by SupremeLending | Feb 28, 2024

If you’re looking for a home with acreage in the country, to build the homestead of your dreams outside the city, or to embrace nature’s beauty of rural living, a USDA loan could be a great mortgage option with it’s no down payment requirement and flexible guidelines.

The U.S. Department of Agriculture (USDA) guarantees the loan for homebuyers in rural areas, including designated small towns and eligible suburbs outside of large cities. USDA loans help encourage rural development across America by offering affordable home financing to those with lower to moderate income. USDA loans may be one of the least-known government mortgage programs available, so let’s go over the loan features and potential benefits.

Why choose a USDA loan? If you’re located in an eligible area, there are several features USDA loans:

- No down payment requirement.

- Lower closing costs and interest rates.

- 100% financing with a one-time guarantee fee that can be rolled into the loan.

- Lower credit score minimums.

- Gift funds and grants permitted from family or government assistance agencies.

- Eligible properties include single-family homes, new construction, modular homes, planned unit developments (PUDs), and eligible condominiums.

- Mortgage insurance is required.

- Borrower’s income can’t exceed the USDA Rural Development limits for the area.

You can check to see if a property’s location is eligible for a rural development loan on the USDA’s website using the property eligibility maps and income limit calculator.

Ready to say goodbye to city life and hello to wide open spaces? Realize your dream of rural living with the possibility of a USDA loan.

For more mortgage information, reach out to your local Supreme Lending branch today.

by SupremeLending | Feb 21, 2024

New year, new décor? Interior design can turn a house into a home with the combination of modern or traditional flare and personal style. Whether you’re planning to sell your current home in 2024 and need to attract potential buyers with stage-worthy features or looking to renovate or elevate your space, here are a few interior design trends to enhance the appeal of your home and leave a lasting impression.

Neutral Elegance

Using a neutral color palette creates a timeless and refined look. In keeping up with 2024 interior trends, design expert Ashely Childers suggests embracing natural colors and textures to foster a warm, clean, and sophisticated environment. Neutral tones and materials also show potential buyers a blank canvas to envision their own style in the space.

Nature’s Charm

Bringing nature indoors can not only elevate the space, but also has been known to enhance people’s energy, creativity, and mood. Consider adding statement greenery and plants, natural materials like wood or stone, and large windows that let in ample natural light.

Tech Chic

Incorporating modern smart home technology offers convenient features, such as controlling the thermostat with a mobile device or automating room lighting, but it also helps create a modern, elevated environment. Replace any old or outdated technology that may be visually unappealing and opt for the latest line of home electronics and appliances.

Bold Move

While neutrals are essential, that doesn’t mean you have to shy away from making bold, playful statements. Introduce pops of color, vibrant patterns, rich textures, or eclectic decor pieces to add personality to a room. While pastels have been popular, designers featured in Architectural Digest predict that colors in 2024 will be taken up a notch with more vibrant, saturated hues, such as deep blues, browns, burgundy, and plum. Bold moves can help enrich a space and create a memorable and visually striking impression.

While you visualize your home’s interior design or staging, Supreme Lending is here to help with your home financing needs. Contact us to learn about our wide variety of mortgage options and refinancing.

by SupremeLending | Feb 21, 2024

Condominiums—commonly known as condos—are a great option for homebuyers looking for less maintenance, urban settings, lock-and-leave lifestyle, and community amenities. But the differences between financing condos and single-family homes may bring more complexity to the condo loan process.

Condos are privately-owned units within a building where residents have ownership of their interior space and share ownership of common areas and exterior space (i.e., pool, roof, landscaping). Condo buildings are typically managed by a homeowner’s association (HOA). Upkeep of the common areas can be funded through monthly HOA fees, which are in addition to a resident’s mortgage payment.

The condo loan process typically considers several more factors than the process for a single-family home. Down payment minimums and interest rates may be higher for condo loans too. When financing a condo, lenders will not only look at the buyer’s financial history but may also evaluate the condo community’s condition and finances.

