Payments. With the provided mortgage information, the calculator will provide an estimate of your new mortgage costs and monthly payment.

5. Compare Costs and Savings. The refinance calculator can help you review potential savings and total interest paid for the life of the loan. Consider the break-even point, which is the time it takes for your savings to cover the refinancing costs.

6. Evaluate Additional Factors. Consider any pre-payment penalties or other fees that may be applied to the current loan and the impact of extending or shortening the loan term. Additionally, if you used a down payment assistance program for your initial mortgage, be sure to refer back to the agreed upon terms. In some cases, the assistance may need to be paid back if refinancing before a specified period of time.

Calculate Refinancing Costs

When using a refinance calculator, it’s important to review associated costs to get an accurate picture of whether refinancing may be beneficial. Common refinancing costs include:

- Application Fee. This fee is charged to process the loan application.

- Origination Fee. The lender may charge a fee to process and originate the loan.

- Appraisal Fee. This is the cost of having a home appraised to determine its market value.

- Title Insurance and Search Fees. These are costs associated with verifying the home’s ownership and ensuring there are no outstanding claims on the property.

- Closing Costs. Other fees and charges may be included that can typically amount to 2-5% of the loan amount.

Determine Monthly Payments

The refinance calculator can also help you determine new estimated monthly payments. By comparing your current payment and the new projected calculation, you can see the impact on your loan and plan your budget accordingly. If the new payment is significantly lower, refinancing may be a great option. If the new payment is higher due to a shorter loan term or other factors, you may need to decide if the long-term benefits outweigh the upfront refinancing costs.

Refinancing a mortgage may offer benefits, but it’s essential to understand the costs and new loan terms involved. A refinance calculator may help you make an informed decision with a comparison of your current mortgage and proposed new loan. Take a step further and get pre-qualified with Supreme Lending today. Let us help you make the most of homeownership and explore your mortgage and refinancing options.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

**Results received from this calculator are designed for comparative purposes only, and accuracy is not guaranteed. Supreme Lending is not responsible for any errors, omissions, or misrepresentations.