Several types of loans have requirements that condo associations must meet for a lender to be able to provide financing, which identify the condo as “warrantable.” If a condo property doesn’t follow specified guidelines, lenders, including Supreme Lending, can offer condo loan options for non-warrantable properties if eligible. Condo loan options include Conventional, FHA, VA, and new construction.

While the condo loan process may be more complex, Supreme Lending has an experienced in-house Project Review Office team dedicated to helping speed up the process by gathering and processing required documents for condo loans for a smooth homebuying experience.

Are you looking to finance a condo now or in the future? Contact your local Supreme Lending branch to get started.

by SupremeLending | Feb 20, 2024

When it comes to buying a home, which could be one of the biggest investments you make, it’s important to understand your financing options. While a Conventional loan is more traditional, FHA loans have seen a rise in popularity due to more flexible guidelines. Let’s dive into a few of the FHA loan benefits and features for homebuyers to consider when choosing a mortgage.

What is an FHA loan?

The Federal Housing Administration (FHA) knows the tremendous value homeownership can bring to people’s lives and communities, which is why it was founded in 1934 to boost home sales and the economy. The government organization offers special mortgage insurance to lenders as an option to help more people who may not qualify for a Conventional or other type of home loan, qualify through an FHA loan.

When applying for a home loan, an FHA loan may be a practical option, especially if you:

- Are a first-time homebuyer.

- Have a lower credit score.

- Want a lower down payment.

- Are refinancing a high-cost mortgage.

FHA loan benefits and features include:

- Low down payment requirements with a minimum of 3.5%. Mortgage insurance is required.

- Credit scores as low as 580 may be accepted.

- Gift funds can be used for 100% of the down payment or closing costs.

- Fixed-rate and adjustable-rate mortgage options are available.

- Flexible qualification guidelines.

Now you might be asking, what properties are eligible for FHA loans? In addition to single family homes, FHA loans could also finance other qualified properties, such as 2- to 4-unit complexes and condos. Properties with an FHA loan will require an FHA appraisal to ensure the living space is safe and meets proper standards.

FHA loans could be a great option as a steppingstone into homeownership. Could these FHA loan benefits match your mortgage needs?

If you’re ready to see if an FHA loan or other home loan program is right for you, Supreme Lending is ready to help. Contact us to get started today!

by SupremeLending | Feb 12, 2024

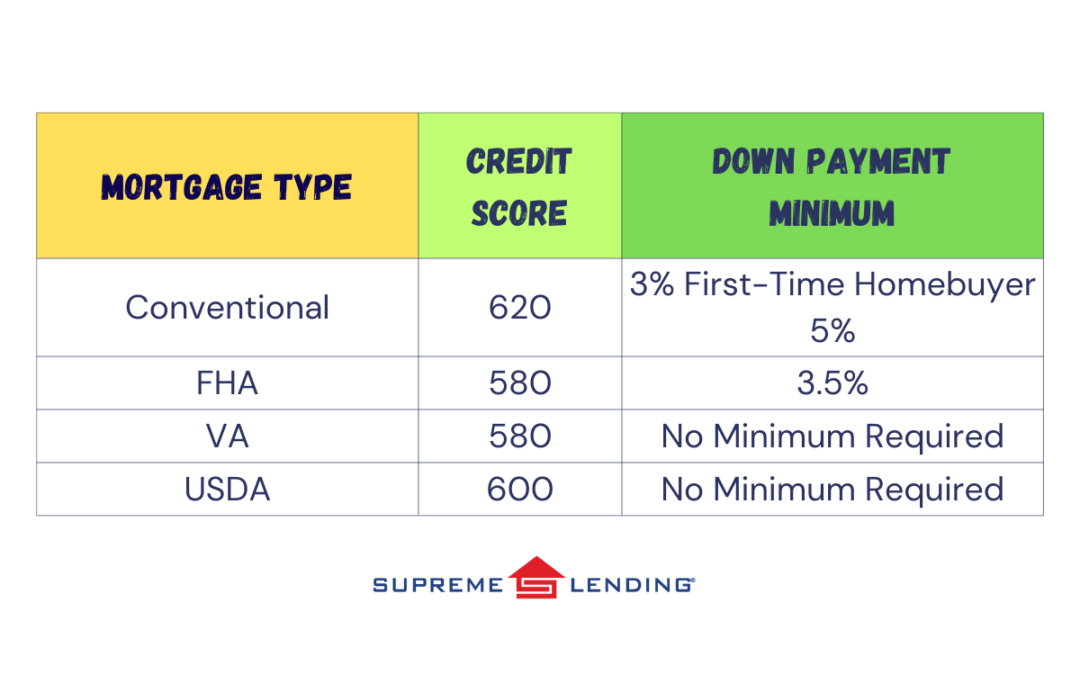

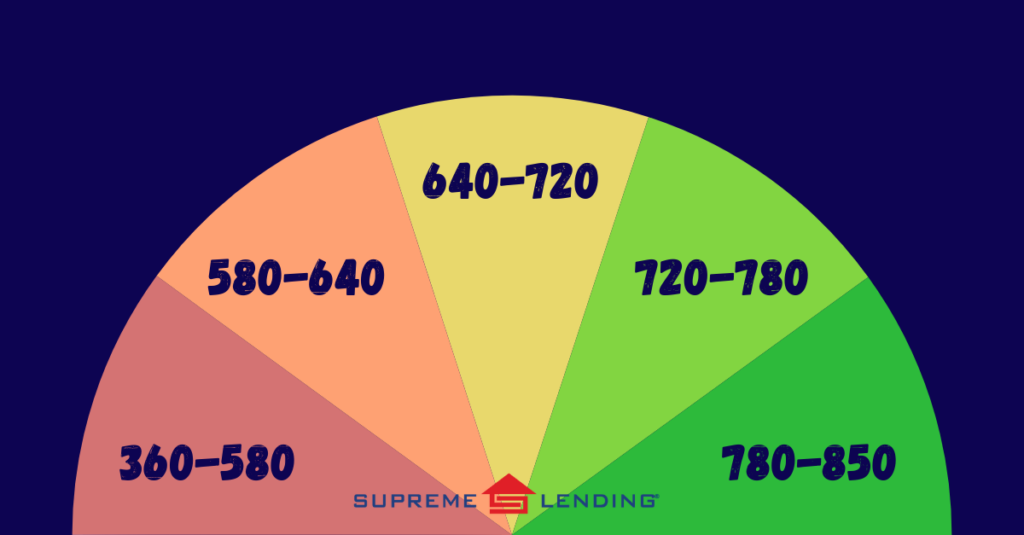

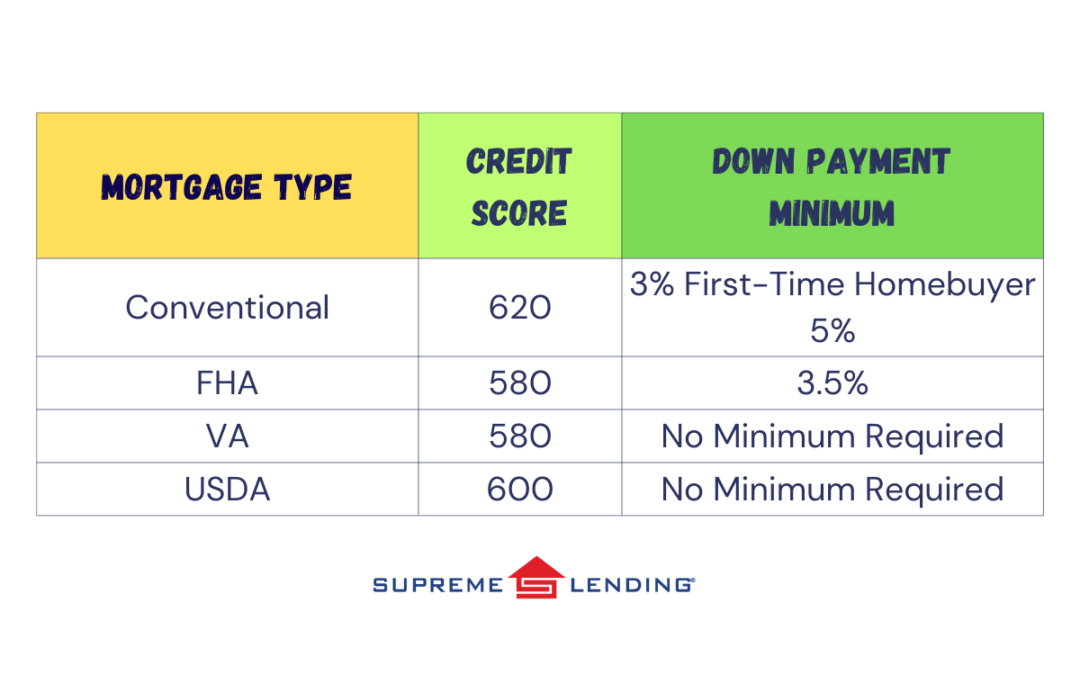

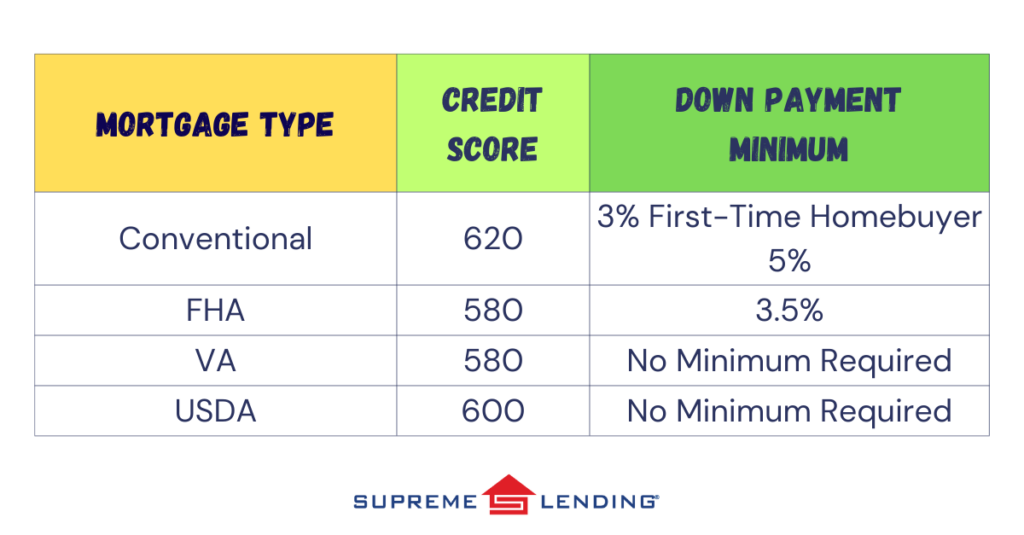

For aspiring homeowners and first-time buyers, many questions can arise about the mortgage process. What credit score do you need to qualify? How much down payment is required? Answers are based on several factors including the property, purchase price, and, most importantly, the mortgage type.

Here’s a breakdown to simplify the numbers and help you understand what you need to open the door to your dream home depending on common mortgage types:

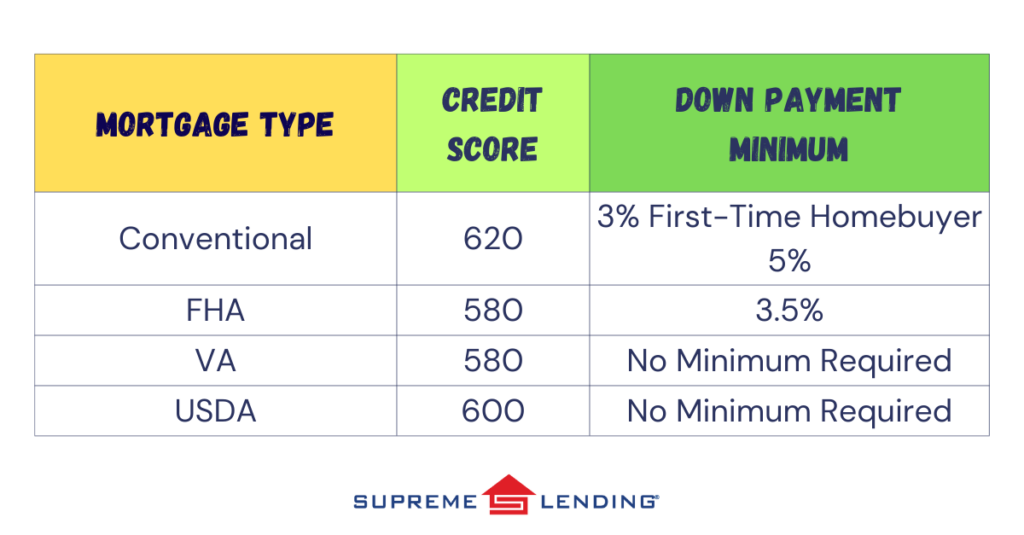

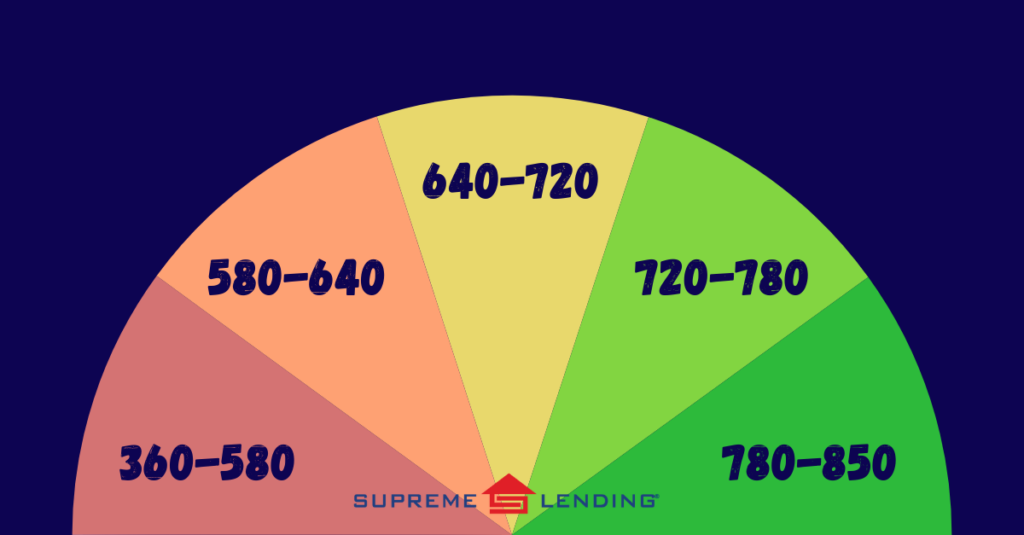

What Is a Credit Score?

Commonly determined by FICO® score, credit scores are calculated using the borrower’s financial background information such as payment history, credit utilization, length of credit history, types of credit in use, and recent credit behavior. The average credit score in the United States in 2023 was 715, according to Experian data.

Down Payment Assistance Options

If a homebuyer doesn’t have the required minimum down payment or would like to access more financing, Supreme Lending offers several down payment assistance options for qualified buyers. This can also help first-time buyers open the door to homeownership. Guidelines and eligibility vary depending on the program. For example, the Supreme Dream program offers down payment assistance in the form of a fully forgivable second loan and requires a minimum credit score of 620. Ask your Supreme Lending Loan Officer about qualified assistance programs.

Understanding credit score and down payment requirements for different types of mortgages is crucial for prospective homebuyers. While each loan type has its own guidelines, maintaining a good credit score and having sufficient funds for upfront costs at closing remains a common denominator for securing favorable terms and interest rates. By proactively managing your credit and staying informed about your options, you can navigate the mortgage process with confidence on your journey to homeownership.

Contact your local Supreme Lending branch to get pre-qualified and learn about your home financing options.